Australian dollar slips amid by iron ore downturn

2024-04-03

Summary:

Summary:

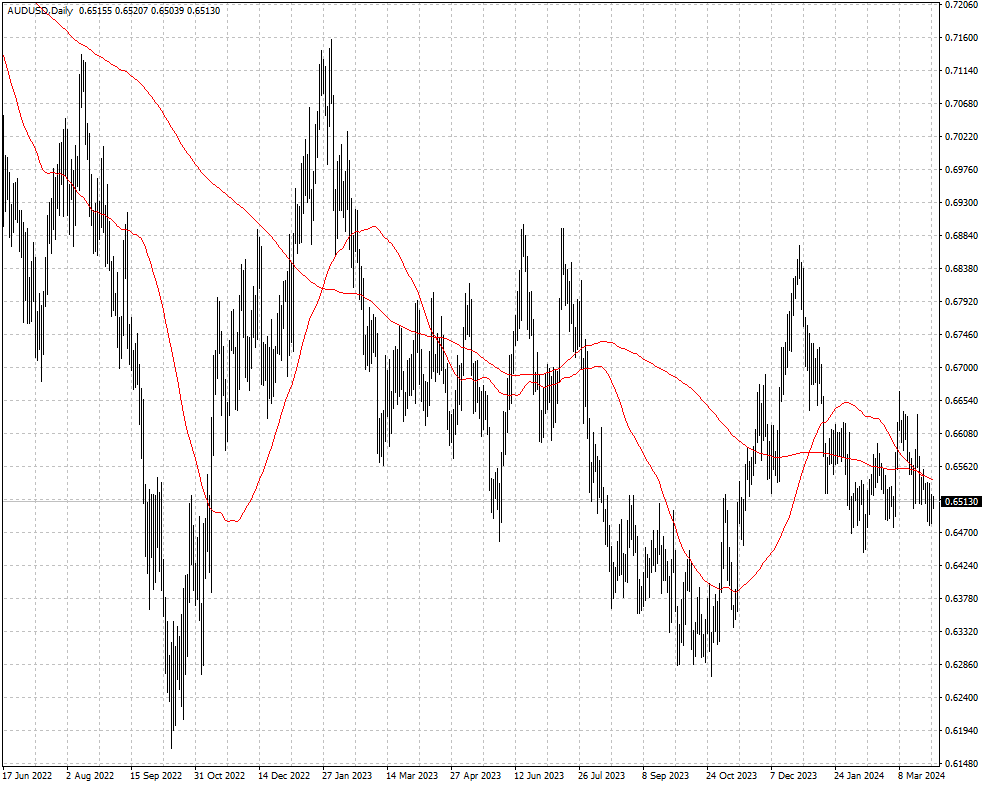

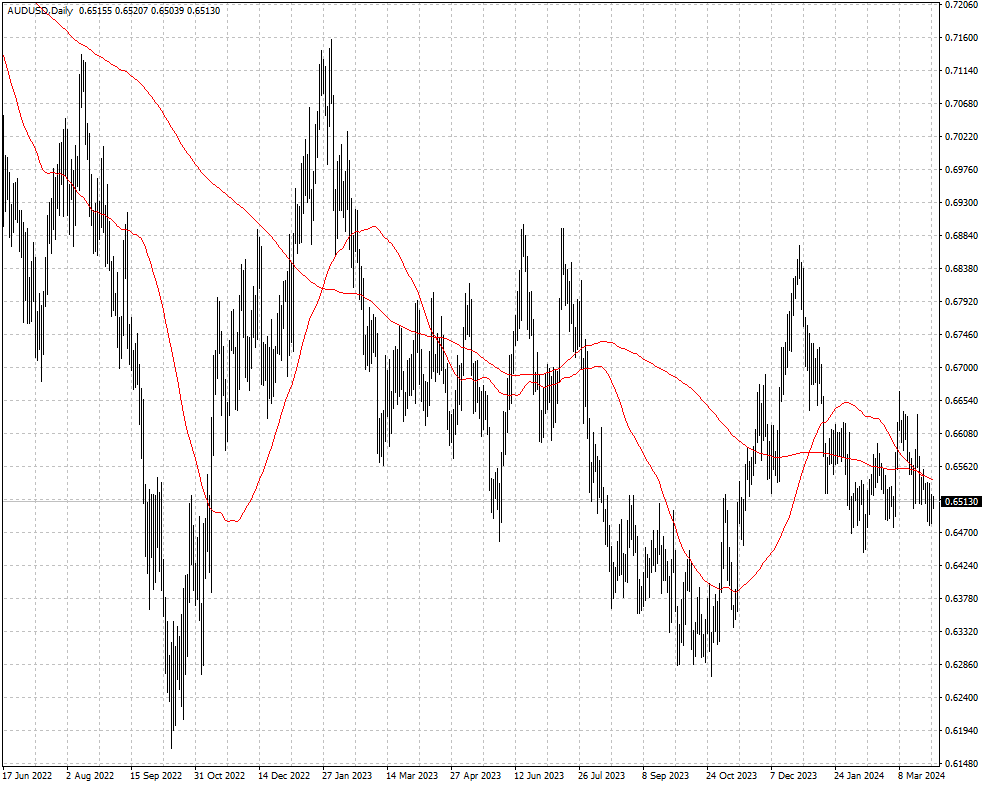

On Wednesday, the Australian dollar continued to weaken against the US dollar, down about 4.5% this year due to global economic uncertainties.

The Australian dollar remained on the back foot against the US dollar on

Wednesday. The antipodean currency has lost around 4.5% this year due to

uncertainties around global economy.

Australia's economy grew at the weakest pace in 1.5 years in Q4 as high

prices and rising interest rates dampened consumer spending. There were signs of

further softness ahead under the current financial conditions.

The latest meeting minutes signalled the RBA’s potential shift towards a

neutral stance. The central bank noted the balance of risks to the outlook were

“a little more even” than previously.

Adding to concerns about the country’s recovery, iron ore dipped to its

lowest level in 10 months this month. Stockpiles held at China’s ports are the

largest in more than a year – a sign of oversupply.

The China Iron & Steel Association last week warned that the property

downturn and relatively weak infrastructure were a drag on steel demand. CRIC

cautioned that the new-home market may not warm up soon.

China steel industry’s PMI for March sank to 44.2 — its lowest reading since

May last year, whereas factory activity beat estimates and snapped a five-month

contraction.

The Aussie is close to the low of 0.6477 hit in 5 March with the “dead cross”

pattern reflecting strong downward momentum. A break below that level will

expose the yearly trough around 0.6440.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.