Oil rises to multi-month highs on Ukraine deeper strike

2024-04-04

Summary:

Summary:

Thursday's oil prices rose on supply concerns from output cuts and geopolitical tensions, outweighing a surprise increase in US crude stocks.

Oil prices rose on Thursday on concerns of lower supply as major producers

keeping output cuts in place and ongoing geopolitical conflicts outweighed an

unexpected rise in US crude stocks.

Both the June Brent contract and the May WTI contract have risen for the past

four days and closed on Wednesday at the highest since the end of October.

A meeting of top ministers from the OPEC and its allies including Russia,

kept oil supply policy unchanged on Wednesday and pressed some countries to

boost compliance with output cuts.

Ukrainian drones attacked one of Russia’s biggest oil refineries and a drone

factory in the Russian province of Tatarstan in what appeared to be Kyiv’s

deepest strike inside Russian territory since the war.

Crude inventories swelled for a second straight week, rising by 3.2 million

barrels in the week to 29 March, the EIA said, compared with analysts'

expectations in for a drop of 1.5 million barrels.

But gasoline stocks fell more than expected as harsh weather and planned

maintenance resulted in several major outages at US refiners this year. That

also added to bullish sentiment.

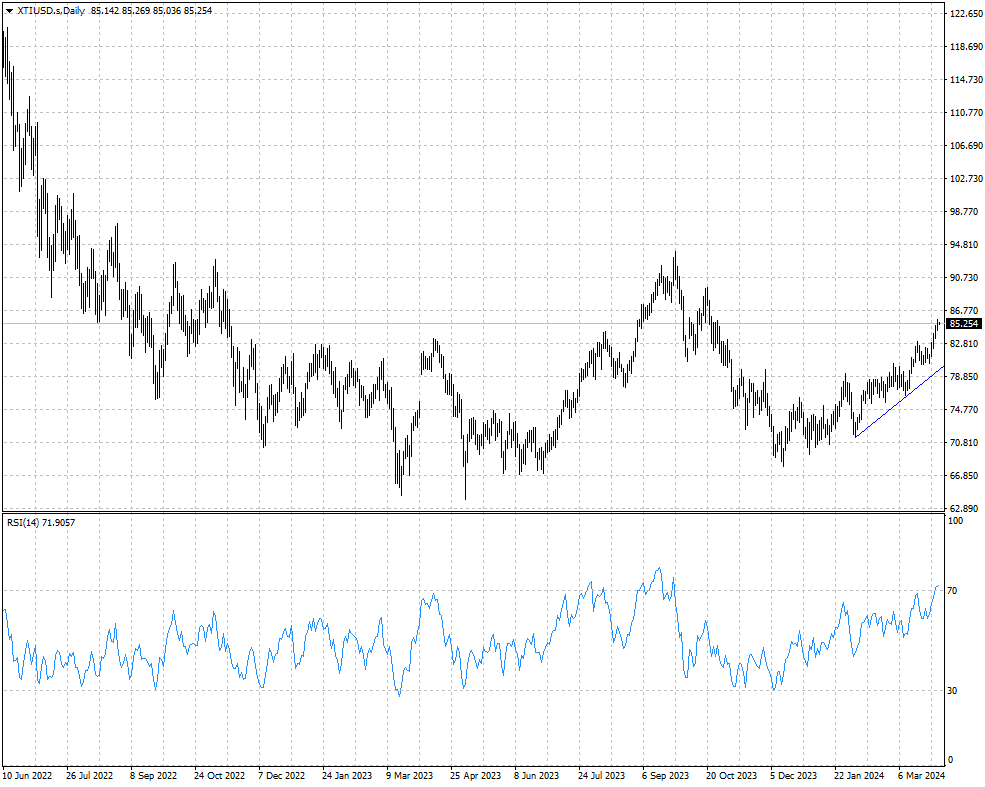

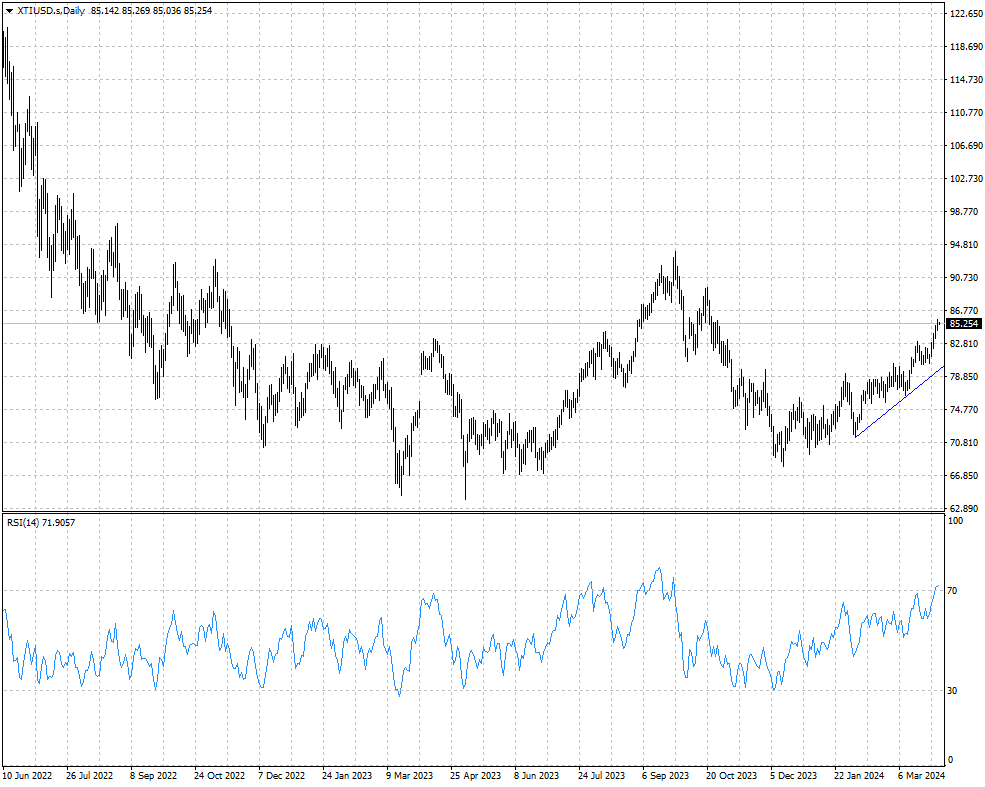

WTI crude extended the rally from mid-December, with RSI indicating

overbought conditions. The next major resistance could be the high around $90

hit in late-October.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.