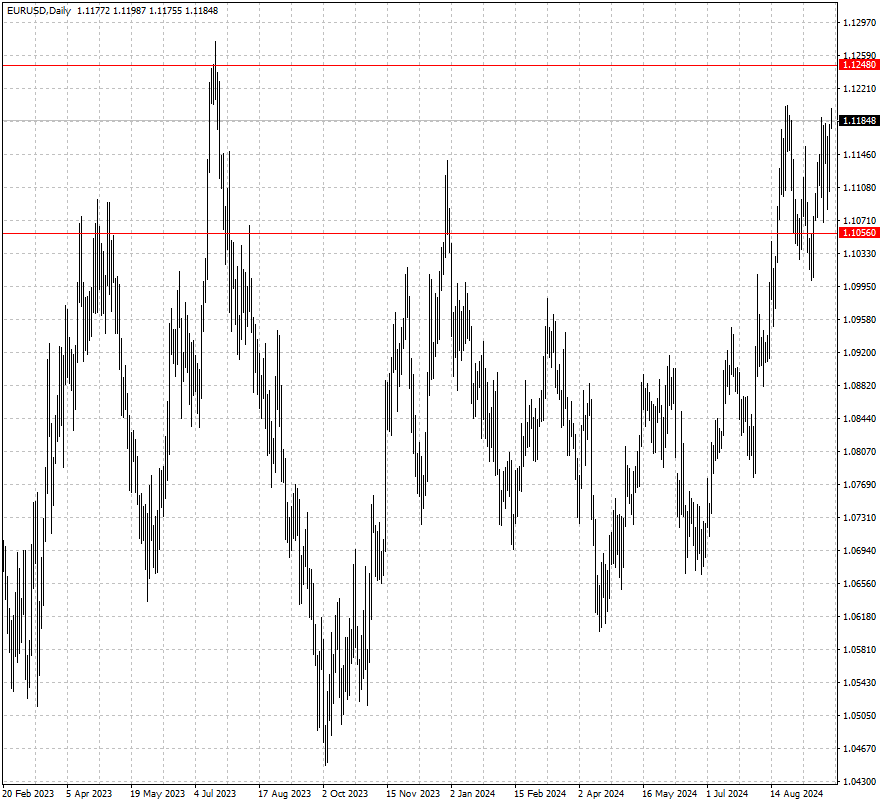

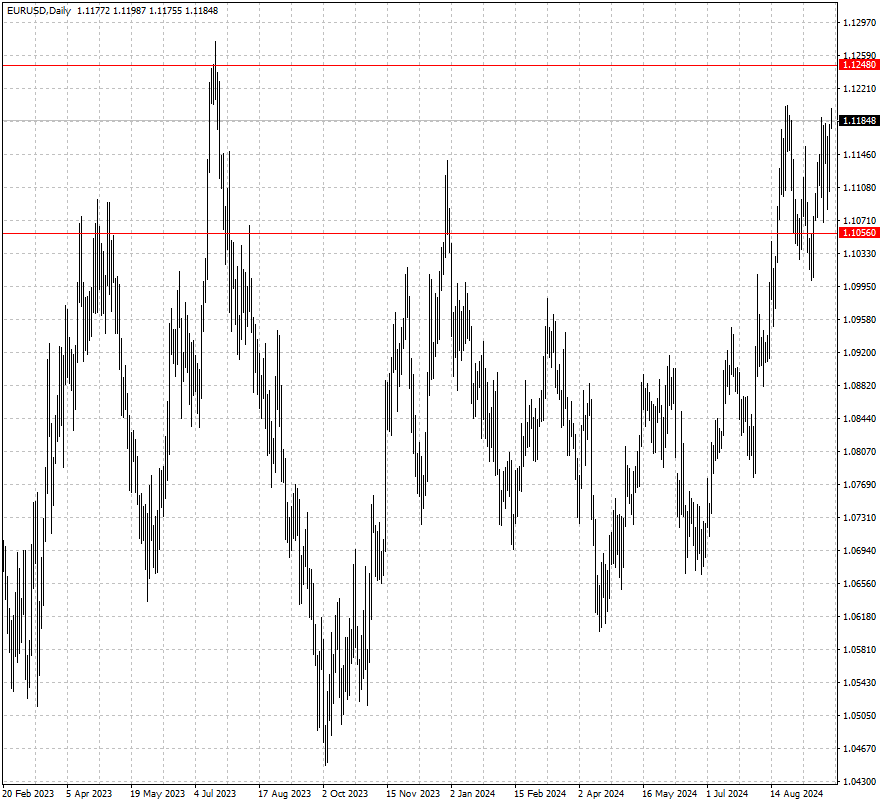

The Euro Traded Close to the August High

2024-09-25

Summary:

Summary:

The dollar weakened as China's stimulus lifted risk appetite and expectations grew for a significant US rate cut in November.

EBC Forex Snapshot, 25 Sep 2024

The dollar came under pressure on Wednesday after China's aggressive stimulus

moves buoyed risk appetite, with growing bets of another outsized US rate cut in

November adding to headwinds for the greenback.

Markets are now pricing in a 59.5% chance of a 50-bp rate cut at the Fed's

next policy meeting, according to the CME FedWatch tool. Data showed US consumer

confidence unexpectedly fell in September.

The euro traded close to the August high. The German economy will recover as

high inflation and interest rates fade, but the country still needs major

reforms, Bundesbank President Joachim Nagel said.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 16 Sep) |

HSBC (as of 25 Sep) |

|

Support |

Resistance |

Support |

Resistance |

| EUR/USD |

1.0857 |

1.1202 |

1.1056 |

1.1248 |

| GBP/USD |

1.2812 |

1.3266 |

1.3131 |

1.3561 |

| USD/CHF |

0.8375 |

0.8763 |

0.8355 |

0.8530 |

| AUD/USD |

0.6618 |

0.6871 |

0.6705 |

0.6993 |

| USD/CAD |

1.3441 |

1.3792 |

1.3350 |

1.3579 |

| USD/JPY |

140.25 |

147.13 |

140.29 |

145.51 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.