Forex CFDs, or Contracts for Difference, have gained immense popularity among traders seeking to capitalise on currency price movements without actually owning the underlying currencies. This financial instrument allows you to speculate on whether the value of a currency will rise or fall against another, enabling you to profit from both upward and downward trends in the market.

Unlike traditional forex trading, where you exchange one currency for another, CFD Forex trading enables you to enter a contract with a broker that reflects the price movement of the currency pair, without the need to physically own the currency. For instance, if you believe the EUR/USD pair will rise, you can buy a CFD based on this pair, and if it does indeed increase in value, you can profit without ever holding actual euros or US dollars.

The beauty of CFD Forex trading lies in its simplicity and the ability to trade without taking ownership of the asset. Whether the market is going up or down, you can potentially profit, which opens up opportunities for traders regardless of market conditions. This ability to trade on both rising and falling markets gives you more flexibility, allowing you to take advantage of a wider range of market movements.

Leveraged Trading and Amplified Risk

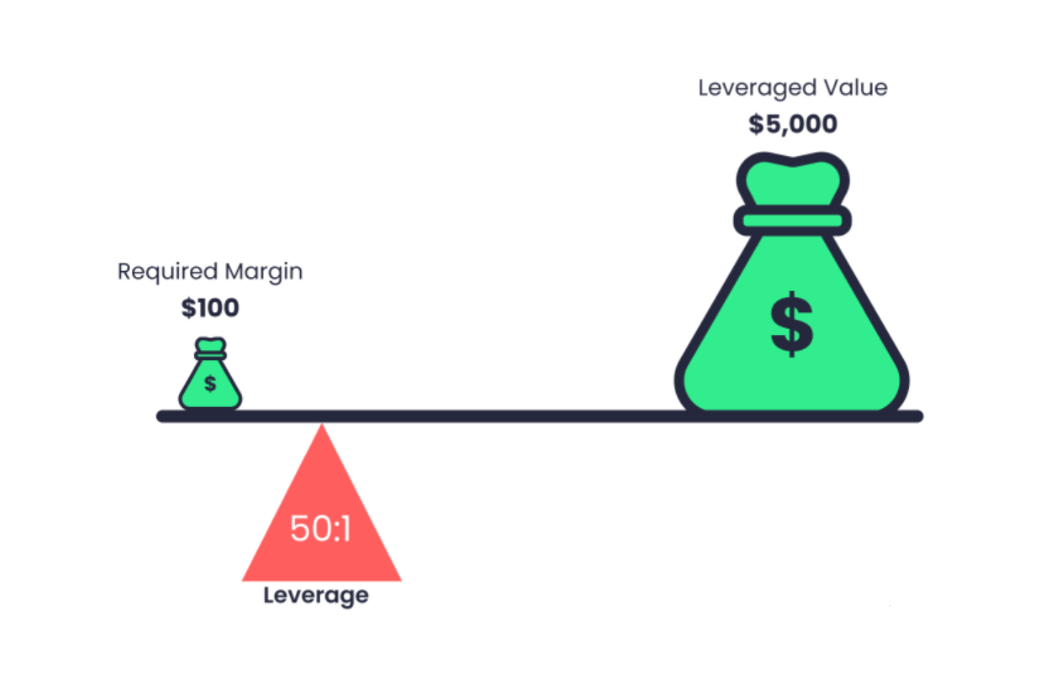

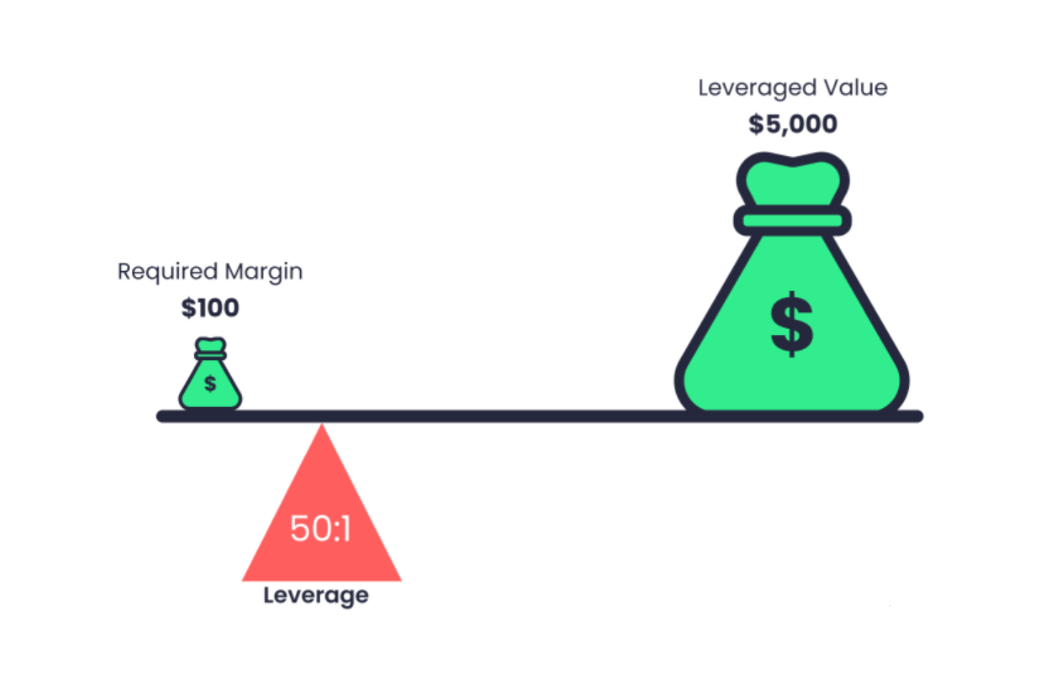

One of the most appealing features of trading Forex CFDs is the ability to use leverage, which allows you to control a larger position with a smaller initial outlay. For example, with leverage of 50:1. you could control a position worth 50 times more than your initial deposit. While this leverage offers the potential for higher profits, it also amplifies the risks significantly.

Leverage is a double-edged sword. It can magnify profits when the market moves in your favour, but it can also intensify losses if the market moves against you. This makes effective risk management crucial when trading CFD Forex. To protect your capital, traders typically use stop-loss orders, which automatically close a position at a set price, limiting potential losses.

Additionally, it's important to remember that the leverage effect works both ways. A small change in currency prices can lead to substantial gains or losses, depending on the size of your position and the leverage applied. Therefore, a well-thought-out strategy is necessary to avoid substantial financial setbacks.

Furthermore, position diversification is another risk management technique that can help mitigate the effects of a market downturn. By spreading your investments across multiple currency pairs or markets, you reduce the risk of losing everything on a single trade. The more diversified your portfolio, the more balanced your overall risk will be.

Choosing the Right CFD Broker

Selecting the right broker is a pivotal decision in Forex cfd trading. A reliable broker ensures that you have access to competitive spreads, a user-friendly platform, and solid customer support. It's also vital to ensure the broker is regulated by a reputable authority, which ensures the safety and transparency of your funds and trades.

When it comes to Forex CFDs, brokers typically offer a wide range of currency pairs, from major pairs like EUR/USD and GBP/USD to more exotic pairs. In addition, it’s important to understand the trading costs involved. While some brokers charge a commission per trade, many operate with a spread, which is the difference between the buy and sell prices of a currency pair.

Apart from spreads, overnight fees (or swap rates) may also apply when you hold a position overnight. These fees are the costs associated with financing a leveraged position for an additional trading day. Depending on whether you are holding a long or short position, the broker may either charge you or pay you an overnight fee, which can add up over time. Understanding all of these fees upfront will ensure you're fully prepared for the costs of trading and avoid any surprises.

The platform provided by the broker is also an essential consideration. Many brokers now offer sophisticated platforms with charting tools, real-time news, and other helpful features that can enhance your trading experience. A good platform will allow you to make quick and informed decisions, especially when trading in volatile currency markets.

Navigating the Forex cfd market

Forex CFD trading offers significant opportunities to profit from currency fluctuations without the need to own the underlying currencies. By trading on margin, you can access larger positions with less capital, which amplifies the potential returns on your trades. However, this also introduces higher risk, making it crucial to manage your trades carefully and use strategies such as stop-loss orders and position diversification.

The key to success in Forex CFD trading lies in choosing the right broker, understanding the associated costs, and employing sound risk management strategies. By keeping these factors in mind, you can navigate the complexities of the Forex CFD market and potentially unlock a wealth of trading opportunities.

As with any form of leveraged trading, the risks are substantial, and there is no guarantee of profit. Therefore, it's essential to start with a well-researched strategy, stay informed about market trends, and always trade with caution. With the right knowledge and approach, Forex CFDs can be an exciting and rewarding way to engage with the global currency markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.