The dollar was firm in Asian trading on Monday

2024-04-08

Summary:

Summary:

USD steady Monday, watching inflation and US bond yields. The Fed may cut 50% in June. AUD up on commodities; iron ore futures rise on China demand.

EBC Forex Snapshot,8 Apr 2024

The dollar was firm in Asian trading on Monday as investors looked ahead to US inflation data after the big payrolls number last week, and as Treasury yields reached for December highs.

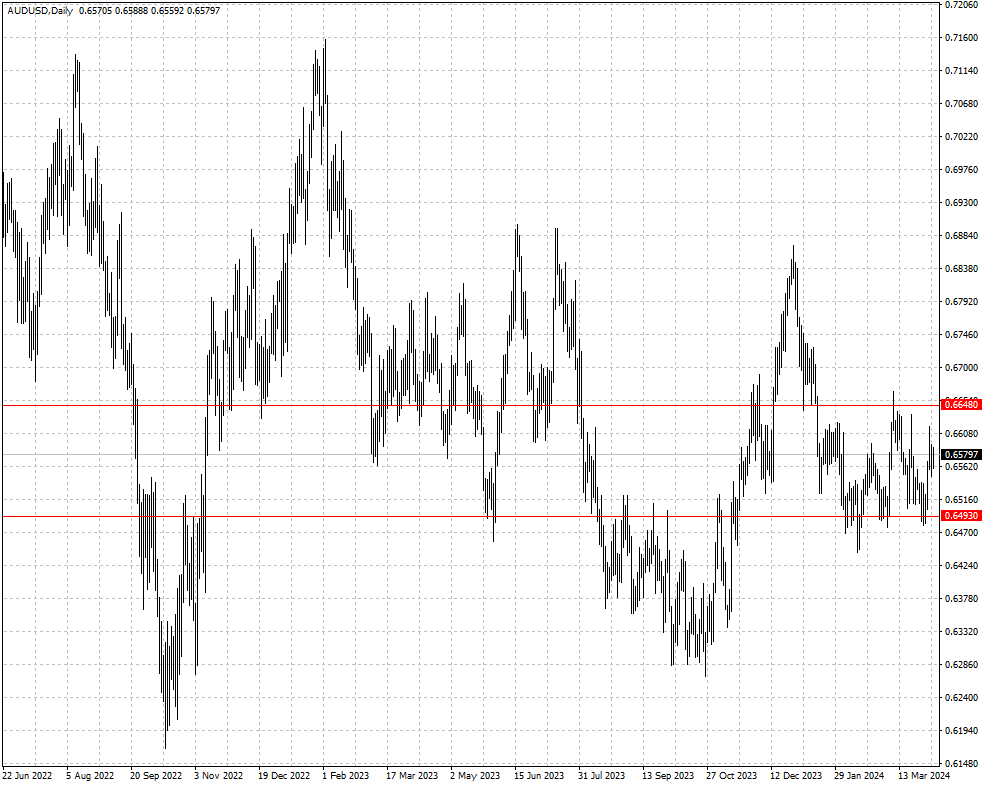

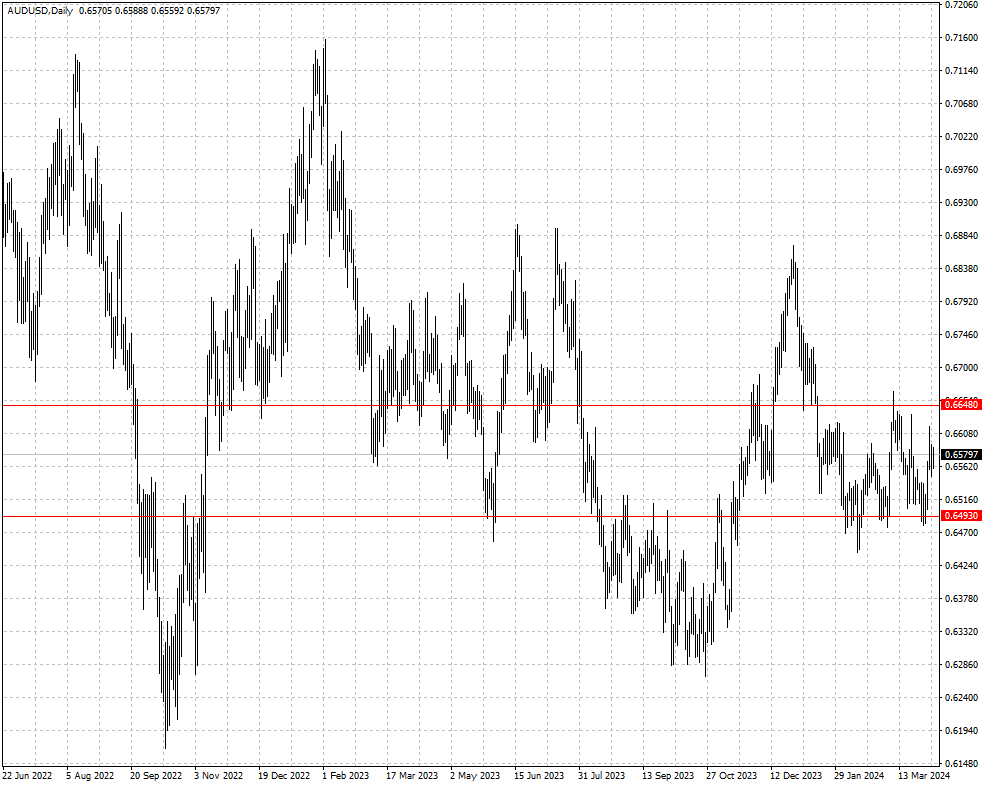

The US rate futures market has reduced the odds of a June rate cut to 50%, the CME's FedWatch tool showed. The Australian dollar inched up due to commodity prices rally.

Iron ore futures pushed back above $100 a ton on speculation that demand may pick up in China. Steel demand from construction and manufacturing “both have potential to improve,” said China Industrial Futures.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 25 Mar) |

HSBC (as of 8 Apr) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0695 |

1.1017 |

1.0725 |

1.0944 |

| GBP/USD |

1.2503 |

1.2896 |

1.2514 |

1.2781 |

| USD/CHF |

0.8741 |

0.9112 |

0.8869 |

0.9127 |

| AUD/USD |

0.6443 |

0.6691 |

0.6493 |

0.6648 |

| USD/CAD |

1.3359 |

1.3607 |

1.3478 |

1.3672 |

| USD/JPY |

146.66 |

151.91 |

149.76 |

152.71 |

The green numbers in the table indicate that the data has increased compared with the previous time;the red numbers indicate that the data has decreased compared with the previous time;and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.