The dollar was on solid footing on Wednesday

2024-01-24

Summary:

Summary:

Wednesday's robust dollar is due to stronger-than-expected jobs and inflation reports, causing investors to lower bets on Fed interest rate cuts in Q1.

EBC Forex Snapshot

24 Jan 2024

The dollar was on solid footing on Wednesday as jobs and inflation report

that came stronger than expected earlier in the month made investors reduce bets

that the Fed will cut interest rates in Q1.

The rate futures market priced in a roughly 47% chance of a March rate cut,

sharply down from as much 80% about two weeks ago, according to LSEG. San

Francisco Fed President Mary Daly said an imminent rate cut is not

necessary.

The Swiss franc rallied from more than one-month low despite verbal

interventions by the SNB. President Thomas Jordan said a stronger currency has

been painful for domestic companies.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 15 Jan) |

HSBC (as of 24 Jan) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0848 |

1.1139 |

1.0781 |

1.0959 |

| GBP/USD |

1.2536 |

1.2848 |

1.2592 |

1.2784 |

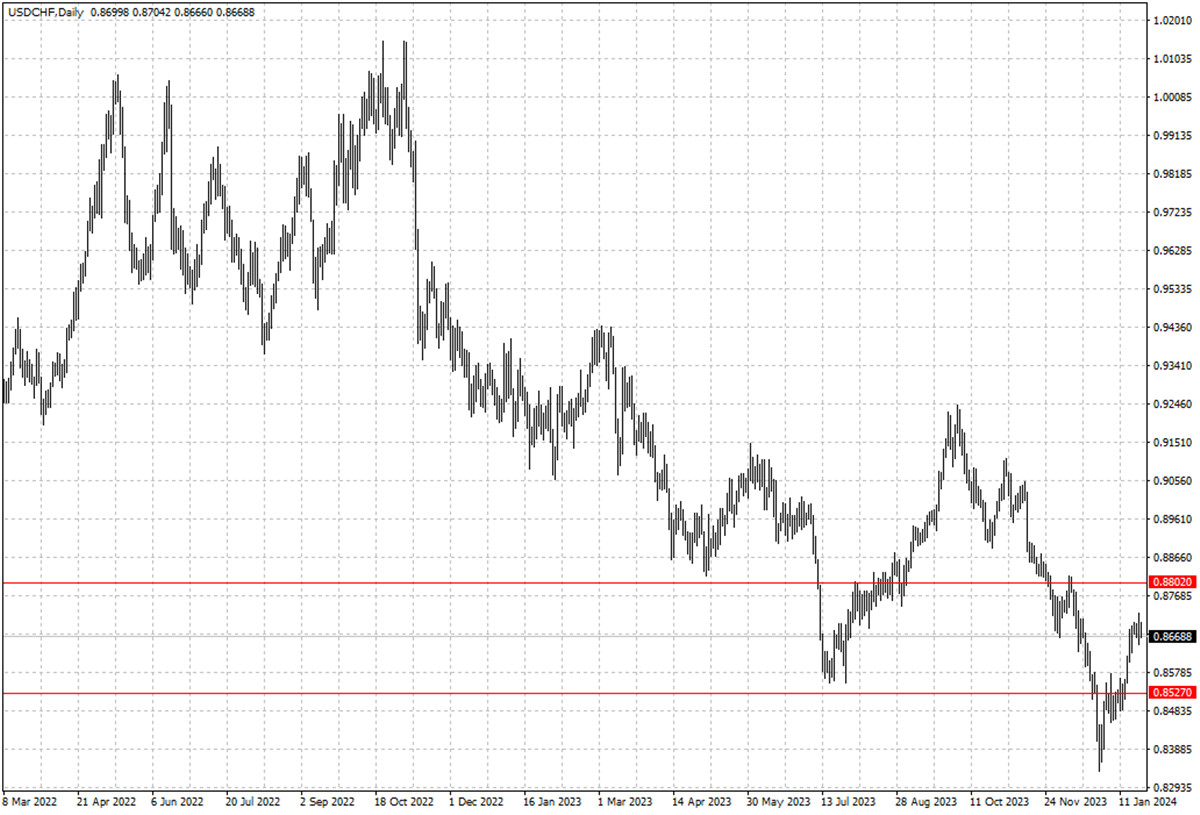

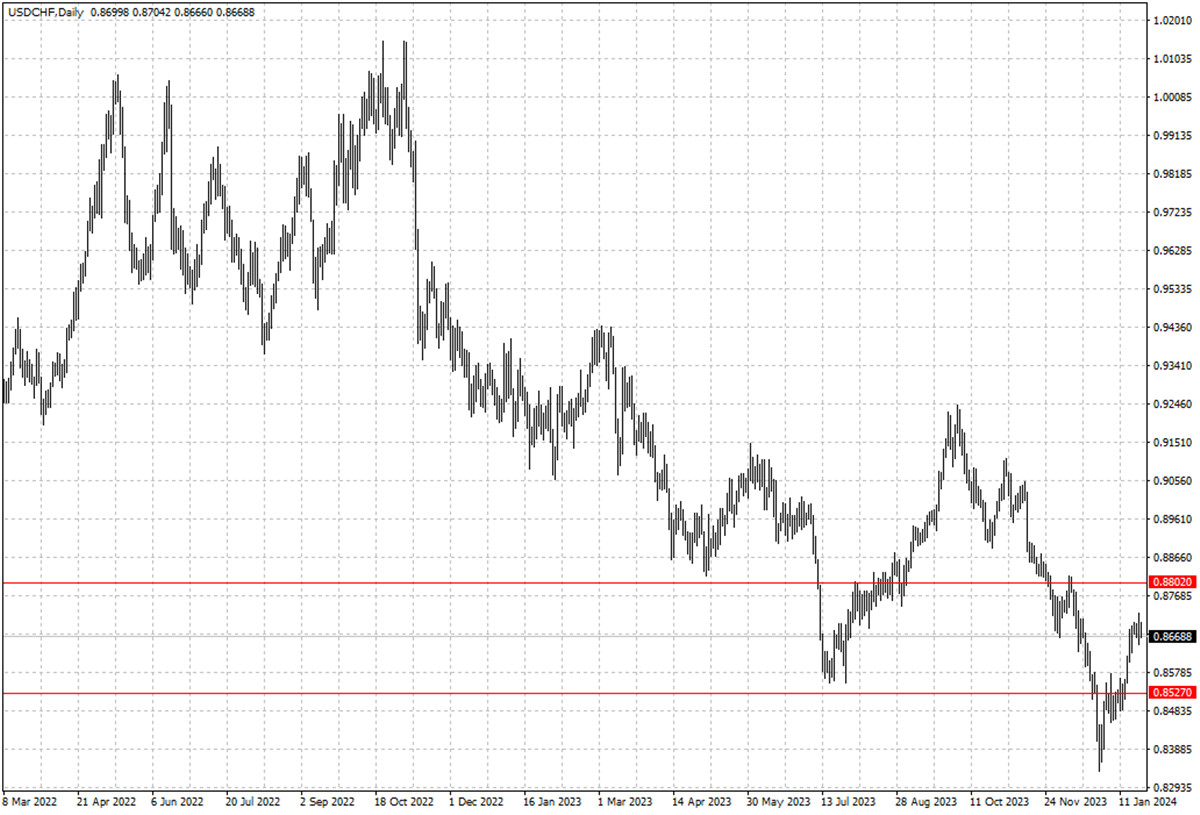

| USD/CHF |

0.8333 |

0.8667 |

0.8527 |

0.8802 |

| AUD/USD |

0.6612 |

0.6900 |

0.6481 |

0.6718 |

| USD/CAD |

1.3093 |

1.3177 |

1.3316 |

1.3572 |

| USD/JPY |

140.59 |

146.49 |

144.53 |

150.49 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.