The Yen Stabilized Mid-Range Last Month

2024-10-01

Summary:

Summary:

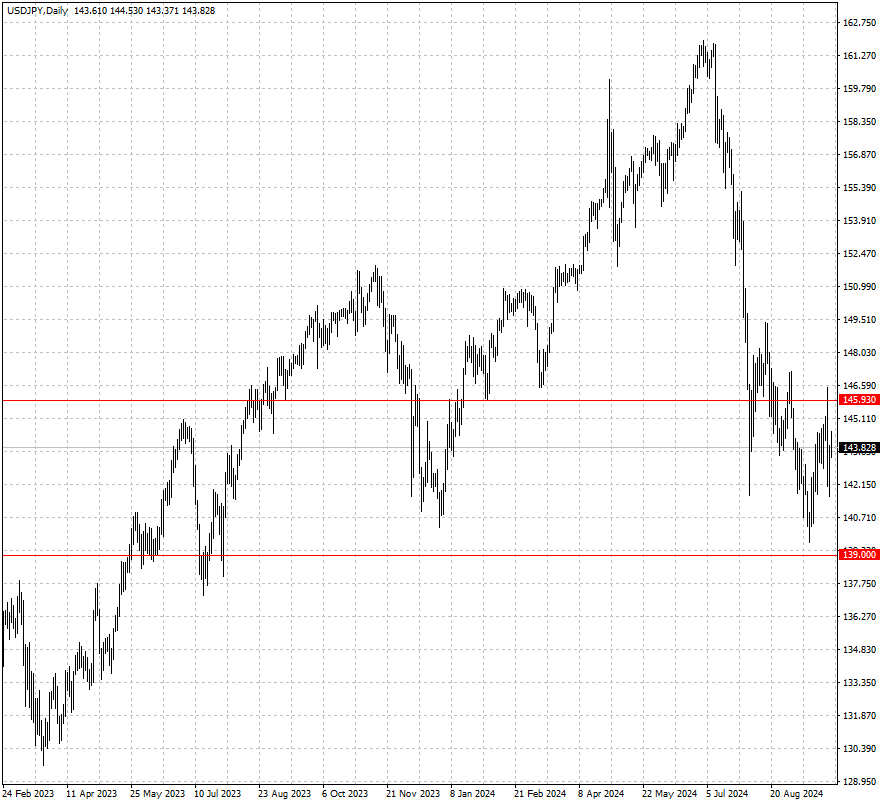

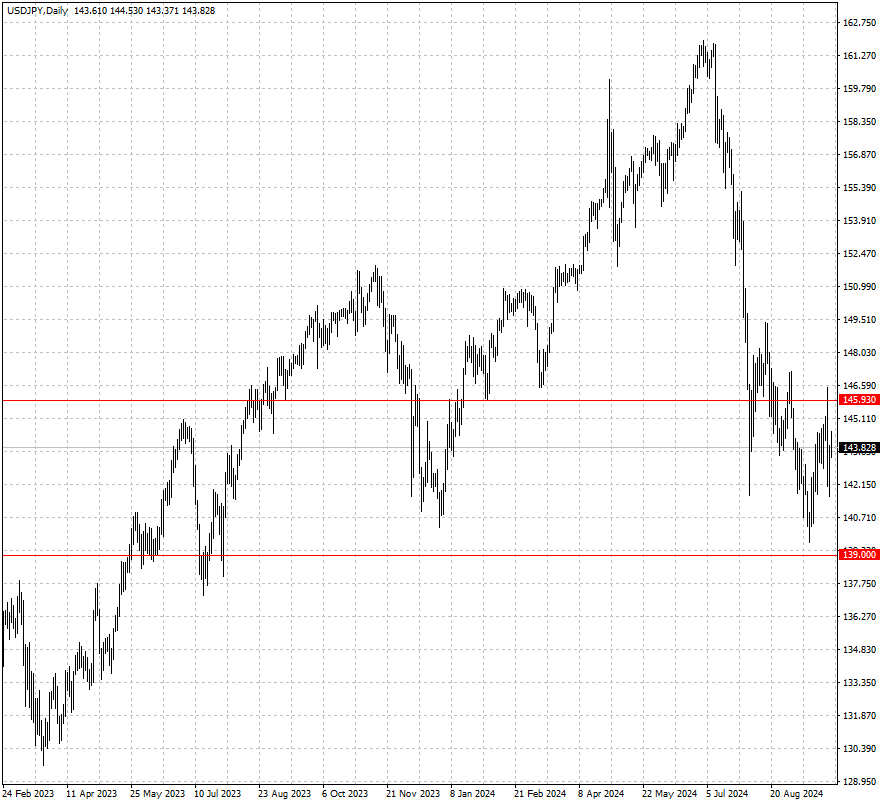

The US dollar rallied Tuesday as Fed Chair Powell rejected expectations for large rate cuts, while the yen steadied mid-range.

EBC Forex Snapshot, 1 Oct 2024

The US dollar rallied broadly on Tuesday after Fed Chair Jerome Powell pushed

back against bets on more supersized interest rate cuts. The yen steadied close

to the middle of its trading range over the past month.

Traders remain certain that the Fed will cut again at the next policy setting

meeting in November, but slashed expectations for a 50-bp reduction to 35.4%,

according to CME Group's FedWatch Tool.

Minutes of the BOJ September meeting showed that policymakers discussed the

need for caution over near-term interest rate hikes, with little impact on the

market.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 23 Sep) |

HSBC (as of 30 Sep) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0857 |

1.1202 |

1.1038 |

1.1250 |

| GBP/USD |

1.2812 |

1.3353 |

1.3103 |

1.3538 |

| USD/CHF |

0.8375 |

0.8749 |

0.8346 |

0.8506 |

| AUD/USD |

0.6622 |

0.6871 |

0.6702 |

0.7019 |

| USD/CAD |

1.3441 |

1.3792 |

1.3404 |

1.3633 |

| USD/JPY |

139.50 |

147.13 |

139.00 |

145.93 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.