China Yet Supports Commodity Currencies on Monday

2024-09-30

Summary:

Summary:

On September 30, 2024, China's stimulus supported commodity currencies, pressuring the dollar as core inflation eased to a near three-year low.

EBC Forex Snapshot,30 Sep 2024

The dollar slipped on continued strength of commodity currencies on Monday. St Louis Fed president Alberto Musalem acknowledged that the labour market had cooled in recent months.

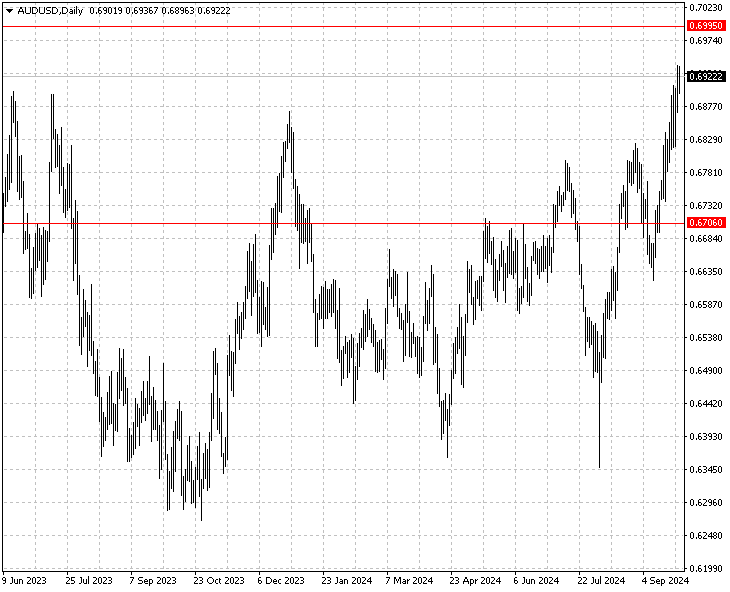

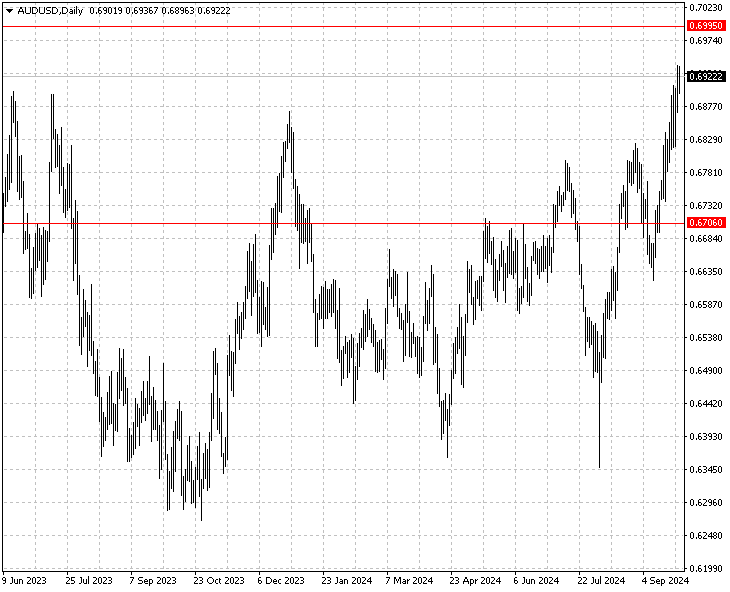

The Australian dollar traded near the 2024 highs they struck on Friday as rate cuts and expectations of fiscal support in China raised hopes of an improvement in the slowing economy.

Last week data showed US inflation running at a pretty benign 2.2% for the 12 months to August, the lowest since February 2021. sending Treasury yields lower.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 23 Sep) |

HSBC (as of 27 Sep) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0857 |

1.1202 |

1.1047 |

1.1259 |

| GBP/USD |

1.2812 |

1.3353 |

1.3131 |

1.3566 |

| USD/CHF |

0.8375 |

0.8749 |

0.8384 |

0.8544 |

| AUD/USD |

0.6622 |

0.6871 |

0.6706 |

0.6995 |

| USD/CAD |

1.3441 |

1.3792 |

1.3372 |

1.3601 |

| USD/JPY |

139.50 |

147.13 |

141.14 |

146.89 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.