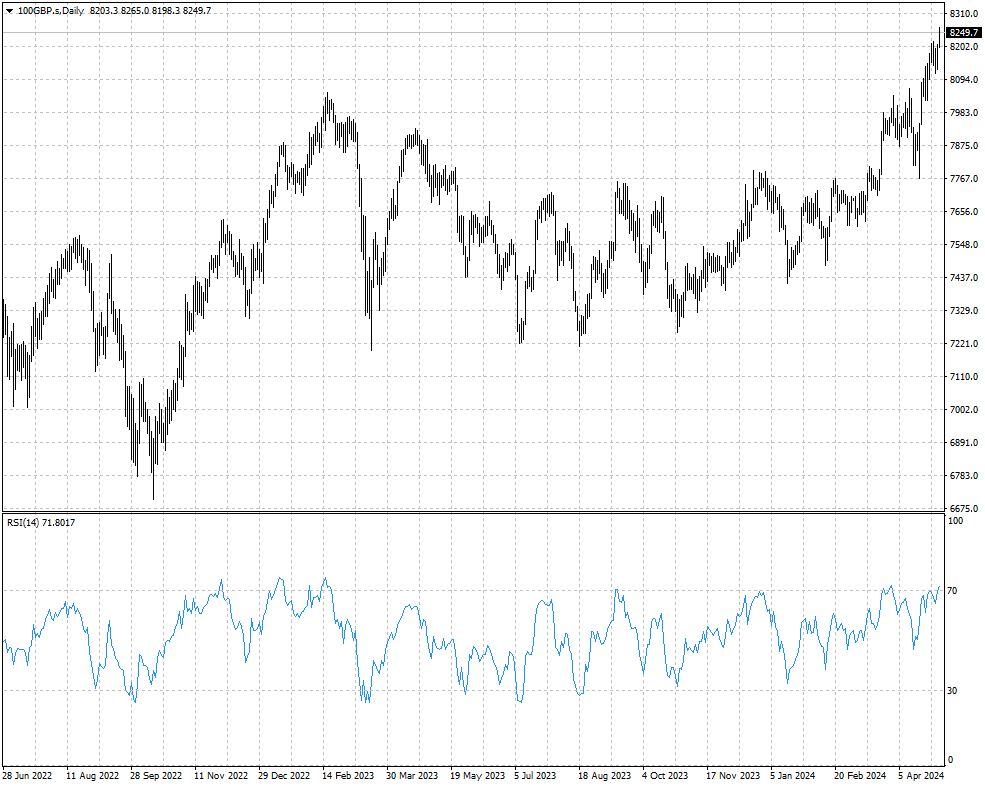

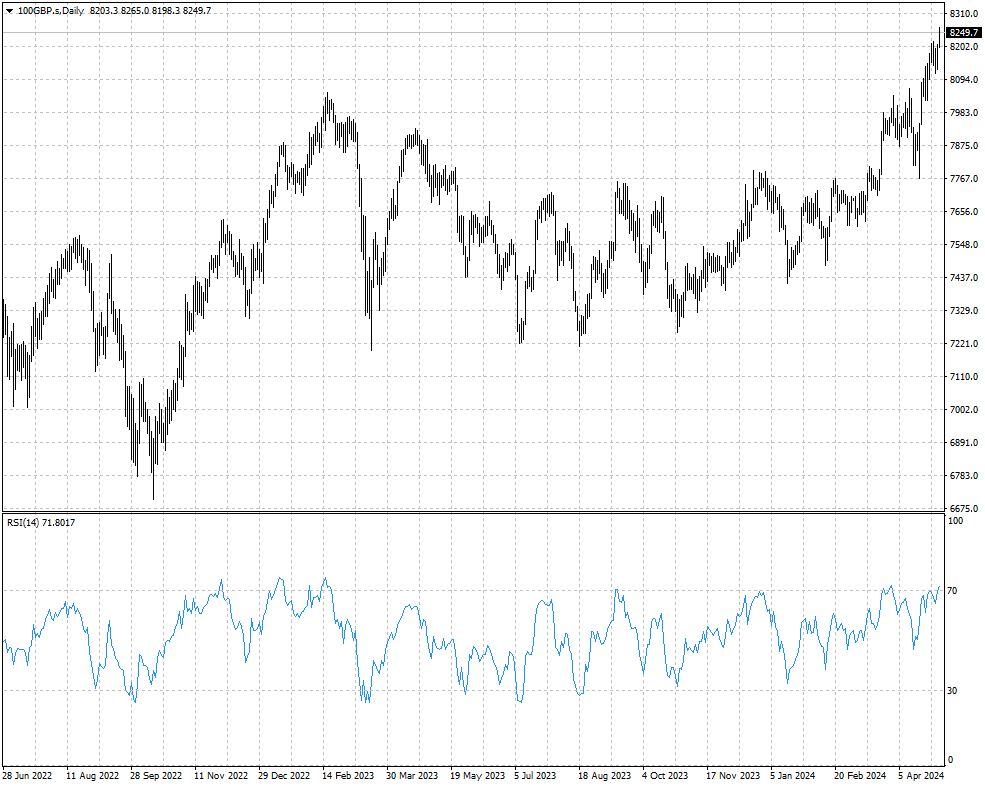

UK stocks finally come back into fashion

2024-05-06

Summary:

Summary:

Global stocks cheered softer-than-expected US jobs data. Britain's FTSE 100 hit a record high on Friday and marked its second straight week of gains.

Global stocks cheered softer-than-expected US jobs data that had put

investors on edge. FTSE 100 hit a fresh record high on Friday and

registered a second straight week of gains.

Signs of easing inflation, hopes of early interest rate cuts by the BOE and

attractive prices have helped boost confidence in UK equities.

Interest-rate-sensitive homebuilder stocks were benefited in particular.

UK service sector saw activity surge to the highest level in almost a year

last month despite increased cost pressures. That marked the sixth consecutive

month in positive territory.

Standard Chartered said its earnings grew over the start of the year due to

its big presence in Asia. HSBC’s Q1 results were likewise buoyant, bucking the

trend of UK banks which have seen profits dwindle.

Anglo American CEO met on Friday South African mines minister Gwede Mantashe

for the first time to discuss the bid from BHP. Glencore is also studying an

approach for the company, sources told Reuters.

Anglo American share price has soared by roughly 39% so far, which played a

major role in propelling the benchmark index. The UK stock market have gained nearly

the same as its German and France peers.

The FTSE 100 has entered overbought territory as indicted by RSI – a sign of

potential profit-taking. Political uncertainties could weigh against stocks as

Tories were trounced in the latest local elections.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.