Tourism boom

France is set to see a record sum of international tourist spending this

year, a bright spot in the euro zone’s economy which is already burdened by

Germany’s stagnancy.

The French tourism ministry on Tuesday projected expenditure by overseas

tourists would reach €64 -€67 billion in 2023 after a strong summer season, even

the number of international arrivals is yet to top the pre-pandemic level.

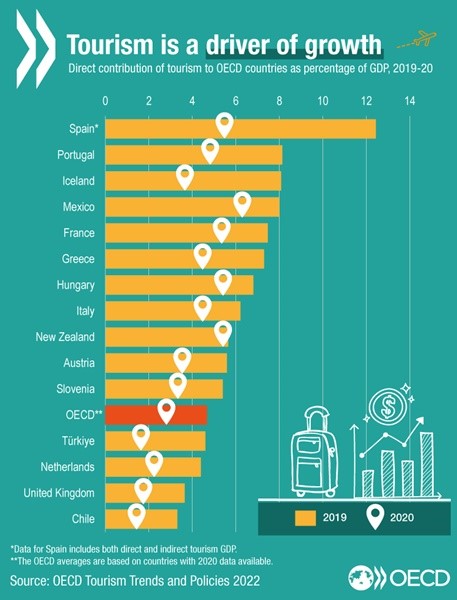

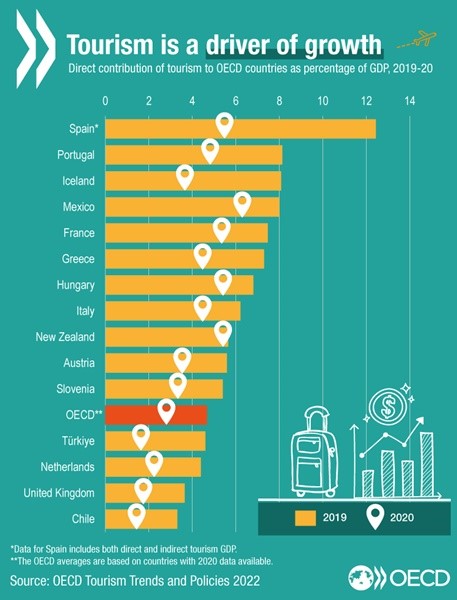

France is one of the most visited countries in the world. The industry

accounted for 8% of GDP last year. The 2024 Paris Olympic Games are expected to

give another boost.

Accommodation prices for the Île-de-France region around Paris will increase

85% during the event, according to Deloitte.

Also other popular destinations in Europe are seeing strong rebound after

three years of travel restrictions. Early bookings suggest Italy, Spain, Greece

and Portugal could receive record tourism revenues this year.

Consumers who had little choice but to buy goods rather than services during

the pandemic are now keen to catch up on lost time, some in the industry

say.

inflation gloom

Now the ECB are becoming concerned that a fresh wave of summer inflation

spurred by tourism could complicate their efforts to keep prices under

control.

Ongoing tourism boom feeds into service inflation, a key driver of the

central bank’s preferred price gauge, which is now at an all-time high of

5.6%.

Fabio Panetta, a member of the ECB executive board, pinned the blame for the

latest rise in services prices on ‘robust’ spending on holidays and travel.

Airports Council International Europe shows more visitors are arriving from

outside Europe. Those long-distance flyers tend to spend a lot more than local

counterparts once they arrive.

The ECB president Christine Lagarde said in Friday that interest rates in the

EU will stay high ‘as long as necessary’ to tame stubbornly high inflation.

But she steered clear of likely policy decision at its next meeting in

September. Many analysts expect it to skip a rate hike given bleaker economic

outlook.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.