One more hike priced

The ECB will increase interest rates to 4% in September from 3.75% and start

cutting rates in March, a Bloomberg poll showed. Likewise, money markets

currently have priced a 25 basis-point ECB hike next month.

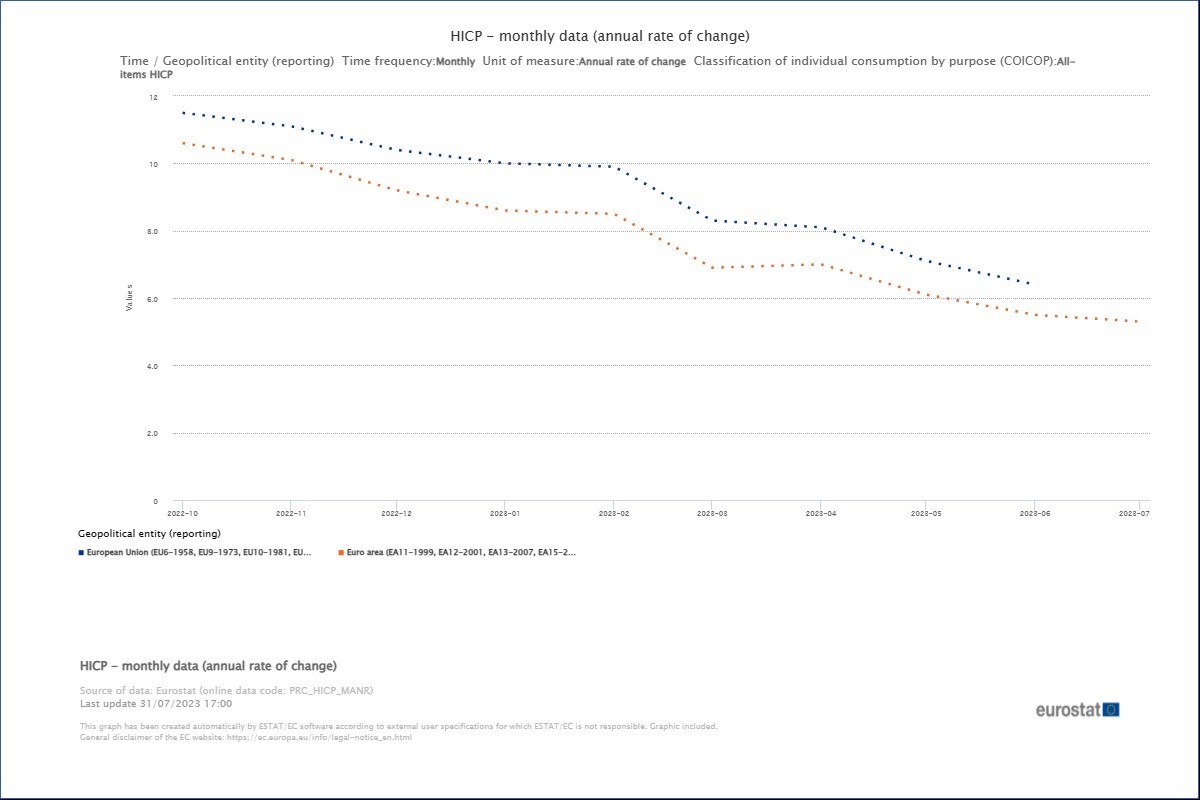

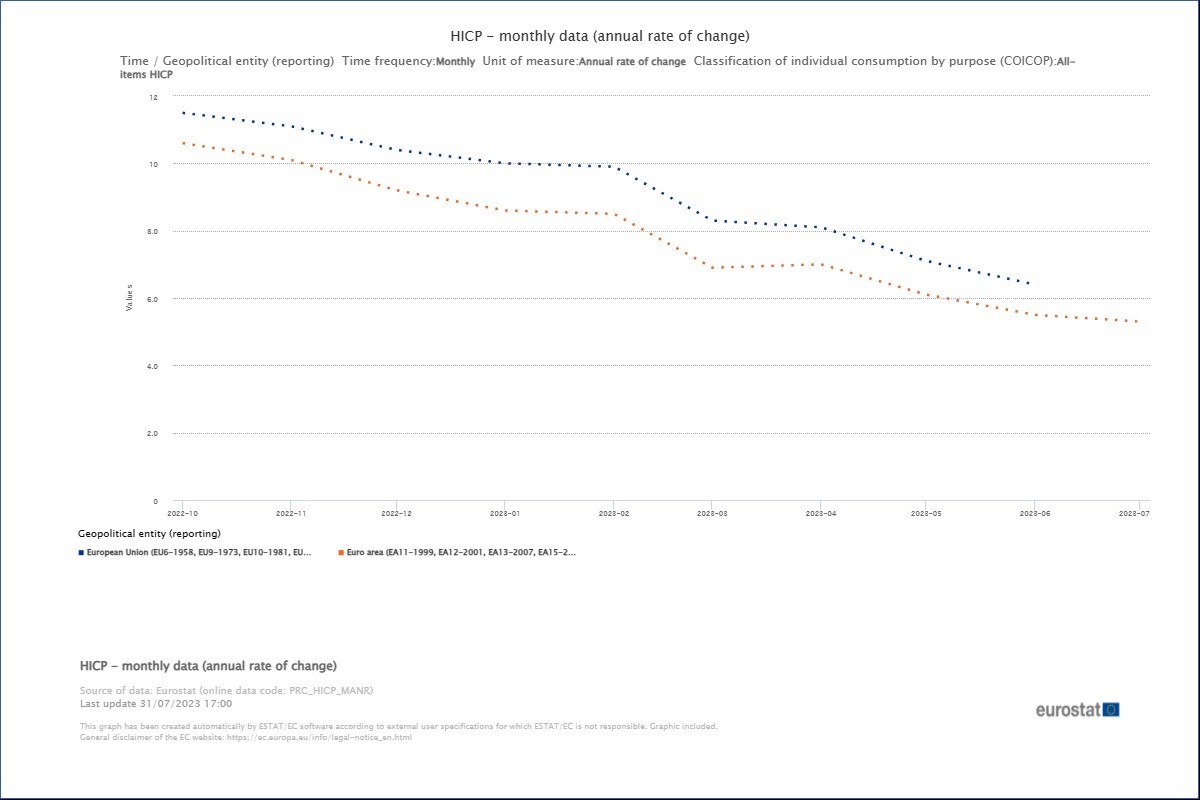

ECB research has suggested that underlying inflation has probably peaked. A

separate poll of consumers reinforced that view, showing that expectations for

price growth across the 20-nation euro zone dropped further.

Aside from inflation, policymakers will have to weigh economic weakness

against inflation fight with Germany growth slowing to a crawl in the second

quarter.

Economists expect another quarter of zero growth in the third quarter and

still see German output shrinking by 0.3% this year, with the outlook for 2024

also shifting down to 0.8% from 1%.

‘We expect the economy to broadly stagnate over the next few quarters as the

euro area will face several headwinds from high uncertainty, the lagged impact

of the ECB tightening cycle... and less fiscal support,’ said Michael Kirker,

European economist at Deutsche Bank.

Executive Board member Fabio Panetta earlier this month urged prudence ‘in

calibrating our monetary-policy stance if we are to reach our inflation target

without harming economic activity unnecessarily.’

Euro zone inflation hit a lower-than-expected 5.5% in June, the first time

since Jan 2022. Falling energy prices were a significant contributor to the

drop.

The latest Economic Bulletin, published last Thursday, said that ‘inflation

continues to decline but is still expected to remain too high for too long’.

Aftermath of war

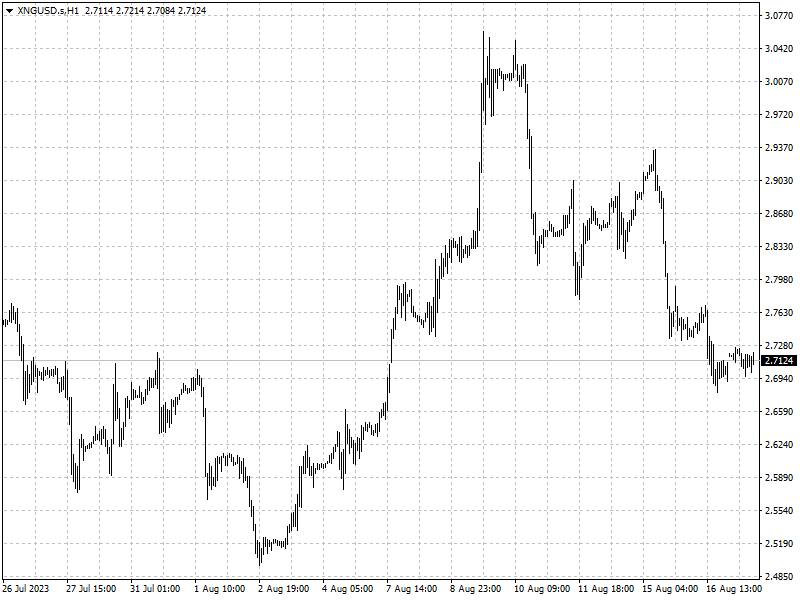

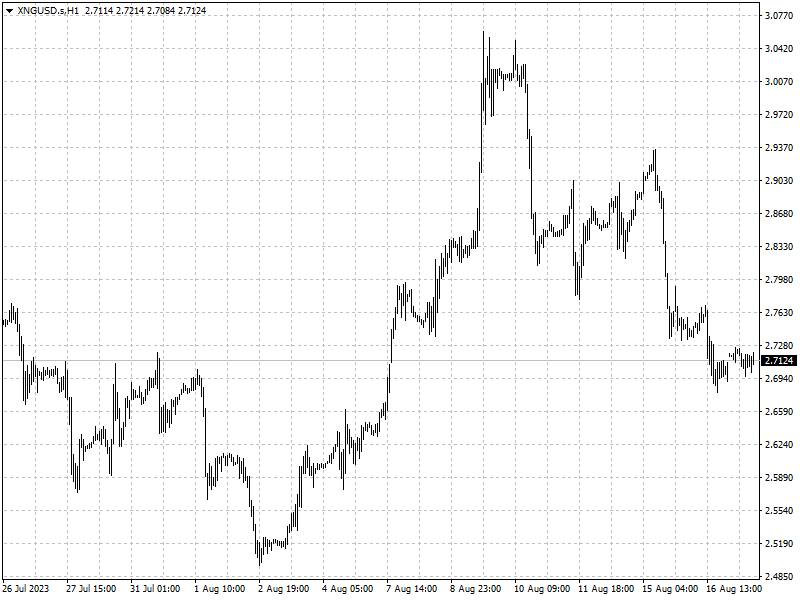

The surge in European gas prices one week ago acts as a warning to investors

who feel over-confident about lower energy cost.

While Europe’s gas supplies are plentiful, the region is still paying four

times more than the US and about double what it was before the pandemic.

The latest escalation in supply fears was sparked by a dispute about pay and

conditions at Australian plants belonging to Chevron and Woodside Energy., which

account for over 10% of global LNG supplies.

A long-lasting war between Russia and Ukraine has weaned Europe off a large

source of its energy supply, increasing the continent’s reliance on LNG

imports.

That has subjected the market to potential supply disruption in any major gas

producer. ING Group NV, Rabobank and Saxo Bank all recommend positioning for a

hawkish pivot from the ECB as energy prices rise again.

State Street said that the jump in prices is unlikely to result in a dramatic

change to the ECB’s policy outlook but tight global food-supply chains, extreme

weather and rising crude prices could thwart inflation slowdown.

Energy analysts believe the bullish momentum for European natural gas prices

will persist over the coming months. Executives of major energy companies have

warned in recent weeks that a cold winter and unexpected outages could still put

the region at risk of shortages.

John Evans, an analyst at brokerage PVM, said that despite countries such as

Germany securing large gas deals with other countries, ‘there still remains a

possibility of a shortfall and a reversion to having to buy at spot as seen in

2022.’

If the Australian supply outage extends into September, that would affect

global supplies and prices in the run-up to the heating season. Prices in both

Asia and Europe would need to rise to attract available LNG.

Rystad Energy said ‘the bullish outlook for gas prices to continue with fewer

LNG imports to Europe, planned maintenance for Norwegian pipelines and continued

heatwaves in multiple regions globally.’