The BOE held rates unchanged on Thursday just as the ECB and the Fed did

recently, though the worst inflationary upsurge in a generation still looks

gloomy.

High inflation will dog the world economy next year, with three-quarters of

over 200 economists polled by Reuters saying the main risk is that it turns out

higher than they forecast.

The survey followed a warning from Christine Lagarde warning that “even

having a discussion on a cut is totally, totally premature.” Jerome Powell also

said rate cuts were not on radar.

The ECB paused an unprecedented hiking cycle in which its main rate has risen

to a record 4%, from below 0% in July 2022, at its policy meeting last week.

Governing Council member Boris Vujcic said “we have finished with the process

of raising interest rates for now.” He expected inflation to hit the target by

2025.

But that was not an assurance that the hiking cycle has ended. Likewise, the

BOE did not rule out the option of another rise if there is evidence of more

price pressures.

Worse inflation

A bright spot is that inflation in the eurozone fell more sharply than

expected to 2.9% in October, down from 4.3% the previous month. That was the

slowest level in more than 2 years.

The core inflation remained above 4%. Mark Wall, chief European economist at

Deutsche Bank Research, said that the ECB “needs to see wage inflation slowing

and this could take a further six months.”

Some of the biggest money managers in Europe warned that the region is

particularly exposed to rising prices if the crisis in the Middle East escalates

as a net energy importer.

Disruptions to key shipping routes and extreme weather wreaking havoc on the

supply of food staples are adding to the factors that could keep European

inflation prints hot.

The UK has faced with a worse situation with evident signs of stagflation.

The CPI rate was 6.7% in the year to September, unchanged from August, due to

rising fuel costs.

Its headline inflation is expected to remain higher this year and next than

in many of the country’s biggest trading partners including the US and the

eurozone.

The country has been relying more heavily on natural gas for heating and

electricity generation than its European neighbours over the last few decades,

which is evident in its existing energy crisis.

So British are more susceptible to another bout of energy inflation as

Russia-Ukraine war is rumbling on and Iran is ferociously threatening Israel to

stop retaliation against Hamas.

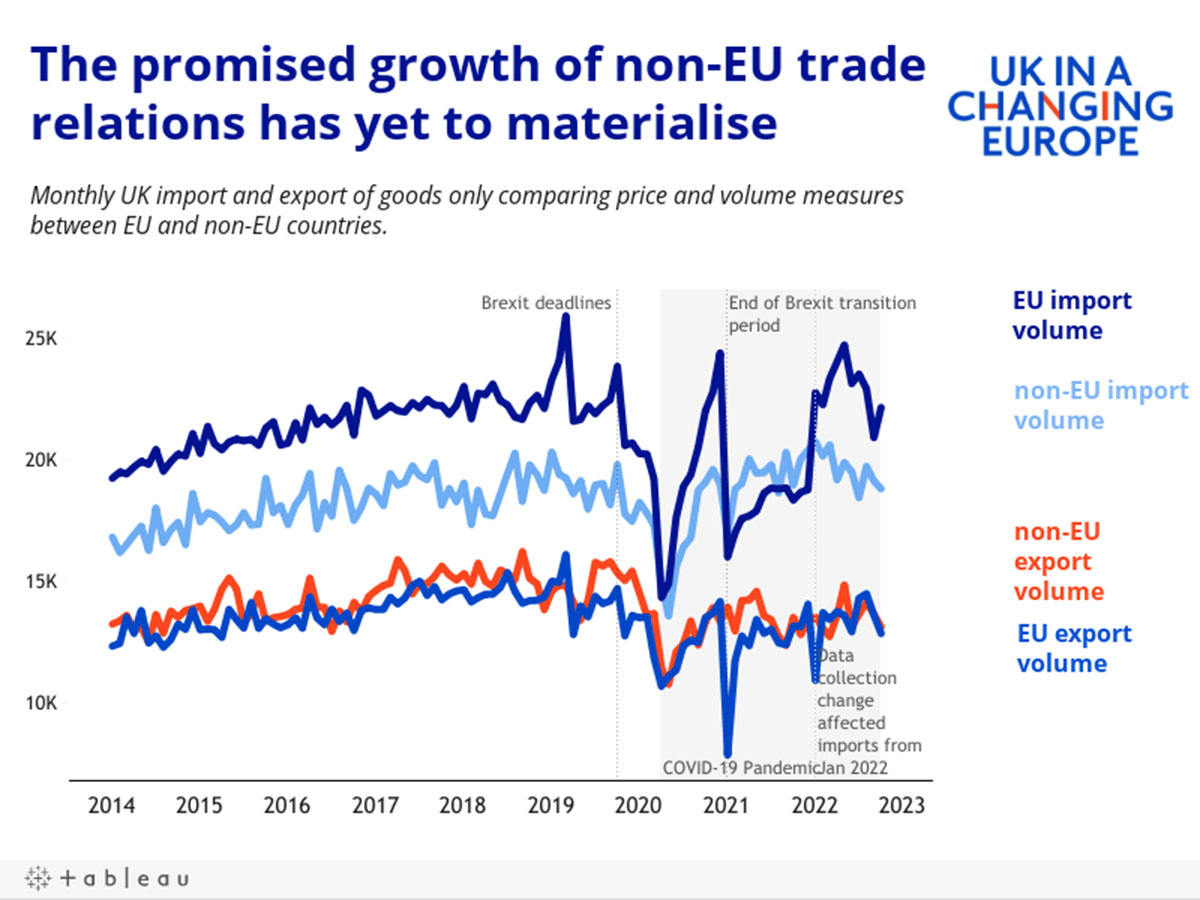

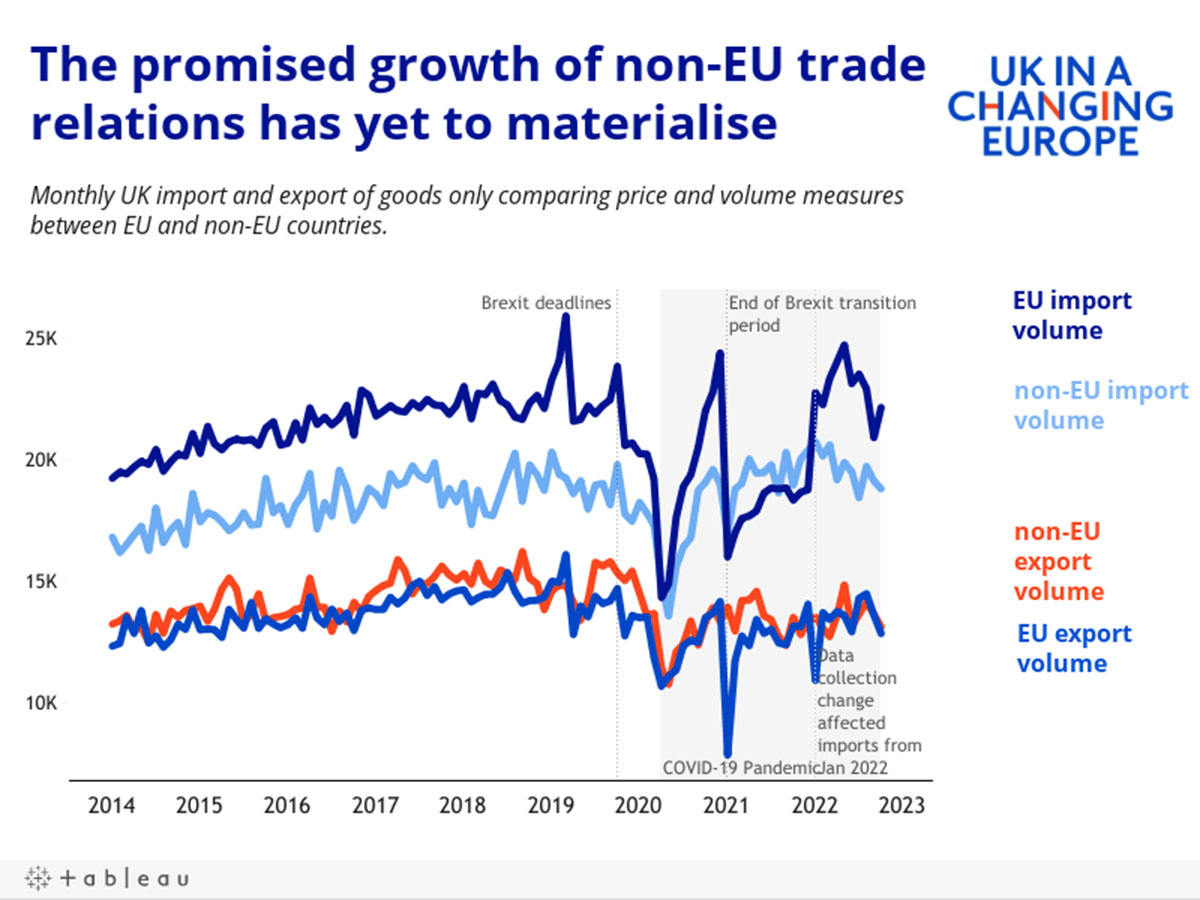

Not only this, but trade barriers and impeding labour flows stemming from the

Brexit have gunged up supply chains between the UK and the Continent, raising

broad-based cost pressures.

Worse economy

The eurozone economy risks falling into recession later this year after

official data showed that output shrank slightly in the third quarter.

GDP across the 20 countries that use the euro fell 0.1% following a rise of

only 0.2% the previous quarter. The bloc’s manufacturing and services sectors

has also been on a downward trajectory.

BNP Chief Executive Officer Jean-Laurent Bonnafe said the European Central

Bank shouldn’t wait long to start easing monetary policy in order to protect the

euro-area economy.

The economy will “remain sluggish” whether or not the eurozone suffers a

technical recession, said Jack Allen-Reynolds, deputy chief eurozone economist

at Capital Economics.

Growth forecasts

|

2023 |

2024 |

2025 |

| UK |

0.50% |

0% |

0.25% |

| Eurozone |

0.70% |

1.00% |

1.50% |

Even so, the UK economic growth will fall further behind the eurozone next

year, according to a survey of economists by Bloomberg earlier this year. That

will do little to support PM Rishi Sunak’s bid to win the next election.

German’s stagnation and Italy’s fiscal challenge are particularly worrying

for the eurozone. The risk premium the Italian government pays over German bonds

dropped below 200 bps in Sep, the highest level in months.

On the other hand, the eurozone is well positioned to be benefiting from

increasing exports driven by demand in the world’s second largest economy.

China’s economy showed signs of emerging from a soft patch in the third

quarter. It is anticipated to make more policy moves to boost growth while

refraining from massive stimulus.

Meanwhile, a UK-US free trade deal in discussion will unlikely offset the

Brexit’s fallout. Corporate insolvencies in England and Wales climbed to their

highest level since the global financial crisis in the six months to

September.

A trickier task is lying ahead of the BOE to balance between price control

and economic stability. In this sense sterling may lose some ground against the

euro heading into 2024.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.