Gold has always had an aura of prestige and permanence. But in 2025. as digital assets boom and financial markets evolve, gold still commands a high price—and it's not just because it looks nice in a necklace. The reason gold is so expensive today comes down to a mix of economics, psychology, and global financial systems.

Limited Supply & Scarcity of Gold

One of the biggest reasons gold is expensive is simple: there's not much of it.

To date, around 200.000 tonnes of gold have been mined in total, according to the World Gold Council. That might sound like a lot, but it's actually very little when you realise all of it would fit into a cube roughly 21 metres in length, width, and height. Unlike other natural resources such as oil or timber, gold isn't easily renewable—and it's becoming harder to find.

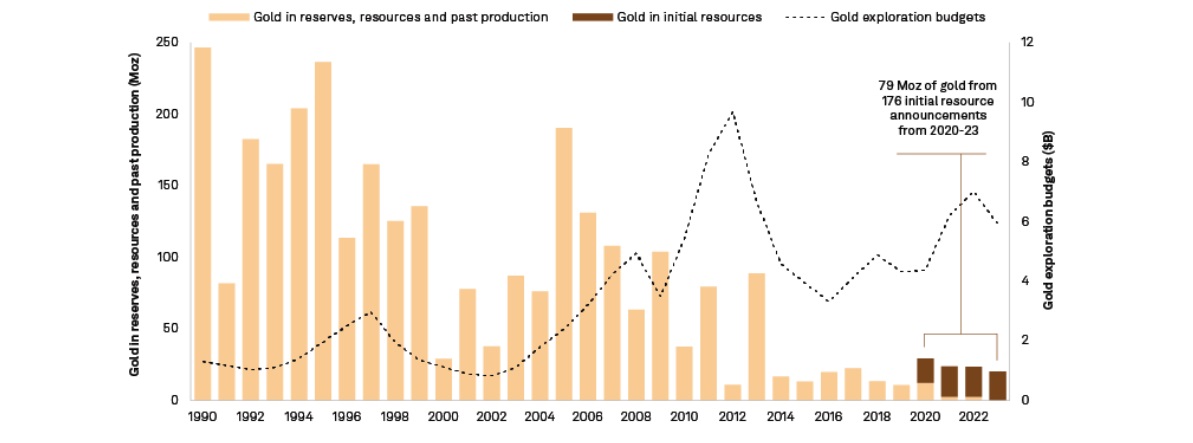

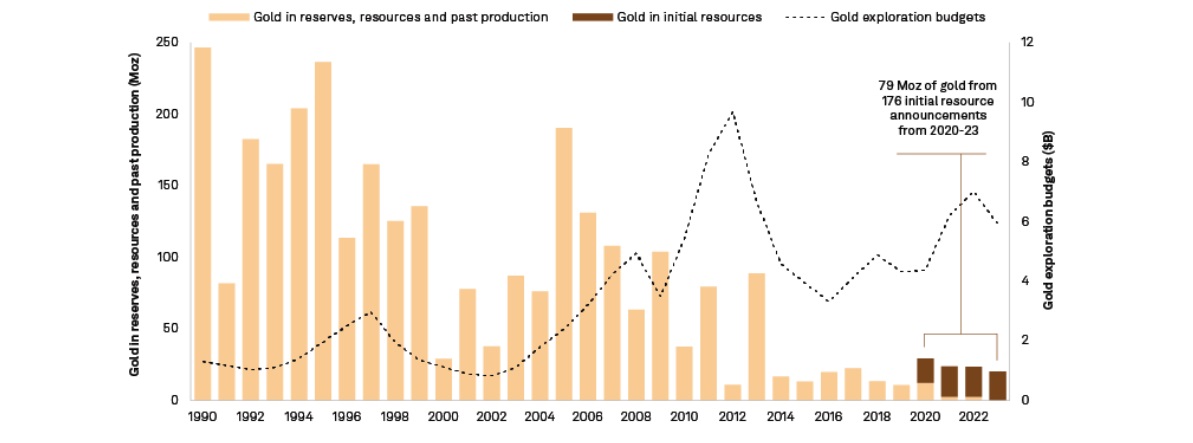

Much of the "easy" gold has already been extracted from the earth. What remains lies deeper underground, often in remote or unstable regions. Mining it not only costs more money and time, but it also requires significant environmental approval and infrastructure investment. Even if we were to find new deposits, it typically takes over a decade to go from discovery to production.

Much of the "easy" gold has already been extracted from the earth. What remains lies deeper underground, often in remote or unstable regions. Mining it not only costs more money and time, but it also requires significant environmental approval and infrastructure investment. Even if we were to find new deposits, it typically takes over a decade to go from discovery to production.

This built-in limitation means gold's supply doesn't increase rapidly—even if prices go up. That kind of rigidity makes gold more vulnerable to shifts in demand, which, in turn, pushes prices higher when people want to buy more.

High Demand for Gold in Jewellery & Luxury Goods

Gold might be rare, but it's also highly desirable—and that demand goes far beyond investment.

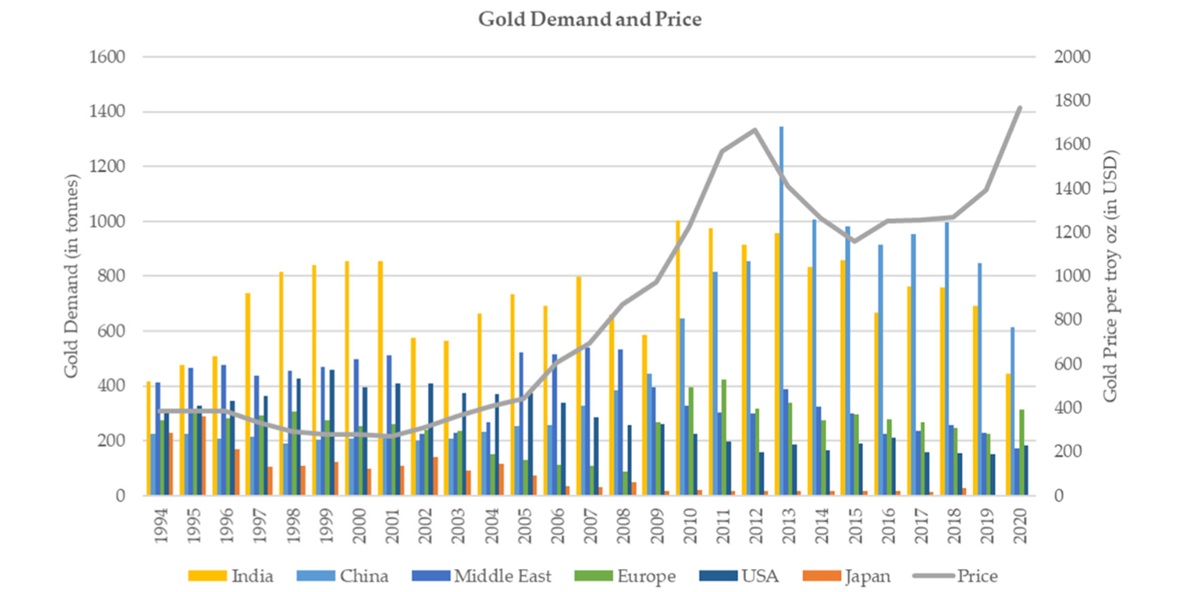

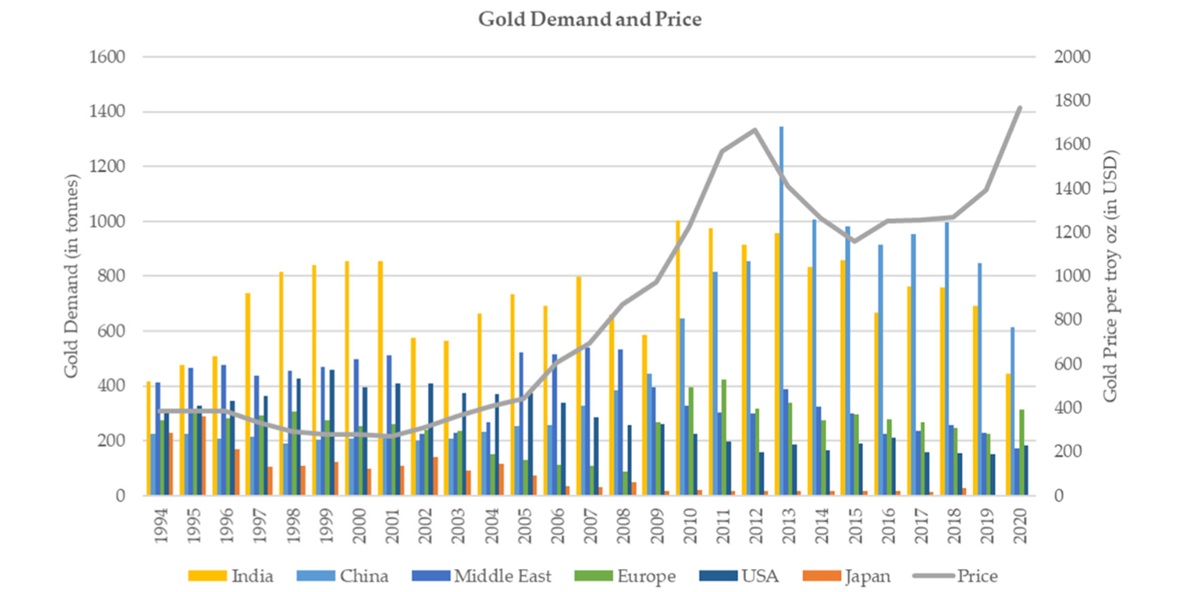

Around 40–50% of global gold demand comes from the jewellery sector. In many parts of the world, gold jewellery isn't just decorative; it's culturally significant and a form of long-term wealth. In India, for instance, gold is deeply tied to weddings, festivals like Diwali, and religious traditions. Families often pass down gold ornaments as heirlooms and savings. A similar cultural weight is seen in China, the Middle East, and parts of Southeast Asia.

Demand spikes around key seasons and festivals, which can drive global prices. What's more, in the luxury goods market, gold remains a staple. It's used in high-end watches, accessories, and bespoke designer items. For many, gold represents prestige, success, and timeless elegance—qualities that maintain its appeal across generations and income levels.

Because this demand is steady and often emotionally or culturally driven, it stays relatively strong even in times of economic uncertainty. People might cut back on other purchases, but gold tends to hold its place in spending priorities, especially in emerging markets.

Gold as a Hedge Against Inflation

Beyond jewellery, gold is widely viewed as a financial safety net—particularly during times of inflation or currency weakness. Unlike paper money, which loses value as inflation rises, gold maintains its purchasing power over time. That's why investors often move money into gold during economic uncertainty.

Think of it as a hedge. If your local currency is buying you less each month, holding gold could offer a way to protect the real value of your wealth. This is especially important in countries where inflation spirals quickly or the national currency is unstable.

Take historical events like the 1970s oil crisis, the 2008 global financial crash, or the COVID-19 pandemic. In each of these periods, investors turned to gold as a "safe haven," pushing prices up significantly. For example, gold rose from around $800 per ounce in 2008 to over $1.900 by 2011 as panic and economic uncertainty spread across global markets.

Even today, with interest rates fluctuating and inflation making a comeback in various parts of the world, gold continues to act as a reliable shield against market volatility. The more uncertain the economic environment, the more attractive gold becomes—and that naturally affects its price.

Central Banks & Government Gold Reserves

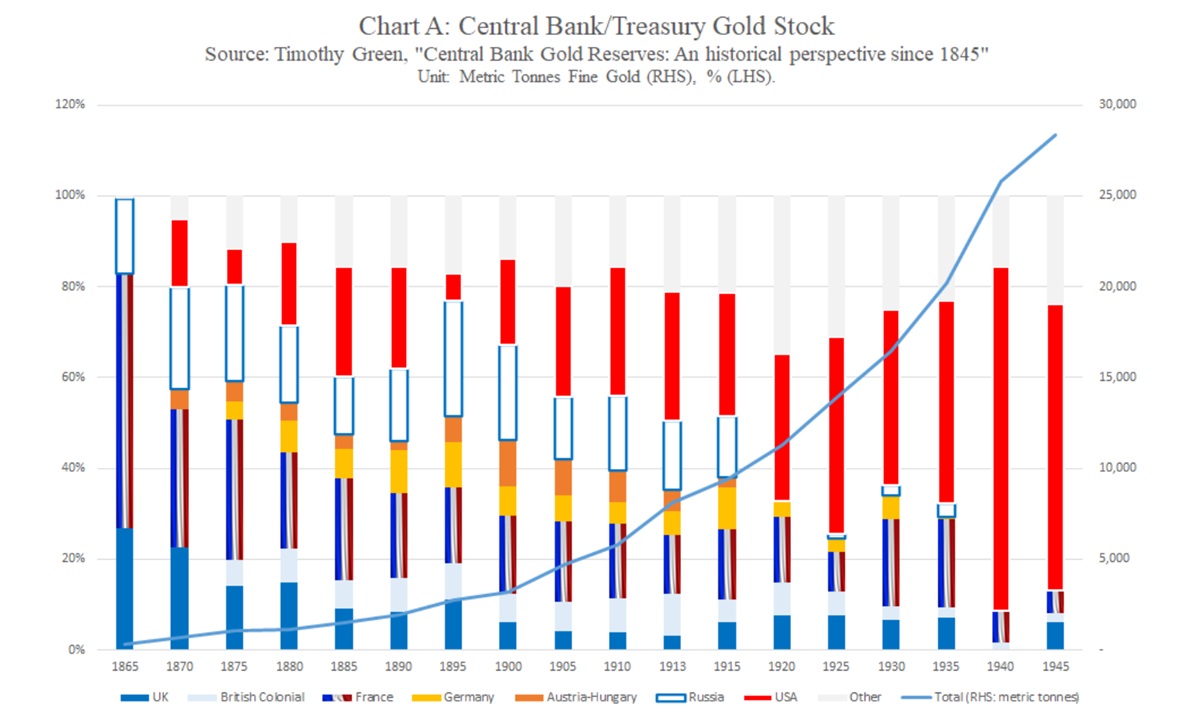

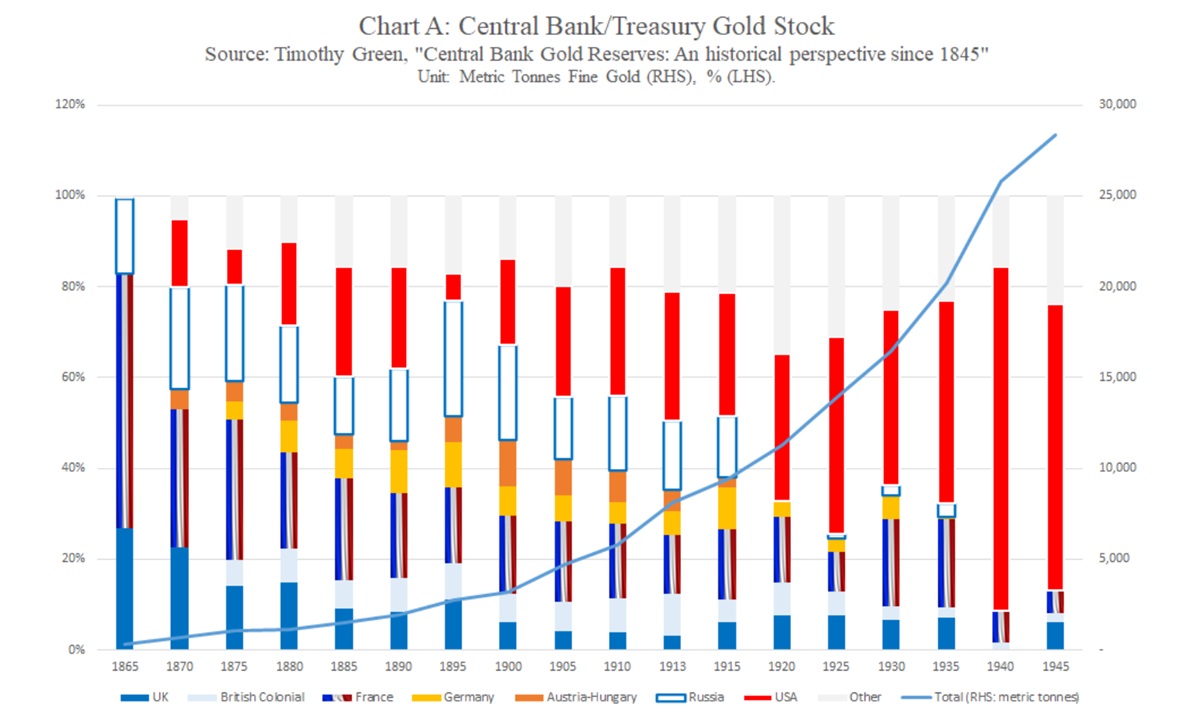

It's not just households and private investors that value gold. National governments and central banks are some of the biggest players in the gold market. They buy and hold large amounts of gold as part of their foreign exchange reserves.

Why? Because gold isn't tied to any single country's economy. Unlike dollars, euros, or yen, gold doesn't rely on monetary policy or interest rates. This makes it a useful tool for central banks looking to balance risk and maintain financial stability.

Why? Because gold isn't tied to any single country's economy. Unlike dollars, euros, or yen, gold doesn't rely on monetary policy or interest rates. This makes it a useful tool for central banks looking to balance risk and maintain financial stability.

Countries such as the United States, Germany, Russia, and China have significant gold holdings, often in the thousands of tonnes. In recent years, central banks in emerging markets have been increasing their reserves as well—viewing gold as a hedge against geopolitical risk and currency depreciation.

When central banks buy gold in large quantities, they don't just increase demand—they also signal to the rest of the market that gold is still considered a trusted, strategic asset. This behaviour creates upward pressure on prices and reinforces gold's global importance.

Gold's Role in Financial Markets & ETFs

In the past, owning gold meant buying physical bars, coins, or jewellery. Today, it's far easier—and more convenient—to invest in gold without touching a single ounce.

Gold-backed Exchange-Traded Funds (ETFs) allow investors to buy into gold through financial markets. These funds track the price of gold and are backed by real gold stored in secure vaults. The introduction of gold ETFs has opened up gold investing to millions of people who would otherwise find it impractical or costly to own physical metal.

What does this mean for price? Well, the easier it is to invest, the more people do it. This added accessibility increases demand—especially during volatile periods, like stock market downturns. When equity markets stumble, investors often "flee to safety," shifting money into gold ETFs. These inflows can be rapid, and the more money that flows in, the more gold has to be bought to match the fund's holdings—further driving up the price.

Conclusion

So, why is gold so expensive? It's the combination of fixed supply, strong cultural and industrial demand, and its unique position in global finance. Whether it's bought for beauty, tradition, or protection, gold continues to carry a weight that few other assets can match. It doesn't just sit in vaults or sparkle in display cases—it holds a deep and lasting place in how people, and nations, think about value, security, and wealth.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Much of the "easy" gold has already been extracted from the earth. What remains lies deeper underground, often in remote or unstable regions. Mining it not only costs more money and time, but it also requires significant environmental approval and infrastructure investment. Even if we were to find new deposits, it typically takes over a decade to go from discovery to production.

Much of the "easy" gold has already been extracted from the earth. What remains lies deeper underground, often in remote or unstable regions. Mining it not only costs more money and time, but it also requires significant environmental approval and infrastructure investment. Even if we were to find new deposits, it typically takes over a decade to go from discovery to production.

Why? Because gold isn't tied to any single country's economy. Unlike dollars, euros, or yen, gold doesn't rely on monetary policy or interest rates. This makes it a useful tool for central banks looking to balance risk and maintain financial stability.

Why? Because gold isn't tied to any single country's economy. Unlike dollars, euros, or yen, gold doesn't rely on monetary policy or interest rates. This makes it a useful tool for central banks looking to balance risk and maintain financial stability.