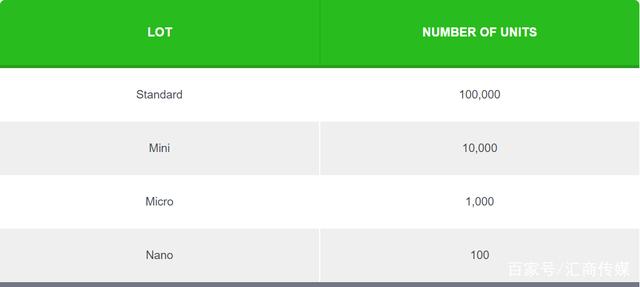

Friends who are familiar with stock trading should know that buying stocks in the A-share market is done by hand, with 100 stocks in one hand. So, in foreign exchange trading, "lots" are also a unit of quantity that represents the size of your purchased position.

In currency transactions, "hands" refer to the number of transactions, such as the unit of quantity for cars being vehicles, the unit of quantity for clothes being pieces, and the unit of quantity for foreign exchange transactions being hands. How much does one hand of currency represent?

The term 'hand count' originated from foreign futures markets, where all trading varieties are packaged in standardized contracts. Traders trade futures contracts instead of physical or financial products, which are uniformly formulated by exchanges. Each contract represents a certain amount of physical or financial products, with fixed quantity units and amounts.

The number of trading hands, also known as the order size, is expressed in the unit of measurement of "hands" for each transaction. The larger the number of "hands", the larger the quantity and scale of the position held. To put it more simply, it means you go to the vegetable market to buy cabbage. "Jin" is the unit of measurement, and the more "Jin", the more vegetables you buy.

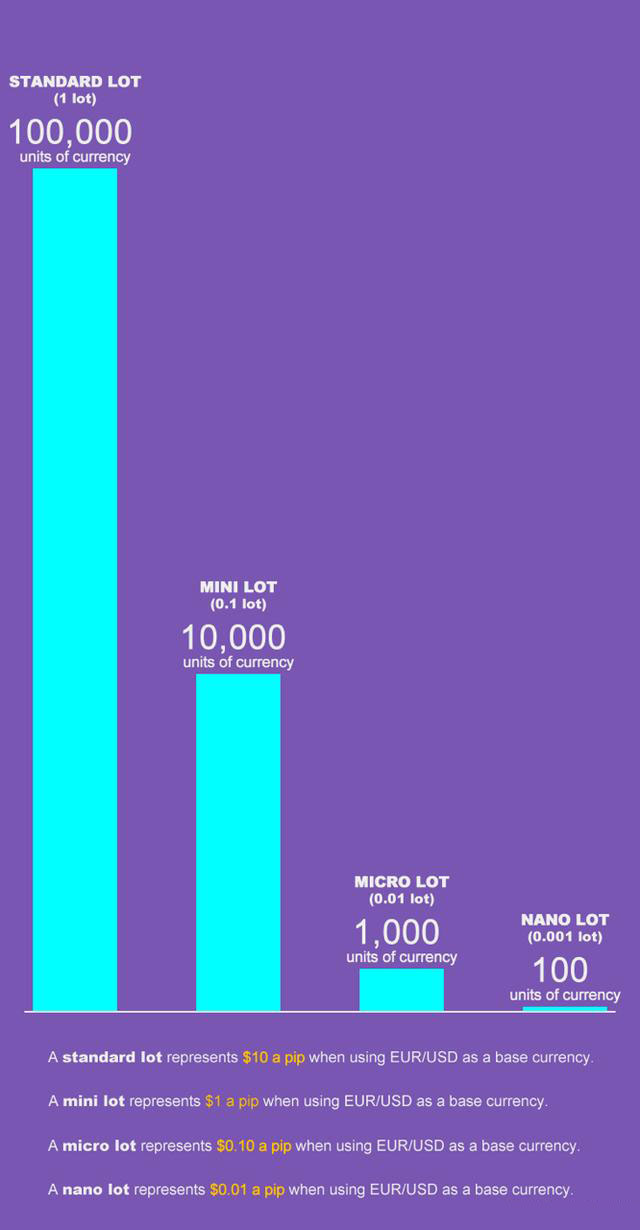

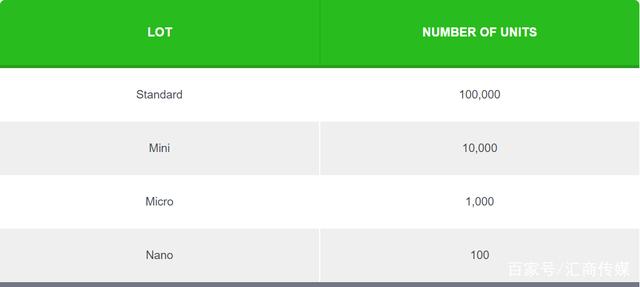

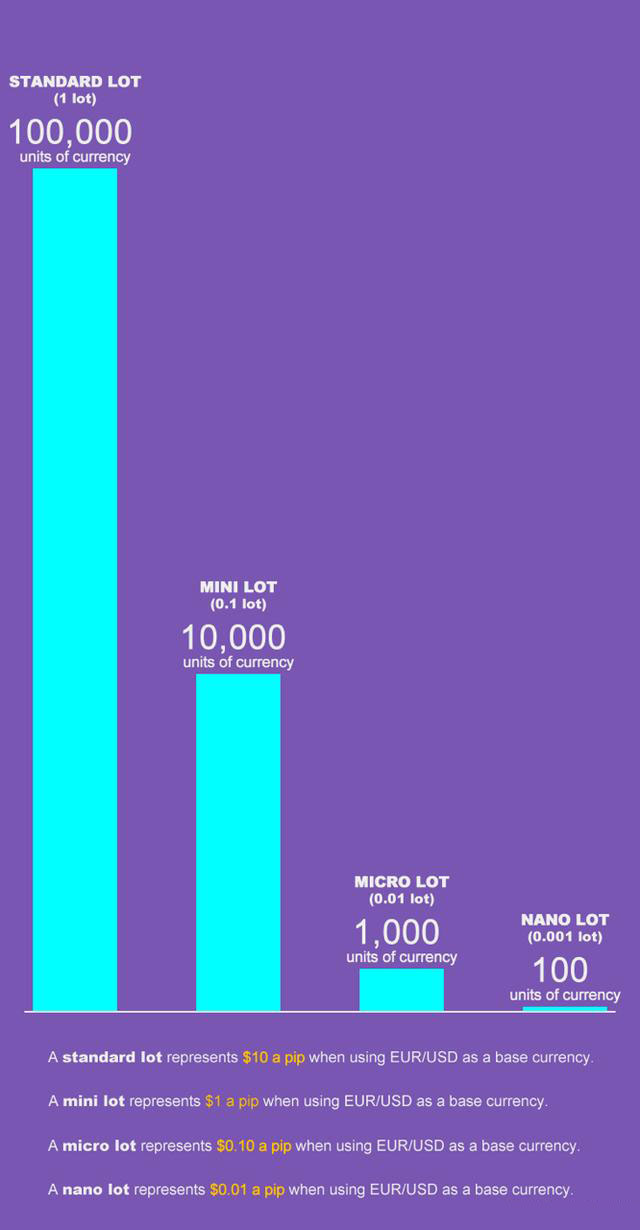

Generally speaking, the standard for online retail transactions is 100000Unit foreign currency, but in recent years, the quantity stipulated in the contract has increased. When the market introduced the Mini, which is 10000 units, the retail trading market began to expand.

Afterwards, the market introduced Micro - only 1000 units. For example, if the leverage ratio ratio is 1:10 and the exchange rate is 1.1500, EUR/USDMicro hand initial margin trading can be as low as $115. Later, brokers even introduced smaller "nano hands" at only 100 units.

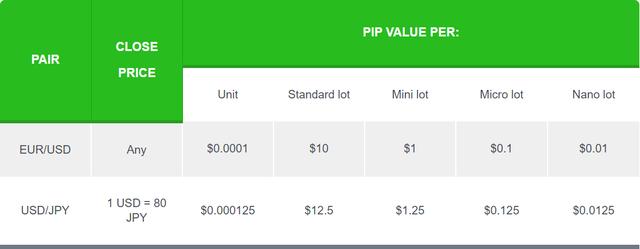

Let's take a look at the exchange rate fluctuation risk corresponding to each type of "hand count". Taking the euro/US dollar as an example, with a trading volume of one standard hand and a fluctuation of one point in the exchange rate, it is 10 US dollars; 1 Mini Hand Fluctuation 1 Point is 1 USD; The micro hand costs $0.1, while the nano hand is even lower, with only $0.0001 per fluctuation point.

Therefore, investors can choose tools such as risk management calculators to calculate the optimal trading volume, or determine the optimal trading volume based on the current size of the Trading Account funds. The trading volume directly affects the impact of market changes on your account.

Nano Hand Trading

You can guess from the words that nano hands definitely mean very little. Indeed, nano hands are a very small trading volume. As we mentioned above, with a trading volume of 1 nanometer hand=1 currency unit, the fluctuation at each point is only $0.0001.

If you are a novice novice, Nano Hand is a good "real gold and silver" testing ground for you, even if the loss is very small. Currency fluctuations of 10 points are equivalent to 1 cent, and 100 points are only 1 dollar.

Currently, some traders provide nano hand trading account services to traders. For traders, nano hands aim to attract traders with very low principal.

However, generally speaking, the ability of anyone who is unwilling or unable to allocate sufficient funds to manage a certain scale account is insufficient to undertake any leveraged trading, and there are indeed reports that nano account holders have a faster rate of exposure than other scale account holders.

Micro Hand Trading

Micro hands are the smallest trading hands available to most brokers. A micro hand is one percent of a standard hand, or 1000 units of base currency.

If your account is denominated in US dollars, this means that one micro hand is the base currency you want to trade with a value of $1000. If the transaction is based on a US dollar currency pair, a fluctuation of one point is equivalent to 10 US dollars, or 0.1 US dollars.

Micro hands are very useful for beginners, as they can minimize risks while practicing trading.

Micro hands make it easier for you to execute quantitative technical strategies in a conservative position. Some trading strategies require the creation of multiple positions simultaneously; In this case, the micro hand can help you calculate the proportional opening of the corresponding position.

Additionally, if you want to test a broker's execution system, real account support, and withdrawal speed without too much risk, then the platform's support for micro accounts is very useful.

Mini Hand Trading

1 mini hand is the base currency for 10000 units. If you use a USD based account and trade USD based currency pairs, the value of each point in the transaction is approximately 1 USD.

If you are a beginner and want to start using mini hand trading, please ensure that you have sufficient funds.

Although $1 per point may seem like a small amount, in Currency Trading, the market can fluctuate by 100 points or even more within a day. If the market is unfavorable to you, you will soon lose $100. To trade a mini account, you need to deposit at least $2000.

Standard Hand Trading

The standard hand is the base currency of 100000 units. If you trade in US dollars, it will be a $100000 transaction. Each point of fluctuation in the standard hand is equivalent to $10.

When falling or rising by 10 points, it is best to remember that you will face a loss/profit of $100. Using standard hands means you should have $25000 or more to trade.

In short, keeping the number of hands within a reasonable range relative to the size of the account will help you retain trading capital for long-term trading.

How to calculate the point value corresponding to the "number of hands"?

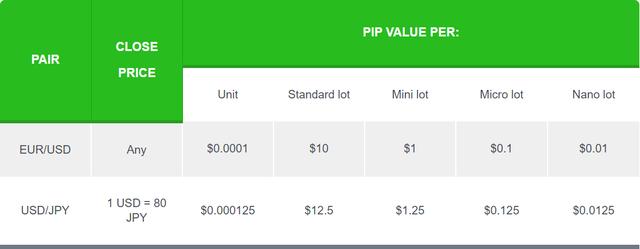

Now let's assume using a standard hand of 100000 units to calculate the point value of a specific currency pair, in order to understand how the number of hands affects the point value:

1. The exchange rate of USD/JPY is 119.80 (. 01/119.80) x 100000=8.34 USD per point

2. The USD/CHF exchange rate is 1.4555 (. 0001/1.4555) x 100000=6.87 USD per point

In the above example, because the US dollar is not the quoted currency in the currency pair, the calculation formula is slightly different.

1. The exchange rate of Euro/USD is 1.1930 (. 0001/1.1930) x 100000=8.38 x 1.1930=9.99734 USD (rounded to 10 USD)

2. The exchange rate between GBP/USD is 1.8040 (. 0001/1.8040) x 100000=5.54 x 1.8040=9.99416 (rounded to $10)

The following is an example chart of euro/dollar and dollar/yen point values, depending on the size of the hands.

For the calculation of point values, different brokers may have different conversion methods, but regardless of the conversion method, they can tell you the value represented by a certain currency to 1 point at a specific time. With the development of the market, the point value of a currency pair will also change with the changes in the exchange rate of your trading currency pair.

If you want to trade Indonesian rupiah against Türkiye lira, the broker may reduce the trading volume to micro hand or nano hand, because these cold currency pairs are extremely risky. However, for cross exchange rates with high trading volume, such as EUR/GBP or EUR/CHF, traders can trade in any number of hands.

The cost of the foreign exchange market mainly includes trading spread and overnight interest, both of which are positively correlated with trading volume. Therefore, as the number of trading hands increases, the cost will also increase.

But the number of trading hands is also directly proportional to the potential returns. The larger the number of hands, the higher the returns under the same fluctuation situation, and vice versa, the more losses.

When the market is in line with expectations, increasing the number of trading hands will indeed increase returns, but do not overly overweight. In trading, the mentality of controlling the number of trading hands is still necessary, as controlling the number of trading hands can to some extent reduce risk.

summary

The importance of risk management in transactions is self-evident, and controlling the size of positions is one of the key points of risk management. The size of the position directly determines your level of risk and return. The larger the position size, the greater the risk and return. In the volatile foreign exchange market, traders need to control their positions within a certain range, otherwise they face huge loss risks.

We need to emphasize that no one can accurately predict the trend of foreign exchange prices. At this point, the trend is positive, and there may be a reversal in the next second. If a trader trades heavily or fully, there is a high probability of a sell-out in the event of a judgment error or market reversal.

If the trading volume can be scientifically controlled, even in the event of unexpected situations, losses will still be within a reasonable range and will not cause significant losses.

The concept of foreign exchange trading volume and opening position is also the same, but their names are different. Investors can only move forward in the longer term by treating their trading accounts well and selecting the appropriate trading volume based on their account balance and stop loss range.

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.