Thursday saw the dollar near a three-month low

2023-11-30

Summary:

Summary:

Thursday saw the dollar near a 3-month low, poised for its largest monthly drop in a year. Investors bet the Fed won't raise rates further.

EBC Forex Snapshot

30 Nov 2023

The dollar was stuck near a three-month low on Thursday and was set to post

its biggest monthly decline in a year as investors ramped up bets that the Fed

is done with rate hikes.

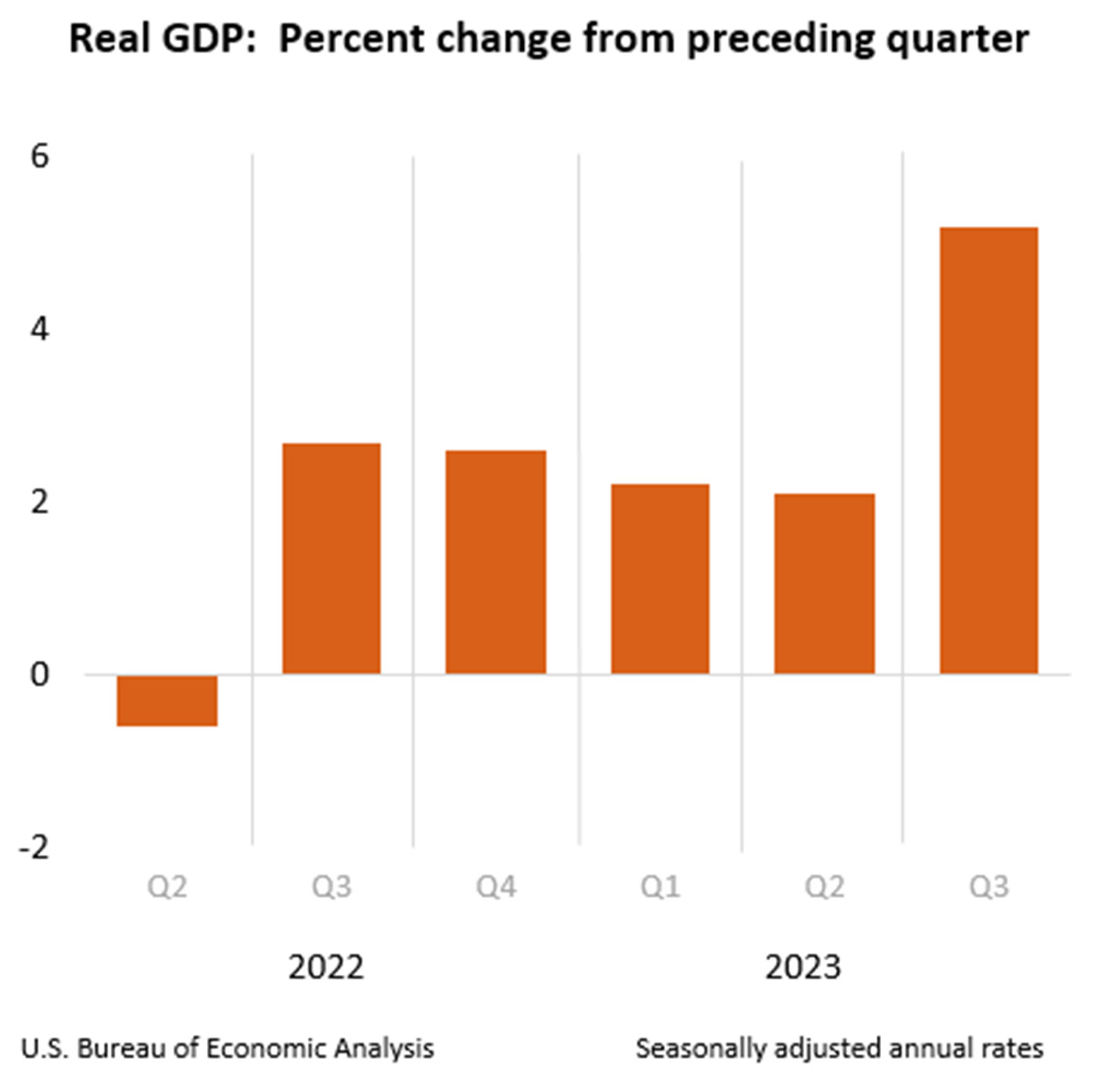

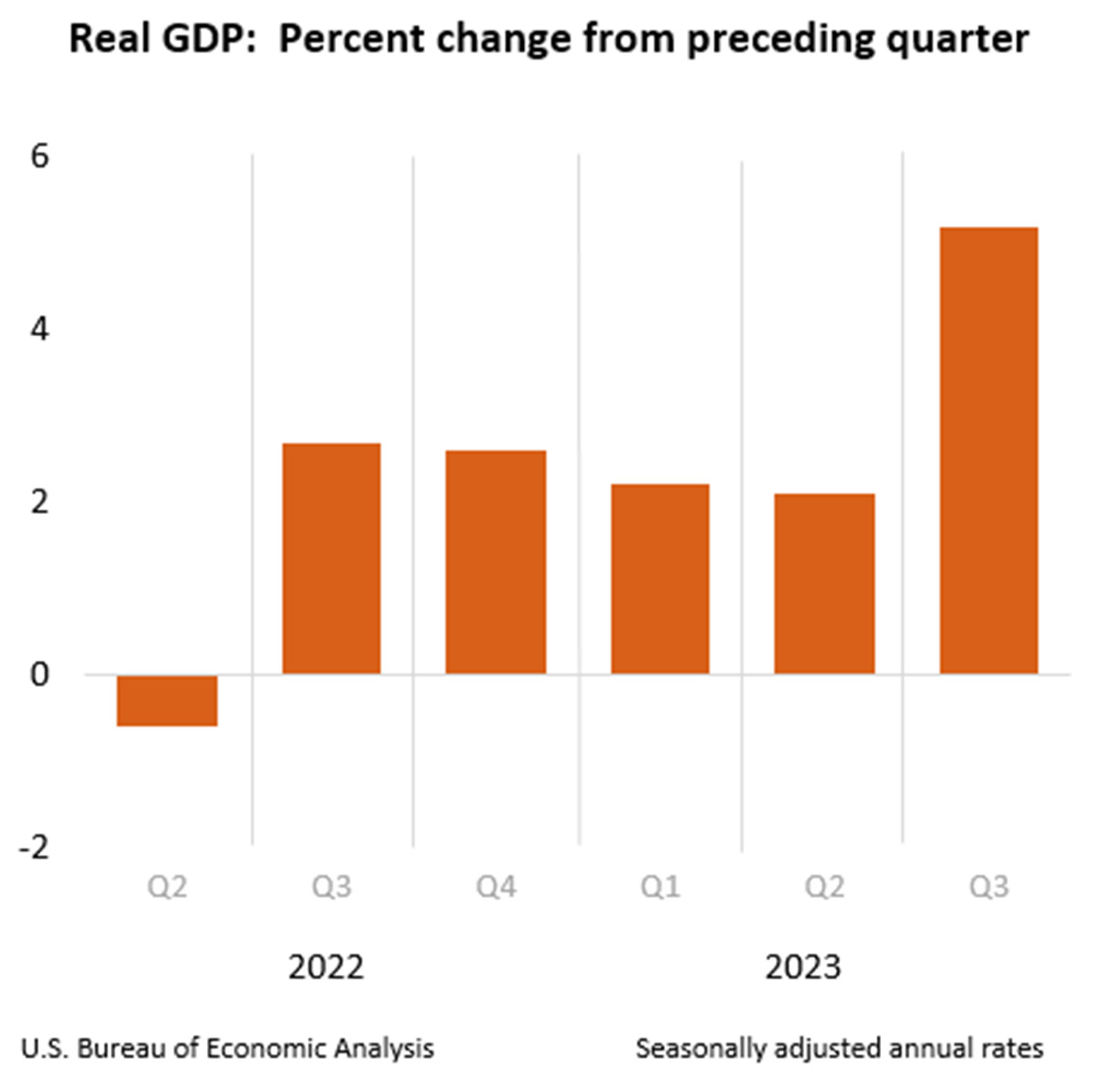

US GDP increased at a 5.2% annualised rate last quarter, revised up from the

previously reported 4.9% pace. That was the fastest pace expansion since the

fourth quarter of 2021.

The yen traded around a 2.5-month high against the dollar. Japan board member

Toyoaki Nakamura said on Thursday the central bank will likely need some more

time before phasing out its massive stimulus.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 20 Nov) |

HSBC (as of 30 Nov) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0517 |

1.0945 |

1.0742 |

1.1105 |

| GBP/USD |

1.2037 |

1.2525 |

1.2341 |

1.2890 |

| USD/CHF |

0.8745 |

0.9338 |

0.8621 |

0.8955 |

| AUD/USD |

0.6340 |

0.6520 |

0.6411 |

0.6750 |

| USD/CAD |

1.3640 |

1.3899 |

1.3467 |

1.3782 |

| USD/JPY |

149.21 |

151.91 |

145.29 |

150.56 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.