EBC Forex Snapshot

15 Nov 2023

The dollar sputtered on Wednesday as a lower-than-expected US inflation

reading bolstered bets that the Fed has reached the end of its monetary

tightening cycle.

Markets ruled out the possibility of another rate hike next month while bets

of a rate cut in May next year increased to around 50%, according to the CME

Group’s FedWatch Tool.

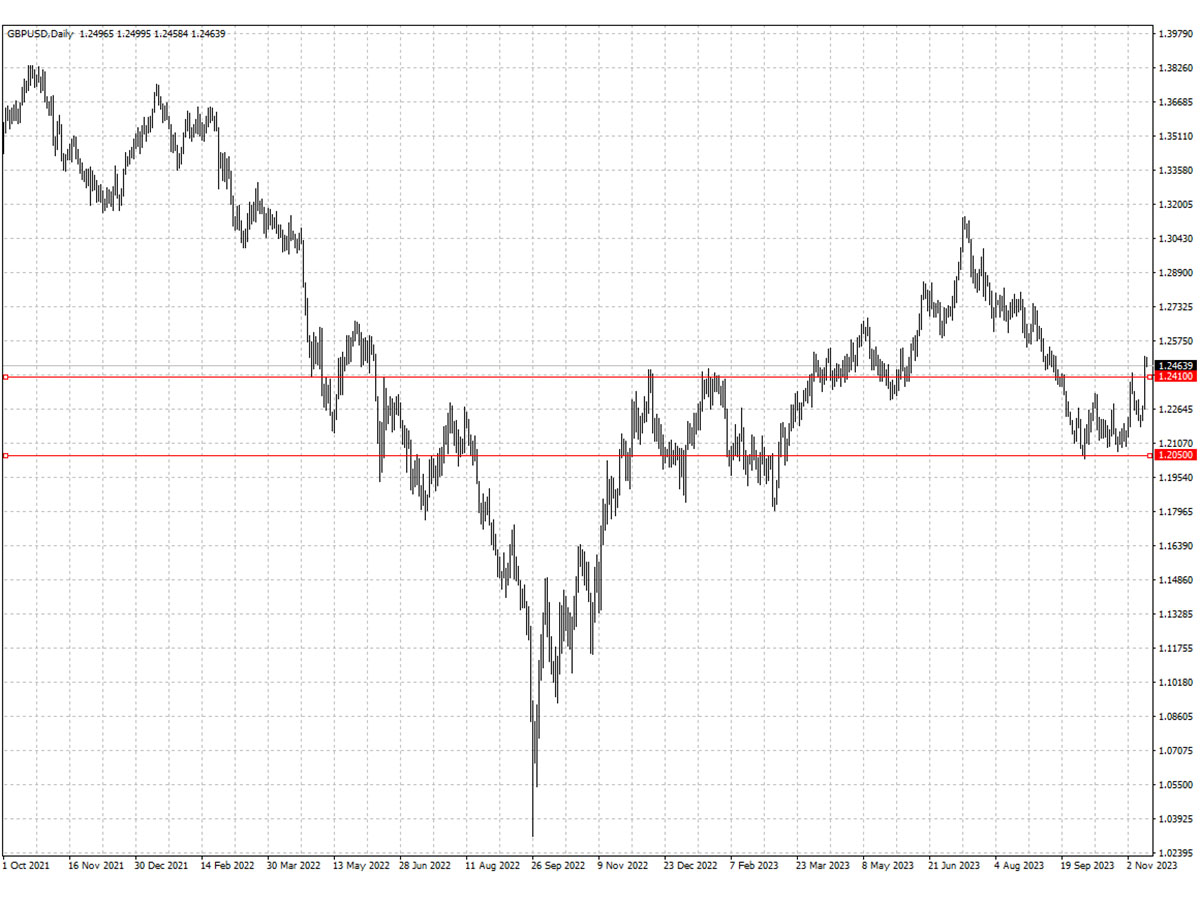

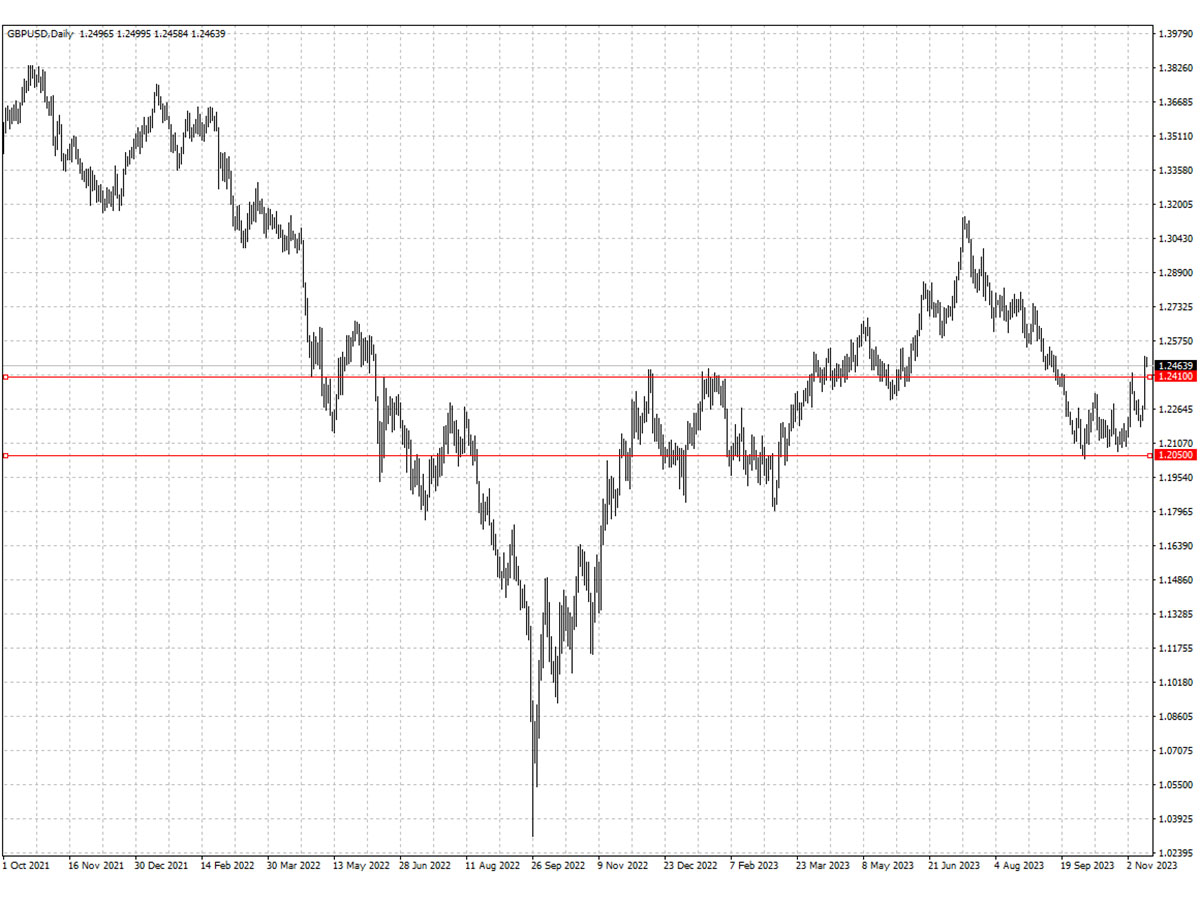

Sterling eased after data showed British inflation cooled more than forecast

in October. CPI rose by 4.6% in Oct, the lowest level in two years, from Sep’s

6.7%.

Sterling eased after data showed British inflation cooled more than forecast

in October. CPI rose by 4.6% in Oct, the lowest level in two years, from Sep’s

6.7%.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 6 Nov) |

HSBC (as of 15 Nov) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0448 |

1.0737 |

1.0535 |

1.0776 |

| GBP/USD |

1.2037 |

1.2448 |

1.2050 |

1.2410 |

| USD/CHF |

0.8745 |

0.9338 |

0.8905 |

0.9131 |

| AUD/USD |

0.6400 |

0.6599 |

0.6248 |

0.6502 |

| USD/CAD |

1.3569 |

1.3899 |

1.3656 |

1.3928 |

| USD/JPY |

147.43 |

151.95 |

149.51 |

152.46 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.

Sterling eased after data showed British inflation cooled more than forecast

in October. CPI rose by 4.6% in Oct, the lowest level in two years, from Sep’s

6.7%.

Sterling eased after data showed British inflation cooled more than forecast

in October. CPI rose by 4.6% in Oct, the lowest level in two years, from Sep’s

6.7%.