The world of trading is full of opportunities, and when it comes to high-growth potential, few markets stand out like China's. With its rapidly developing economy, booming technology sector, and increasing consumer base, Chinese stocks are on the radar for many traders looking for both short-term gains and long-term growth. However, tarding in Chinese stocks can be quite different from trading in other global markets. This guide will walk you through the best Chinese stocks to consider, where the biggest growth opportunities lie, and how you can approach trading in this dynamic market.

Chinese Stocks with High Growth Potential

China's stock market has a lot to offer, especially when it comes to high-growth companies. The country's economy is the second-largest in the world, and it continues to grow at a remarkable pace. With increasing urbanisation, a rising middle class, and technological advancements, Chinese companies across various industries are thriving.

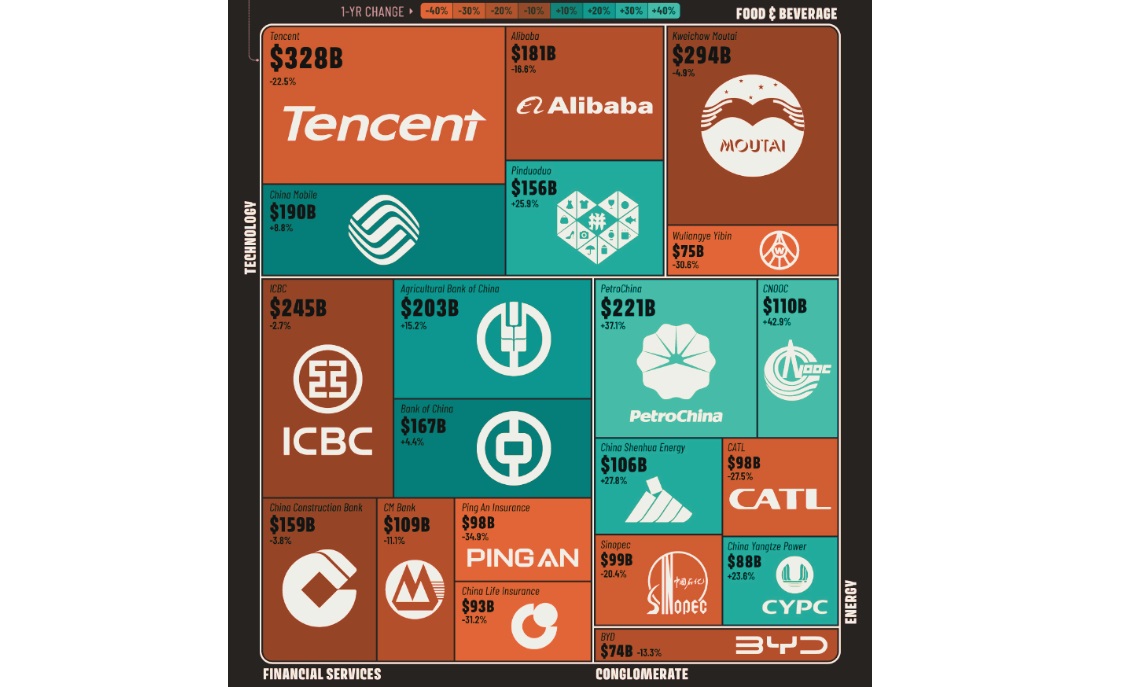

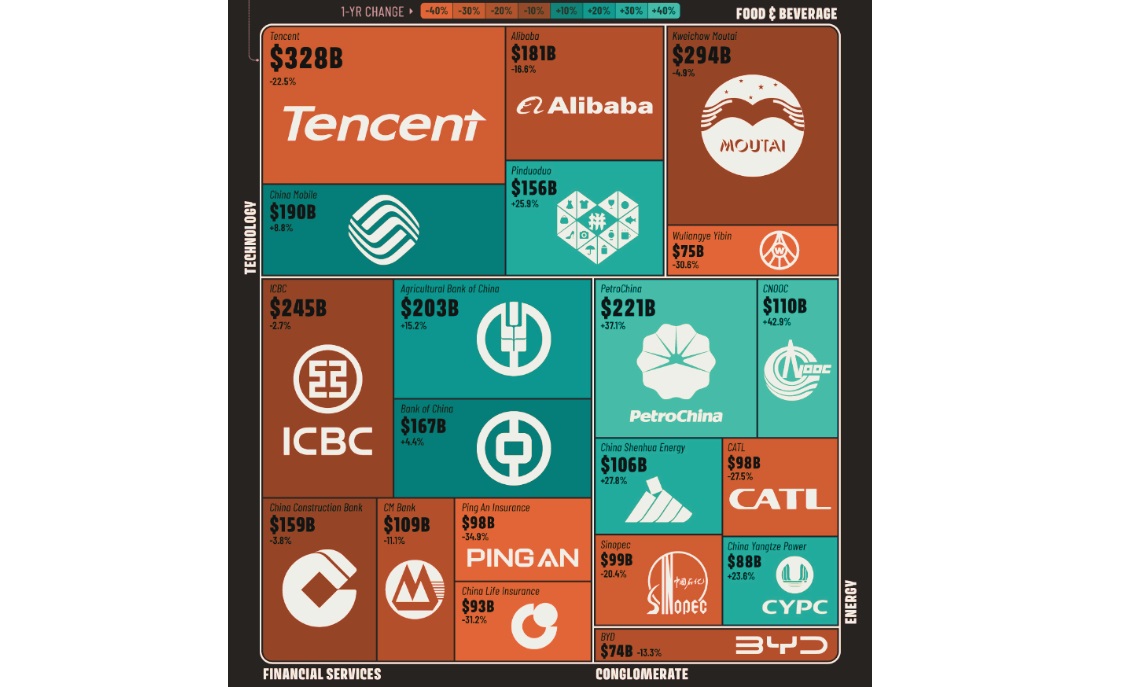

One of the most promising areas of growth is the technology sector. Chinese tech companies like Alibaba and Tencent have become global giants, competing with the likes of Amazon and Facebook. These companies are not just dominating in China, but also expanding internationally, positioning themselves to benefit from the growing demand for e-commerce, cloud computing, and digital entertainment.

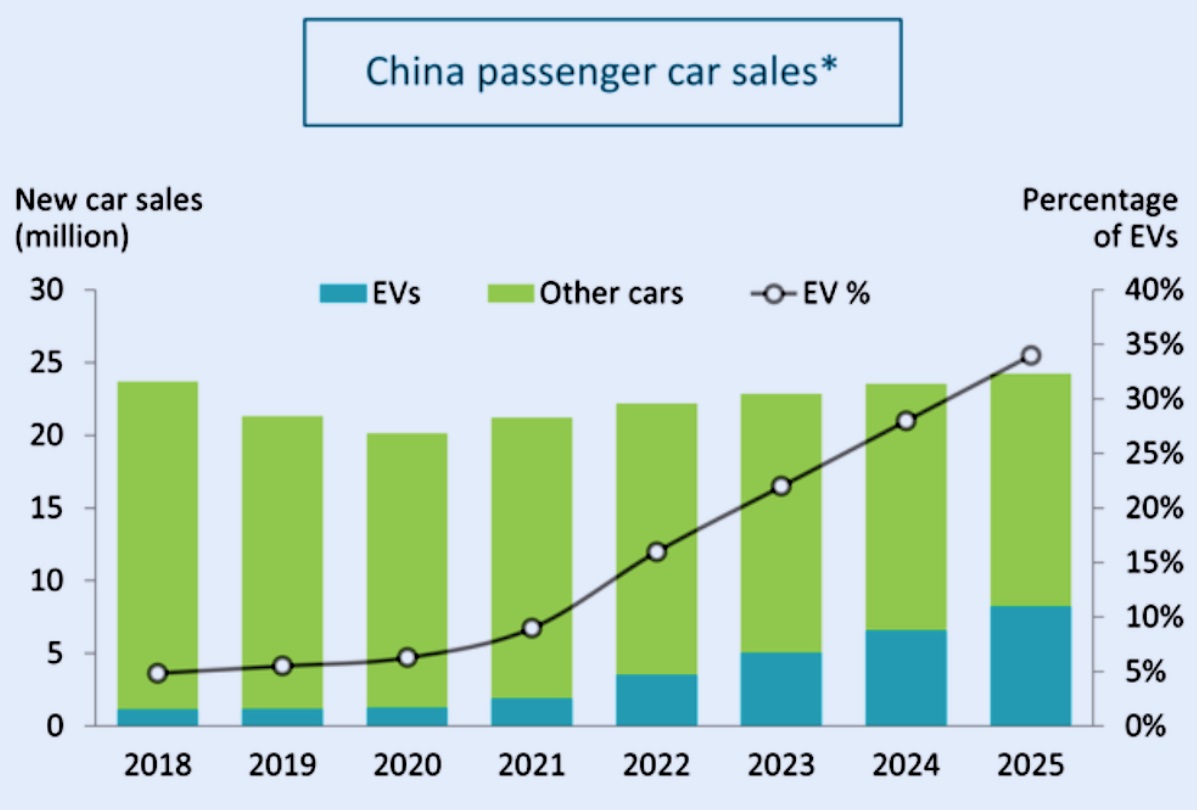

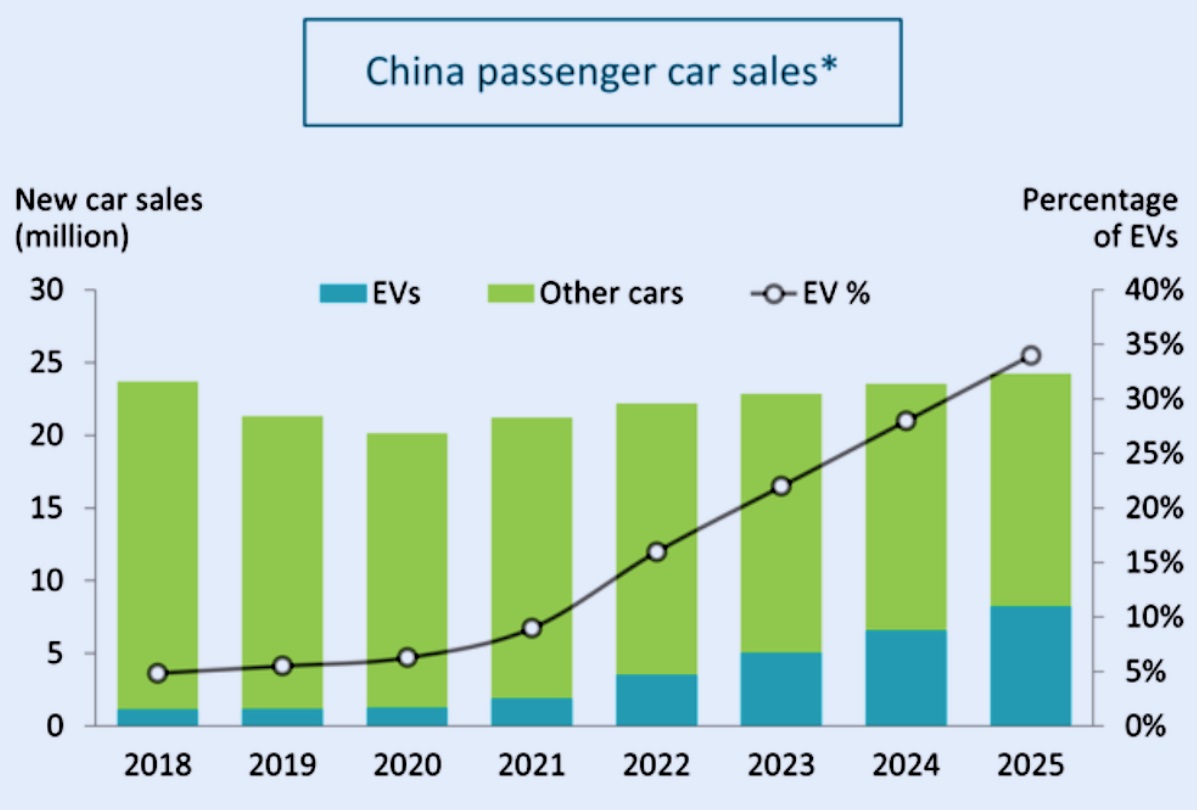

Another growth sector is the electric vehicle (EV) market. As China leads the way in electric car production, companies like BYD and NIO are gaining global attention. BYD, for example, is not only a leader in electric vehicles but also manufactures renewable energy products like solar panels and batteries, making it a highly diversified company with a wide reach in the green energy sector.

But growth isn't limited to the tech or EV sectors. The Chinese consumer market, with its increasing disposable income and appetite for premium goods, offers substantial opportunities. Companies like JD.com and Meituan are benefitting from the surge in consumer demand, making them key players in the future of Chinese retail and services.

But growth isn't limited to the tech or EV sectors. The Chinese consumer market, with its increasing disposable income and appetite for premium goods, offers substantial opportunities. Companies like JD.com and Meituan are benefitting from the surge in consumer demand, making them key players in the future of Chinese retail and services.

As you look at these stocks, consider their long-term growth potential. Stocks that dominate in areas like technology, clean energy, and consumer spending are likely to perform well, not just in the short term but for years to come.

Key Sectors Driving the Chinese Stock Market

Key Sectors Driving the Chinese Stock Market

To understand which Chinese stocks to buy, it's essential to know which sectors are currently driving the market. Technology, consumer goods, and green energy are the big ones, but each plays a different role in shaping China's economic future.

The technology sector is undoubtedly the driving force behind much of China's stock market activity. China is home to some of the world's largest tech companies, with a massive user base and a wealth of data that enables them to innovate rapidly. Companies like Alibaba, Tencent, and Baidu have a presence across e-commerce, social media, cloud computing, and artificial intelligence (AI). As China's digital economy expands, these companies are likely to continue to dominate, especially in sectors like fintech (financial technology), where Ant Group (Alibaba's fintech arm) is at the forefront.

The consumer goods sector is equally important. As China's middle class grows, so does the demand for premium and luxury products. This is where companies like JD.com and Pinduoduo come into play. These e-commerce platforms are capitalising on China's appetite for everything from electronics to fashion. With Chinese consumers spending more on online platforms, these companies are well-positioned for future growth.

Then there's the green energy sector. China is leading the way in the transition to renewable energy, not only producing some of the world's largest solar panel manufacturers but also becoming a major player in electric vehicles and battery production. BYD and NIO are at the forefront of China's EV revolution, and with the government pushing for cleaner, greener energy, these companies are expected to grow rapidly in the coming years. Additionally, the Chinese government's policies support green energy, which provides further assurance that these companies will continue to benefit from both policy and consumer demand.

Risks and Opportunities in Investing in Chinese Companies

While China offers great opportunities, it's also a market that comes with unique risks. Understanding these risks is crucial before diving into any investment, especially for beginners.

First, there's the risk of regulatory changes. The Chinese government has a strong hand in its economy and has been known to introduce sudden policy changes that can dramatically affect specific sectors. For example, the government has recently cracked down on the tech sector, with companies like Alibaba facing antitrust investigations. This can cause a lot of volatility in stock prices, so traders need to be prepared for such fluctuations and understand how government policies might affect the companies they're interested in.

Second, the geopolitical environment plays a significant role. Tensions between China and other countries, particularly the United States, can have a profound impact on Chinese stocks. Trade wars, sanctions, or other international conflicts could disrupt business operations or cause stocks to lose value. It's essential to keep an eye on these geopolitical risks when trading in Chinese stocks.

Lastly, the economic slowdown in China is something to watch. Although China's economy is still growing at a healthy rate, it has started to show signs of slowing down. This can impact the performance of companies in sectors like real estate and manufacturing. However, the government is pushing for domestic consumption and technological innovation to help balance the economy, which may offset some of these risks.

Despite these risks, there are still significant opportunities in China. The market is vast, and its growth potential is unmatched. By focusing on high-quality, growth-oriented stocks in sectors like technology, consumer goods, and green energy, traders can position themselves to benefit from China's long-term growth story.

To sum up, Chinese stocks offer a wealth of investment opportunities, but they also come with their own set of risks and challenges. As an trader, it's important to focus on the sectors that are showing strong growth potential, such as technology, green energy, and consumer goods. By keeping an eye on the broader economic and regulatory landscape, you can navigate this exciting market with confidence.

Whether you're looking to capitalise on the next big tech breakthrough or hoping to ride the wave of China's green energy transition, Chinese stocks have much to offer. And by understanding the key drivers of the market, you'll be well-equipped to make informed investment decisions in 2025 and beyond.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

But growth isn't limited to the tech or EV sectors. The Chinese consumer market, with its increasing disposable income and appetite for premium goods, offers substantial opportunities. Companies like JD.com and Meituan are benefitting from the surge in consumer demand, making them key players in the future of Chinese retail and services.

But growth isn't limited to the tech or EV sectors. The Chinese consumer market, with its increasing disposable income and appetite for premium goods, offers substantial opportunities. Companies like JD.com and Meituan are benefitting from the surge in consumer demand, making them key players in the future of Chinese retail and services. Key Sectors Driving the Chinese Stock Market

Key Sectors Driving the Chinese Stock Market