If you've ever tried to understand market sentiment, you've probably come across the term "Put-Call Ratio" (PCR). This might sound a little technical at first, but in reality, it's a straightforward indicator that can give you valuable insights into how traders are feeling about the market. Whether you're an experienced trader or a beginner, understanding the PCR can enhance your trading strategy and help you make better-informed decisions.

What Is Put-Call Ratio?

At its core, the Put-Call Ratio is a simple measure used to gauge the sentiment of traders. It compares the number of put options traded to the number of call options traded in the market. A put option gives the holder the right to sell an asset at a specified price, while a call option gives the holder the right to buy. By looking at how many puts are being traded compared to calls, the PCR offers a snapshot of whether traders are feeling bullish (optimistic) or bearish (pessimistic) about the market.

If the ratio is high, it suggests that there's more interest in put options, which typically reflects fear or negative sentiment. On the other hand, a lower PCR indicates a higher volume of call options, signalling optimism about future price increases. Essentially, the PCR tells you how many people are betting on the market going down (puts) versus those betting on it going up (calls).

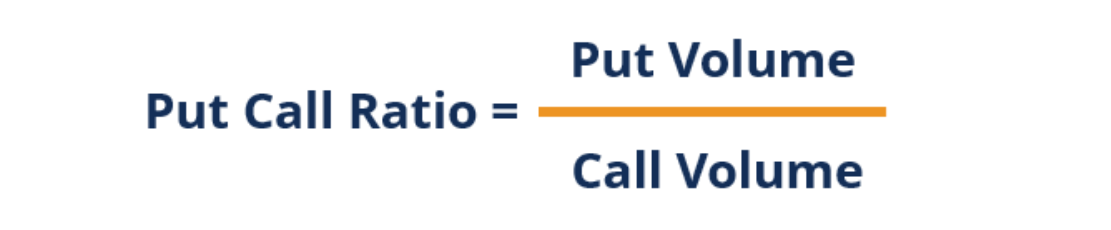

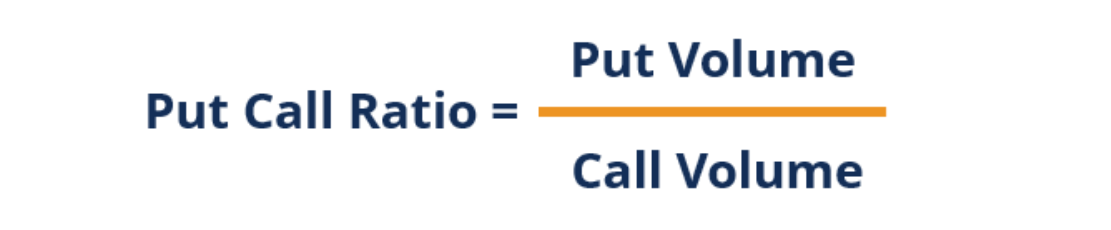

How to Calculate the Put-Call Ratio

The calculation of the Put-Call Ratio is fairly straightforward. All you need to do is divide the number of put options traded by the number of call options traded over a specific period. For example, if 10.000 puts are traded and 20.000 calls are traded, the PCR would be 0.5.

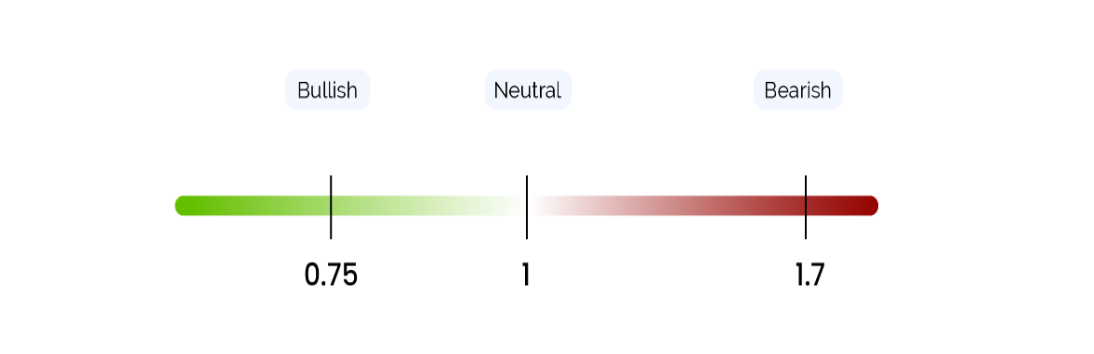

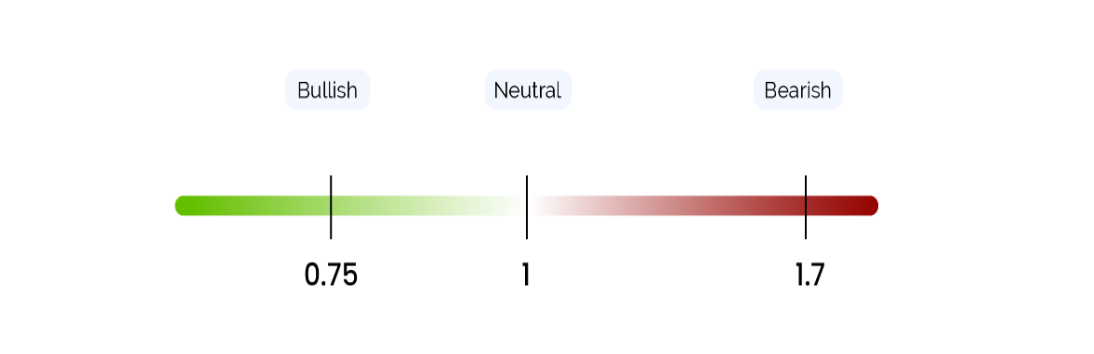

It's important to remember that the PCR is typically calculated on a daily or weekly basis. Traders often use this number to observe trends over time rather than focusing on a single day's data. A ratio of around 1.0 is considered neutral, meaning there is a roughly equal balance between calls and puts. A ratio above 1.0 is seen as more bearish, while a ratio below 1.0 suggests a bullish outlook.

It's important to remember that the PCR is typically calculated on a daily or weekly basis. Traders often use this number to observe trends over time rather than focusing on a single day's data. A ratio of around 1.0 is considered neutral, meaning there is a roughly equal balance between calls and puts. A ratio above 1.0 is seen as more bearish, while a ratio below 1.0 suggests a bullish outlook.

Interpreting the Put-Call Ratio

Interpreting the PCR isn't always as simple as just looking at the number. The key to understanding it lies in recognising the broader trends it signals. Generally speaking, a high PCR (over 1.0) can indicate a bearish sentiment, where more traders are betting on the market falling. This could be a sign that people are anxious or uncertain about future market movements. However, extreme values in the PCR, especially if they're unusually high, might also suggest that fear has reached a peak, which can sometimes signal that the market is oversold and may be due for a bounce.

On the other hand, a low PCR (below 1.0) is usually interpreted as a bullish signal, indicating that more traders are buying call options in anticipation of a price increase. If the ratio becomes very low, however, it could mean the market is becoming overly optimistic, which could eventually lead to a correction or downturn.

While these interpretations can be helpful, they're not always black and white. The PCR should be viewed in conjunction with other market indicators to get a more complete picture of market conditions.

Using the Put-Call Ratio in Trading Strategies

Now that we understand what the PCR is and how to interpret it, how can it be used in practical trading strategies? The most common way traders use the PCR is as a contrarian indicator. In other words, they look for extremes in the ratio to predict potential market reversals. When the PCR is exceptionally high, it could mean that the market is overly pessimistic, and a rally could be just around the corner. Conversely, an extremely low PCR might indicate excessive optimism and the possibility of a market pullback.

Another way to use the PCR is in combination with other indicators, such as technical analysis tools. For example, if the PCR is showing an overly bullish sentiment but technical indicators are suggesting that a market correction is imminent, the two signals might align to create a stronger case for caution.

It's also useful to track changes in the PCR over time. If the ratio is consistently rising, it might signal growing fear and market weakness, while a declining PCR could suggest that traders are becoming more confident. By monitoring these shifts, traders can position themselves accordingly, buying when sentiment is overly negative or selling when sentiment becomes too positive.

Limitations and Considerations

Like any indicator, the Put-Call Ratio is not without its limitations. One key point to remember is that it's just one tool among many. Relying solely on PCR without considering other factors could lead to misleading conclusions. Additionally, the PCR works best when looked at in the context of broader market trends and should be used alongside other sentiment indicators, such as the Volatility Index (VIX), for a more nuanced view.

It's also important to keep in mind that the PCR is a reflection of sentiment in the options market, not necessarily the entire market. A sudden spike in put options might be driven by institutional traders hedging their positions or using options as part of a broader strategy, rather than a signal of a bearish market.

Finally, the PCR tends to be more reliable in the context of more liquid markets. In smaller, less liquid markets, extreme PCR values can sometimes be misleading, as they may not represent the true sentiment of a broad range of market participants.

Conclusion

The Put-Call Ratio may seem like a simple concept, but it's a powerful tool for understanding market sentiment. By comparing the number of puts and calls being traded, it gives traders an idea of how the market is feeling and whether traders are leaning towards optimism or pessimism. While it's most useful when combined with other indicators, the PCR can help guide your trading decisions and keep you attuned to changes in market sentiment. Whether you're looking for contrarian signals or simply trying to understand the mood of the market, mastering the Put-Call Ratio is an essential step towards becoming a more informed trader.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

It's important to remember that the PCR is typically calculated on a daily or weekly basis. Traders often use this number to observe trends over time rather than focusing on a single day's data. A ratio of around 1.0 is considered neutral, meaning there is a roughly equal balance between calls and puts. A ratio above 1.0 is seen as more bearish, while a ratio below 1.0 suggests a bullish outlook.

It's important to remember that the PCR is typically calculated on a daily or weekly basis. Traders often use this number to observe trends over time rather than focusing on a single day's data. A ratio of around 1.0 is considered neutral, meaning there is a roughly equal balance between calls and puts. A ratio above 1.0 is seen as more bearish, while a ratio below 1.0 suggests a bullish outlook.