Understanding the bid-ask spread is an important step for anyone interested in trading or investing. While it might sound like technical jargon at first, the concept is quite straightforward—and once you get the hang of it, you'll see why it's such a vital piece of the financial puzzle.

Definition of Bid and Ask Prices

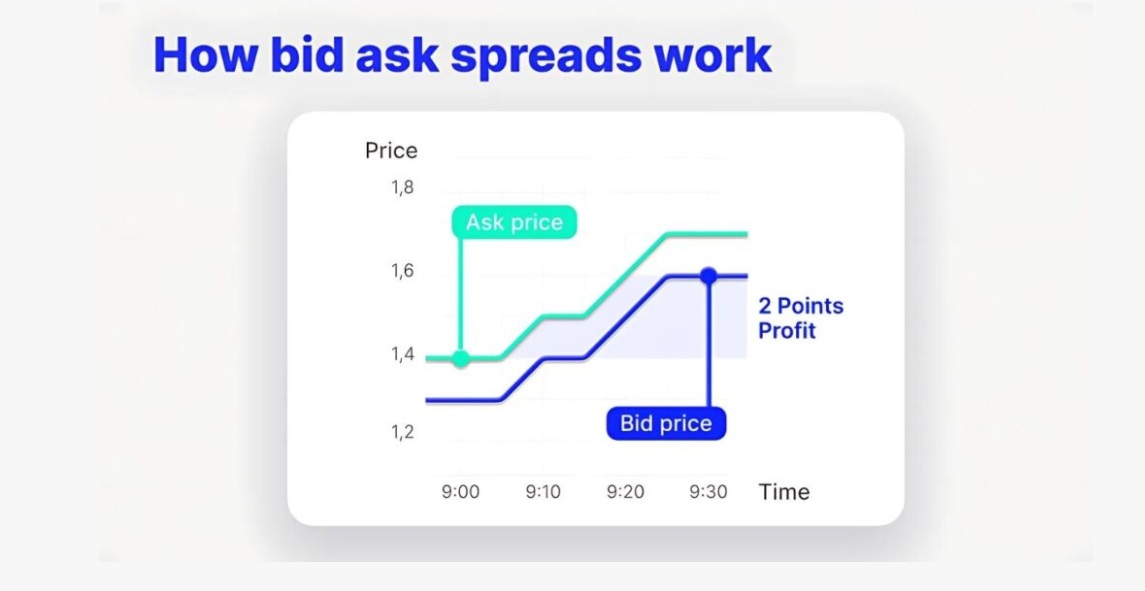

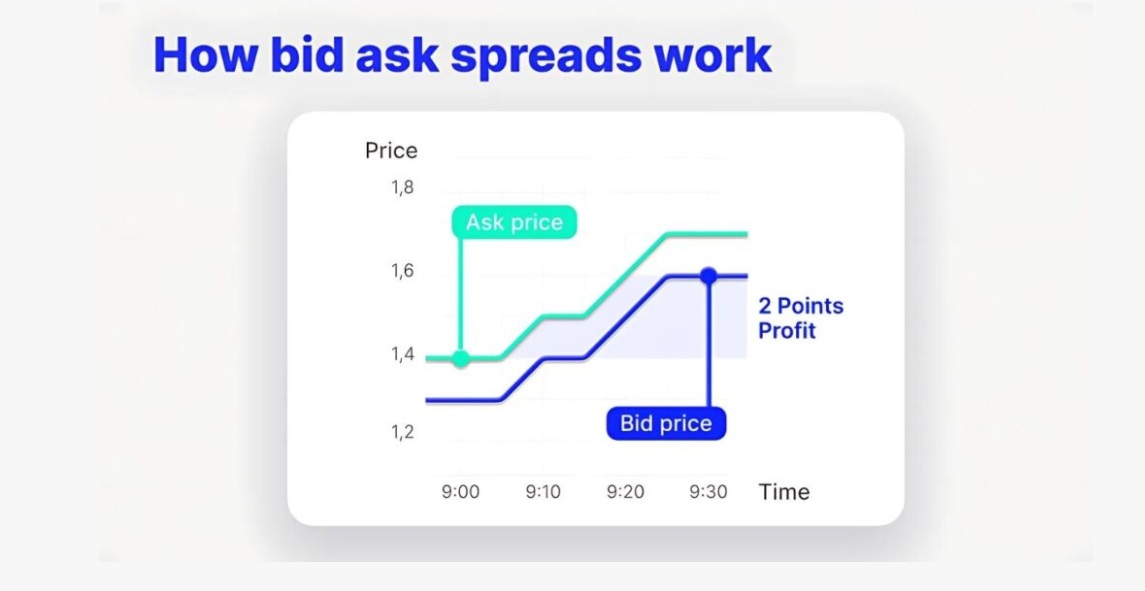

To begin with, the bid and ask prices represent the two sides of any trade. The bid price is the highest amount a buyer is willing to pay for an asset, while the ask price (also called the offer price) is the lowest amount a seller is willing to accept. The bid-ask spread is simply the difference between these two prices.

Think of it as a mini tug-of-war between buyers and sellers. The buyer wants to pay less, and the seller wants to get more. The space between their expectations is the spread. This might only be a few pence for a popular stock or currency pair, or several pounds for something less frequently traded. And while that gap might look small at first glance, it plays a big role in how much you pay to trade—and how much you can make or lose.

Role of Market Makers

Now, who keeps this process moving? That's where market makers come in. These are usually large financial institutions or brokerage firms that help create liquidity in the market by always being ready to buy or sell a particular asset. In essence, they "make" the market by offering both a bid and an ask price at any given moment.

Their goal is to profit from the spread. For instance, if they buy an asset at £10.00 (the bid) and sell it at £10.05 (the ask), that 5p difference is their gain—assuming no major price changes in the meantime. But it's not risk-free. If prices swing unexpectedly, market makers can end up holding assets they can't sell easily, or worse, at a loss. So the spread also compensates them for taking on that risk.

Impact of Liquidity on Spreads

One of the biggest factors affecting the size of the spread is liquidity—how many people are buying and selling a given asset. When there are lots of active traders in the market, it's easy to match buyers with sellers, which tends to narrow the spread. This is why assets like major stock indices or currency pairs (like EUR/USD) usually have very tight spreads. They're constantly being traded, so there's less uncertainty.

But for something less popular—say, a small-cap stock or a niche cryptocurrency—the story is quite different. With fewer people trading, there's more uncertainty, and market makers have to widen the spread to protect themselves from sudden price swings or difficulty offloading assets. So a wide spread often signals that you're dealing with a less liquid, and possibly riskier, investment.

Influence of Volatility

Closely related to liquidity is volatility—how much the price of an asset jumps around. Even in a market with high trading volume, if prices are changing rapidly, spreads can widen. This happens because market makers don't want to be caught on the wrong side of a sudden move. In other words, the more unpredictable the market, the more cautious they become.

A good example of this is during major news announcements, such as central bank decisions or earnings reports. Spreads can suddenly widen just before or after such events, because traders and market makers alike are uncertain about which direction the market will take. It's a protective measure, but for everyday traders, it means higher trading costs and less favourable prices during those windows of time.

Examples Across Asset Classes

To bring it all together, let's look at how bid-ask spreads vary in real markets. In the foreign exchange market, major pairs like GBP/USD or EUR/USD often have spreads as low as 0.1 pip (a pip is 0.0001 of a currency unit). That's because these are some of the most liquid markets in the world. But if you try to trade a less common pair like USD/TRY (US dollar vs. Turkish lira), the spread can be significantly wider, reflecting higher volatility and lower trading volume.

In the stock market, shares of companies like Apple or Shell usually have narrow spreads on major exchanges like the London Stock Exchange or NASDAQ. But smaller firms listed on less active exchanges may show spreads of several pence or even pounds, which can impact your ability to buy or sell without giving up value.

It's the same story in other markets too—commodities, bonds, even cryptocurrencies. The more liquid and stable the market, the tighter the spread. The more volatile or illiquid, the wider it gets.

Conclusion

The bid-ask spread might seem like a minor detail at first, but it's one of those little things that can have a big impact on your trading experience. From the moment you place an order, the spread affects what you pay and what you might earn. By understanding what it is, how it works, and what influences it, you'll be in a much better position to make informed decisions—and avoid unnecessary costs.

If you're new to trading or investing, keep an eye on the spread. It's a useful signal of what's happening in the market and a subtle reminder that there's always more to the price than meets the eye.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.