MT4 is one of the most popular software in forex trading, providing a wide range of functions and tools, and is widely used in major forex trading markets worldwide. However, users need to master certain knowledge when using MT4 for transactions in order to better engage in the transaction.

What is MT4 technology analysis?

technical analysis is an analytical method based on market historical data and price trends. MT4 technical analysis is a method of analyzing market data using tools and indicators on the MT4 platform. These tools and indicators can help traders predict market trends and develop corresponding trading strategies.

A few knowledge points to master when using MT4 for forex trading

1. Account registration and login

Firstly, after downloading and installing MT4 software on a legitimate trading platform, you can enter information such as account number, password, and server IP address to log in to the trading platform. After successful login, forex transactions can begin.

2. Selection of Forex Trading Varieties

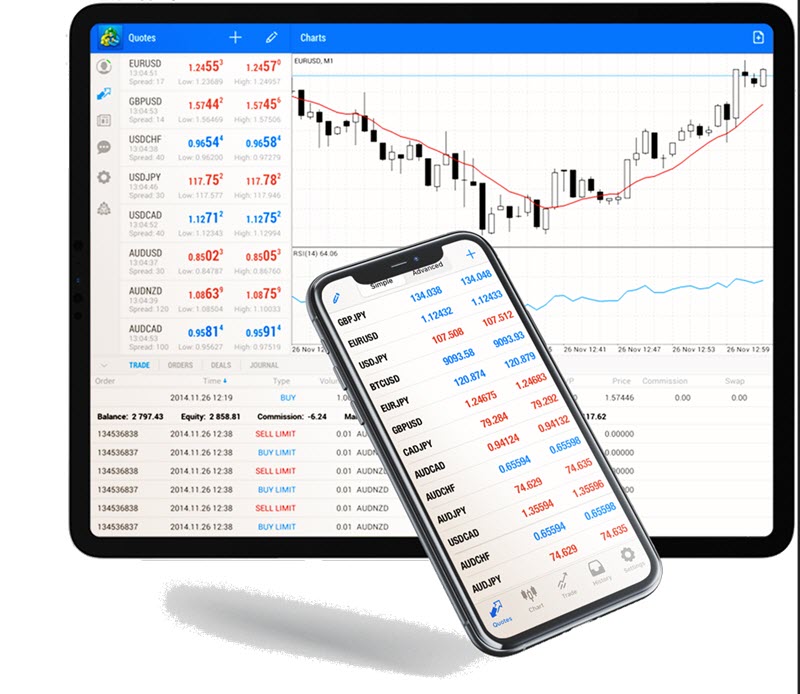

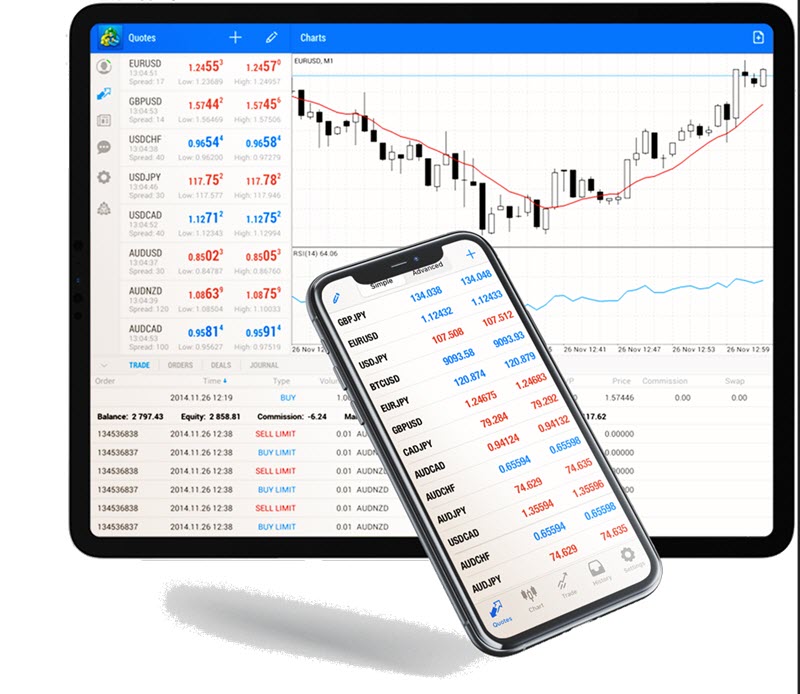

MT4 software provides a variety of forex trading varieties, including major currency pairs (such as Euro/USD, GBP/USD, USD/JPY, etc.) as well as some minor currency pairs. When selecting trading varieties, it is necessary to pay attention to factors such as liquidity, volatility, and transaction costs to choose the most suitable trading variety for oneself.

3. Application of technical analysis tools

MT4 software provides numerous technical analysis tools, such as K-line graphs, moving averages, MACD indicators, Bollinger bands, etc. These tools can help investors analyze market trends, predict price trends, and develop trading strategies to maximize profits. Investors need to learn to use these tools and combine their trading experience and fundamental analysis to make more accurate trading decisions.

4. Order Type and Risk Control

In MT4 software, different types of orders can be selected, such as market orders, limit orders, stop loss orders, tracking stop loss orders, etc. When placing an order, it is necessary to consider factors such as the liquidity and volatility of the trading variety to determine the most effective entry and exit points, and develop risk management strategies to control position and fund risks.

5. Automated transaction applications

MT4 software supports automated trading and can write its own trading strategies and algorithms for trading without human intervention. By automating trading, the impact of emotions on trading can be eliminated, and trading efficiency and profitability can be improved.

Overall, users downloading MT4 for forex trading require investors to be familiar with relevant knowledge and technical analysis tools, as well as possess strong market analysis and risk management capabilities. Of course, MT4 software, as a forex trading tool, is only a part of the trading process. Investors also need to pay attention to various factors such as the global economic and political situation in order to make more accurate trading decisions.

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.