US equities have nearly returned to their highs three months ago as

tightening fears fade away due to signals that central banks are done with

interest rate hikes.

But they remain well below the record highs seen in 2021 when the pandemic

was finally contained through lockdown restrictions and workers settled into

working from home.

Stocks began to move in tandem with bonds again after US inflation rate grew

over 2% in March 2021. Markets were dead wrong about its path and even the Fed

considered it ‘transitory’ until the end of the year.

Since then rising interest rates have held their sway over the financial

market. Analysts and economists were wrong-footed over and again given

unpredictability and uncertainty of the current inflationary environment.

Wall Street banks learnt bitter lessons, so they did not rush to change their

forecast for stock market on the heels of a deep pullback over the course of

this quarter.

Policymakers turn out to be a game changer, having collectively paused hikes

lately. It is therefore pointless to wriggle out of forecast update at this

juncture.

A record high

BofA expects another strong year in 2024 and the S&P 500 to a record high

of 5,000 as markets move past the “maximum macro uncertainty” and absorb

geopolitical shocks this year.

The firm's forecasted year-end target for the S&P 500 implies the

benchmark index will rise about 10% from current levels. The firm sees earnings

growth 6% in 2024 to $235 per share.

"Companies have cut costs and adapted to the weaker demand environment, and

saw earnings growing again in 3Q (+3% YoY)," the bank wrote.

"History suggests earnings typically recover stronger than they fall, as

downturns usually remove excess capacity, resulting in leaner cost structure and

improved margin profiles."

The bank added that there are still plenty of investors who are bearish on

equity markets, a contrarian indicator that heightens the bull case. Pension

fund allocations to stocks are at 25-year lows.

BMO Capital Markets also saw more gains ahead with a more optimistic forecast

that the S&P 500 would end 2024 at 5,100. Deutsche Bank and RBC saw 5,100

and 5,000 respectively.

BOM said that rally will be more broad-based compared to the one highly

concentrated in megacap stocks this year. “We believe investors will need to own

a little bit of ‘everything’.”

Economic soft patch

Strategists at the Wells Fargo Investment Institute refused to join the

cohort of bulls, warning that an upcoming “economic soft patch” will likely

weigh on US equities.

The firm maintained its 2024 year-end S&P 500 target price range between

4,600 and 4,800. Economy has not slowed down enough for the Fed to begin

monetary loosening, it said.

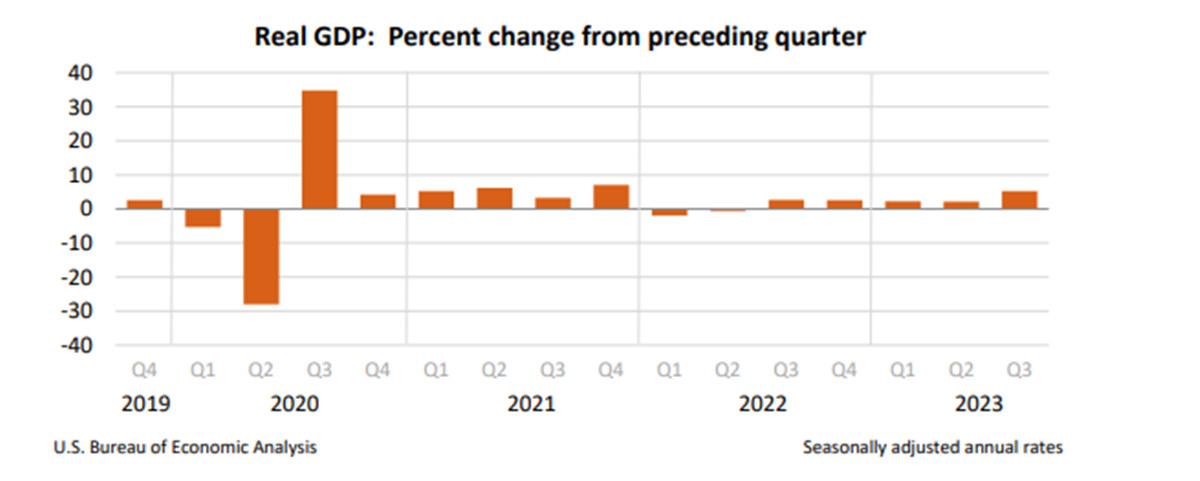

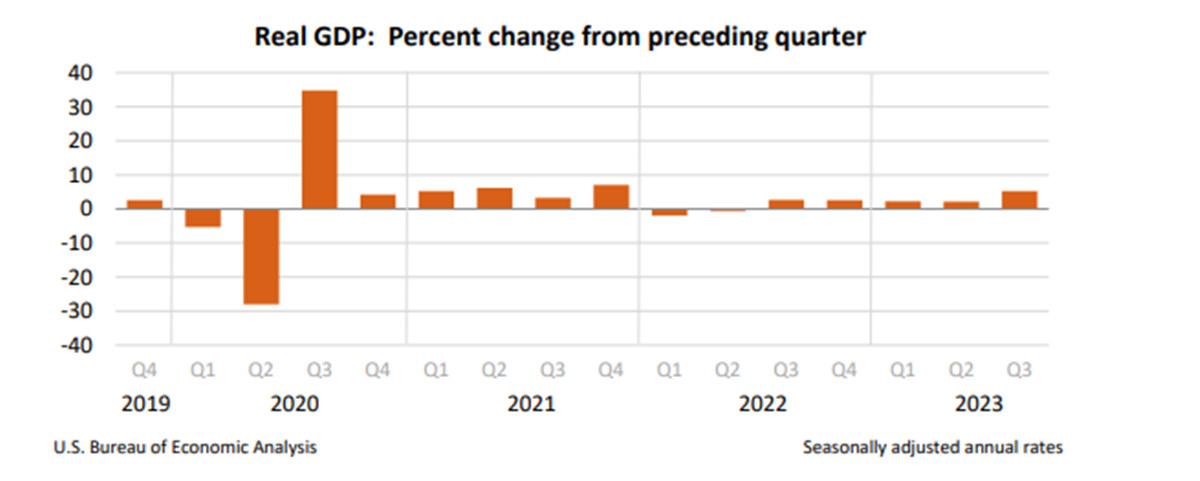

The Atlanta Fed's GDPNow estimates show a 2.1% annualised rate of US growth

in the fourth quarter, down from a third-quarter reading of 5.1% in early

October.

But Wells Fargo added that a re-acceleration of the global economy in the

second half of 2024 will likely push stocks higher as a weakening dollar and

declining interest rates kick in.

The world’s advanced economies are heading into a deepening slowdown as

markedly higher interest rates take a hefty toll on activity that could still

become more acute, the OECD warned.

The US will only begin in the second half of 2024, and not until the spring

of 2025 in the euro area, according to the OECD, though CME's FedWatch Tool

implies euphoria among investors.

Wells Fargo suggested investor add to megacap stocks if the index falls near

to the bottom of its range for the year.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.