Long and short positions in forex are two basic trading strategies in the forex market.

Bullish refers to the trading strategy of investors who believe that the price of a currency will rise and therefore adopt a buying strategy for that currency or currency pair. For example, if an investor believes that the price of the euro against the US dollar will rise, they will adopt a long strategy and buy the euro against the US dollar currency pair.

Bearish refers to the trading strategy of investors who believe that the price of a currency will fall and therefore adopt the selling of that currency or currency pair. For example, if an investor believes that the price of the australian dollar against the US dollar will fall, they will adopt a short selling strategy and sell the currency pair of the Australian dollar against the US dollar.

Long and short positions are two different trading strategies in the trading market, and traders can adopt different strategies based on their own judgment of the market. Investors analyze the fundamental and technical aspects of the market to determine market trends and price trends, and choose appropriate trading strategies to obtain returns.

Identifying long and short positions requires analyzing market trends and trading conditions. Here are some methods that may help you distinguish between long and short positions:

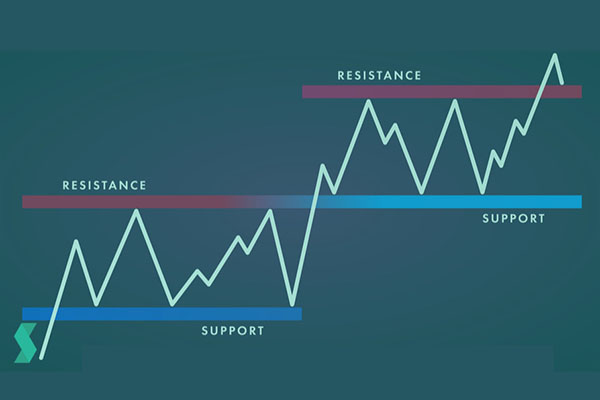

1. Trend Line: By drawing a trend line, you can analyze the price trend of currency pairs and identify market trends. If the trend line shows an upward trend, it indicates a long market trend, and vice versa, it is a short market trend.

2. Moving Average: By observing the intersection of short-term and long-term moving averages, market trends can be analyzed. If the short-term moving average line crosses the long-term moving average line, it indicates a bullish market situation, and vice versa, it is a bearish market situation.

3. Disposable funds: By observing trader' disposable funds, one can determine the market's long and short positions. If trader' disposable funds increase, it indicates that the market is bullish, and vice versa, it is bearish.

4. News events: By observing important news events, market trends can be analyzed. If the market's expectation of an event is bullish (bullish), then the price of the currency pair may rise; If the market's expectation of the event is bearish (short), the price of the currency pair may decline.

5. Technical analysis: By using technical analysis tools such as charts and indicators, it can help identify market bulls. To distinguish forex bulls and bears, it is necessary to analyze and judge market trends.

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the financial market, and investment needs to be cautious. This article does not constitute investment advice.