The yen fell broadly on Tuesday

2024-01-23

Summary:

Summary:

BOJ's expected ultra-easy policy keeps yen falling. Governor Ueda finds quantifying proximity to the 2% inflation target challenging.

EBC Forex Snapshot

23 Jan 2024

The yen fell broadly on Tuesday after the BOJ maintained its ultra-easy

monetary settings as expected. Governor Kazuo Ueda said “it's hard to quantify

how close” trend inflation was to the 2% target.

In a quarterly report on the outlook, the central bank cut its core consumer

inflation forecast for the fiscal year beginning in Apr to 2.4% from 2.8%

projected earlier.

China is weighing a massive rescue package to stabilise the local stock

market, according to Bloomberg, pushing the Australian dollar higher. The PBOC

has left the medium-term policy rate and LPR unchanged in Jan.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 15 Jan) |

HSBC (as of 23 Jan) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0848 |

1.1139 |

1.0817 |

1.0972 |

| GBP/USD |

1.2536 |

1.2848 |

1.2604 |

1.2796 |

| USD/CHF |

0.8333 |

0.8667 |

0.8527 |

0.8778 |

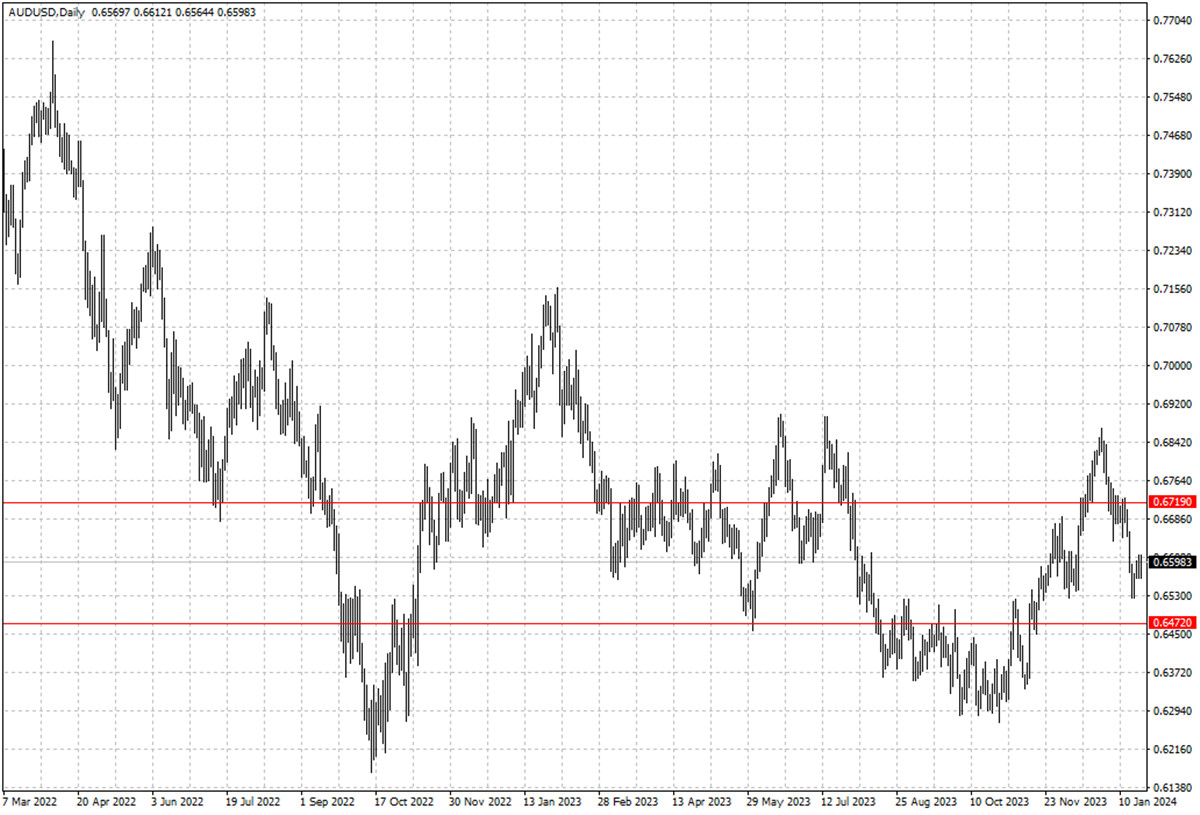

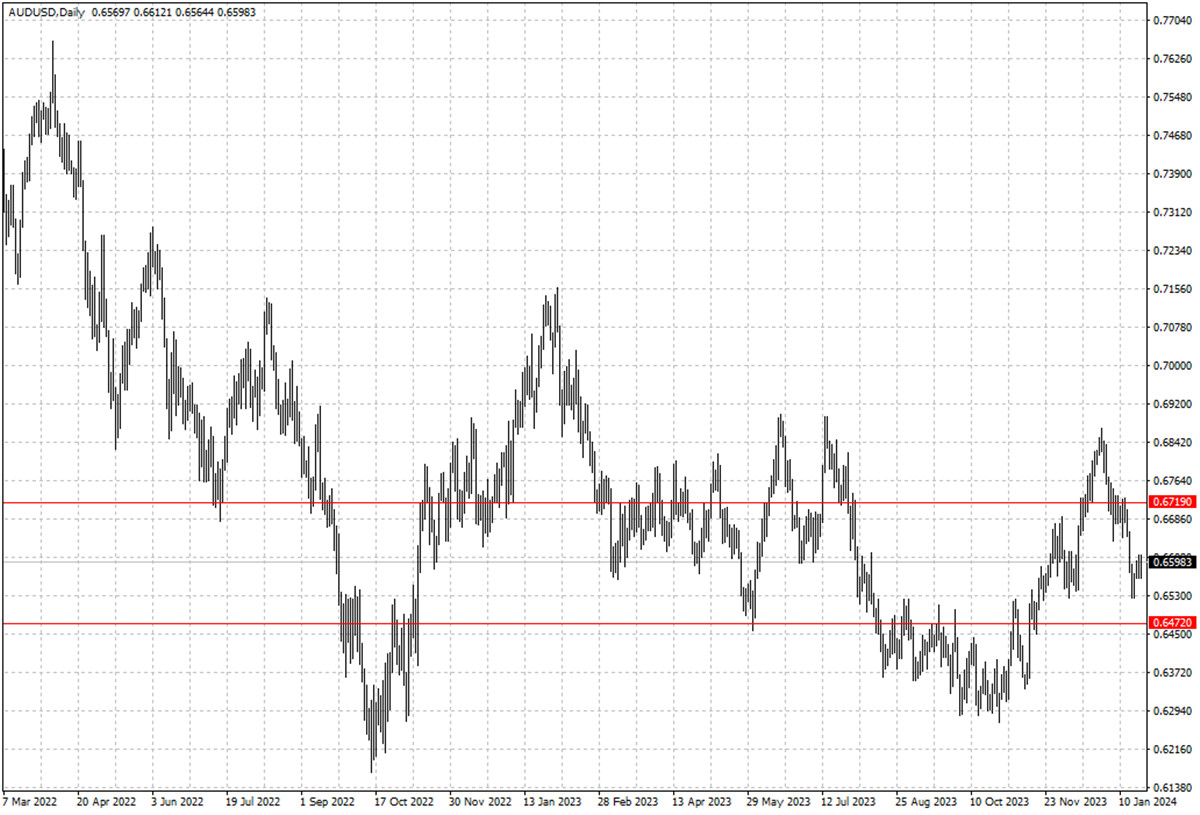

| AUD/USD |

0.6612 |

0.6900 |

0.6472 |

0.6719 |

| USD/CAD |

1.3093 |

1.3177 |

1.3328 |

1.3584 |

| USD/JPY |

140.59 |

146.49 |

143.69 |

150.64 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.