The S&P 500 closed without a drop of at least 1.5% for over 100 trading

sessions in a row. There has been only four days when it dropped more than 1%

since it peaked in late July.

Investors are still pouring money into stocks. US equity ETFs saw a $13.4

billion net inflow in the week through 13 Sep, the ninth week of gains in the

past twelve, LSEG Lipper data show.

US retail sales increased more than expected in August as a surge in gasoline

prices boosted energy bills. Evidence of splurging on services cemented

expectations of a soft landing for the economy.

While investors’ exposure to US equities in July looked stretched, it is now

considerably closer to a neutral level, data compiled by Deutsche Bank show.

Wall St Rout

Wall Street strategists who were largely wrong about this year’s rally are

finally starting to come to accept their rout, raising year-end targets for the

S&P 500.

Societe Generale’s Manish Kabra boosted his year-end target last week on the

index to 4,750 from 4,300, 25% above his original call of 3,800 heading into

2023.

That being said, those capitulators have not been convinced about a bull

market. Kabra believes the index will fall to 3,800 by the mid-2024 due to

consumption crunch.

Morgan Stanley’s Mike Wilson conceded in July that he was pessimistic for too

long though he still expects US stocks to decline more than 10% by the end of

the year.

According to data provider Refinitiv, Q2 2023 had the highest rate of

companies beating expectations since Q3 2021 with nearly 80% of constituent

companies surprising.

Even so a market meltdown for next year is sort of a consensus despite signs

of economic resilience, cooling inflation and improving earnings.

Imminent challenge

Fed officials have signalled they are prepared to lift borrowing costs again

if inflation don’t cool further. It now seems the July’s hike is not end of the

story.

Economists surveyed by Bloomberg expect officials to keep rates in the 5.25%

to 5.5% range at their September meeting, and the first cut to come in May.

Since the Fed’s policy remains largely uncertain, it entails more headaches

to assess whether potential tightening down the road could eventually spur a

devastating recession.

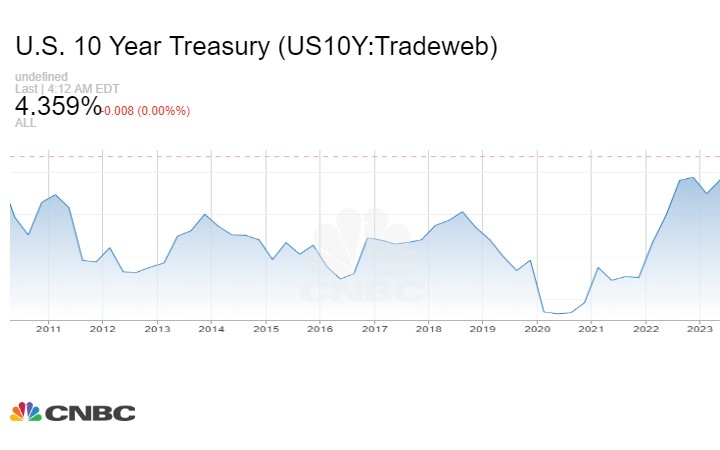

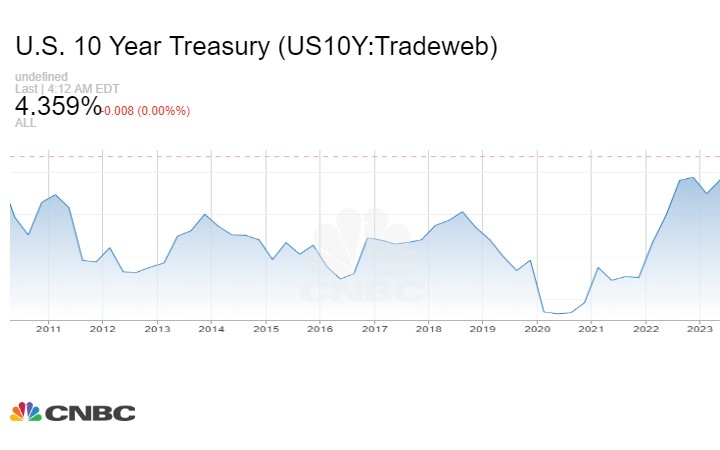

Treasury yields hit a 16-year high on Wednesday, which also dents equities’

appeal. Notably, the US presidential election due next year may be relevant

considering heightened volatility in the wake of Biden and Trump’s victory.

From a technical view, the market has typically hit its peak in September on

or around the 11th trading session of the month, said Jeffrey Hirsch, editor of

the Stock Trader’s Almanac.

That would probably mean a broad retreat from Monday if that theory is

justifiable. He added that the average decline from mid-September through the

end of the month has been about 2%.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.