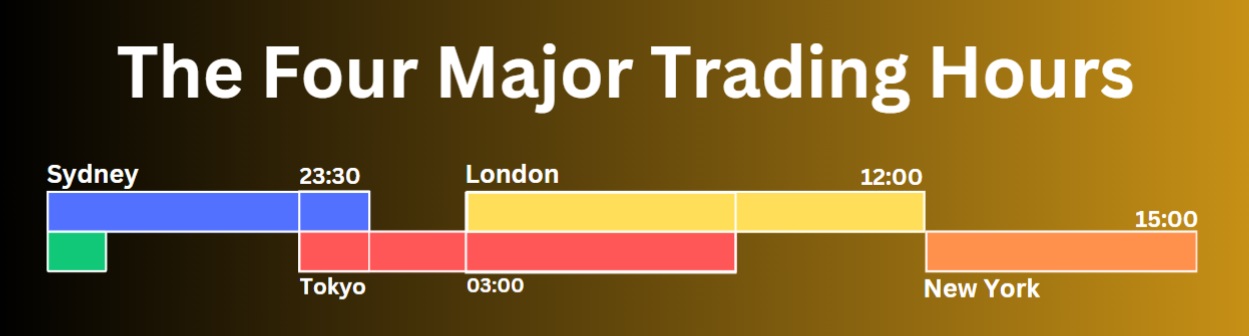

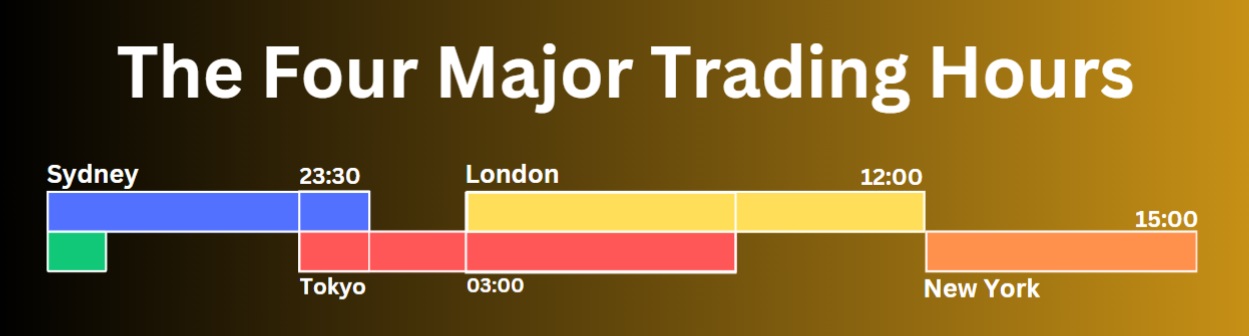

The forex market operates around the clock, providing traders with a rare level of flexibility. It's open 24 hours a day, five days a week, giving you the opportunity to trade at any time, from Sunday evening until Friday evening, in GMT terms. But while the market never sleeps, not all hours are created equal. Some specific hours are much more conducive to profitable trading than others. Understanding market hours and the four key trading sessions – Sydney, Tokyo, London, and New York – can help you strategically time your trades for optimal success.

Each of these trading sessions represents a different geographical region and operates at different times of day. The Tokyo session represents the Asian market, while the London session is the heart of the European market, and the new york session covers the North American market. During these trading hours, local banks, businesses, and traders are active, which increases the volume of trades and the overall market liquidity. It's when the majority of price action occurs and, therefore, when you have the greatest chance to capitalise on market movements.

Best Times to Trade Forex

Despite the forex market's 24-hour availability, it's not necessarily the case that all hours are ideal for trading. Overlapping trading sessions are often considered the best times to trade, as they provide greater liquidity and heightened market activity. For instance, the overlap between the London and New York sessions is widely regarded as the most active period for forex traders. This is because both London, as a major financial hub, and New York, as the largest forex trading centre in North America, are open at the same time, which naturally leads to higher trading volumes and more opportunities to profit.

Additionally, the timing of scheduled economic reports can also create significant volatility. These reports, which include announcements like GDP figures, inflation data, or interest rate changes, can drive sharp price movements. Traders often find that trading around the time of these reports – or using them to inform their strategies – can provide new opportunities for profit.

Liquidity and trading opportunities are maximised during times of high market volatility, especially when two major trading sessions overlap. This is when price action is often at its most exciting, with big swings in currency values creating numerous chances to enter and exit trades profitably. Therefore, the best time to trade is often during these periods when market conditions are ripe for movement.

Worst Times to Trade Forex

However, not every moment in the forex market is ripe for trading. There are certain times when the market is simply less active and more difficult to navigate. Late Friday and early Monday are generally considered the worst times to trade, as liquidity tends to be lower and price movements become erratic.

Late Friday afternoons, particularly after 4:00 PM GMT, are often a period of market slowdown. Many traders close their positions in preparation for the weekend, and there is less market activity, leading to larger spreads and choppy price action. This can be a frustrating time to trade, as the market may not behave predictably, and the risk of losses increases due to the lack of liquidity.

Early Monday mornings, from about 10:00 PM to 5:00 AM GMT, are also periods when trading conditions are not ideal. At the start of the week, the market is often quieter as traders are waiting for fresh news or developments to set the tone for the week ahead. The lack of major economic events or news announcements during this time can lead to thin markets, with erratic price movements and higher spreads.

During these periods of low liquidity, price movements can be unpredictable, and spreads (the difference between the buying and selling price) can widen significantly. This makes it harder to get in and out of positions without taking on extra costs or unexpected slippage.

Adapting Trading Strategies to Different Sessions

It's essential to understand that different trading sessions are suited to different types of strategies. For example, the Tokyo session, which is typically calmer and quieter, is ideal for those who prefer a more methodical approach. This session tends to have lower volatility, making it a good time for traders who want to avoid sharp, erratic price movements. Traders often use this time to focus on range trading or swing trading, both of which rely on price fluctuations within defined boundaries.

The Asian market overlap, where Tokyo meets Sydney, offers more stable trading conditions, which can be advantageous for traders using momentum-based strategies. These strategies involve taking advantage of short-term price moves, and this session can offer consistent and steady price action for those looking to capture smaller gains.

As for the European/U.S. session crossover, this is when things really start to heat up. The combination of the highly liquid London session and the busy New York session creates an environment with significant price movement, particularly in pairs like EUR/USD. This is one of the best times to employ trend-following strategies, as the increased market activity often leads to clearer trends. The volatility during this time creates opportunities for those looking to trade larger price moves.

It's also worth noting that scheduled economic announcements can create major fluctuations in the market. These reports often have a direct impact on the currency pairs involved, so timing your trades around these events can be a key strategy. If you're trading a currency pair linked to a country set to release economic data, such as the UK’s GDP figures or U.S. Non-Farm Payrolls, these announcements can lead to swift and substantial price movements, which can be capitalised on for short-term profits.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.