The dollar traded below recent peaks on Thursday

2024-04-04

Summary:

Summary:

Thursday saw the dollar below peaks while awaiting a US jobs report for rate clues. The Swiss franc fell on easing inflation.

EBC Forex Snapshot, 4 Apr 2024

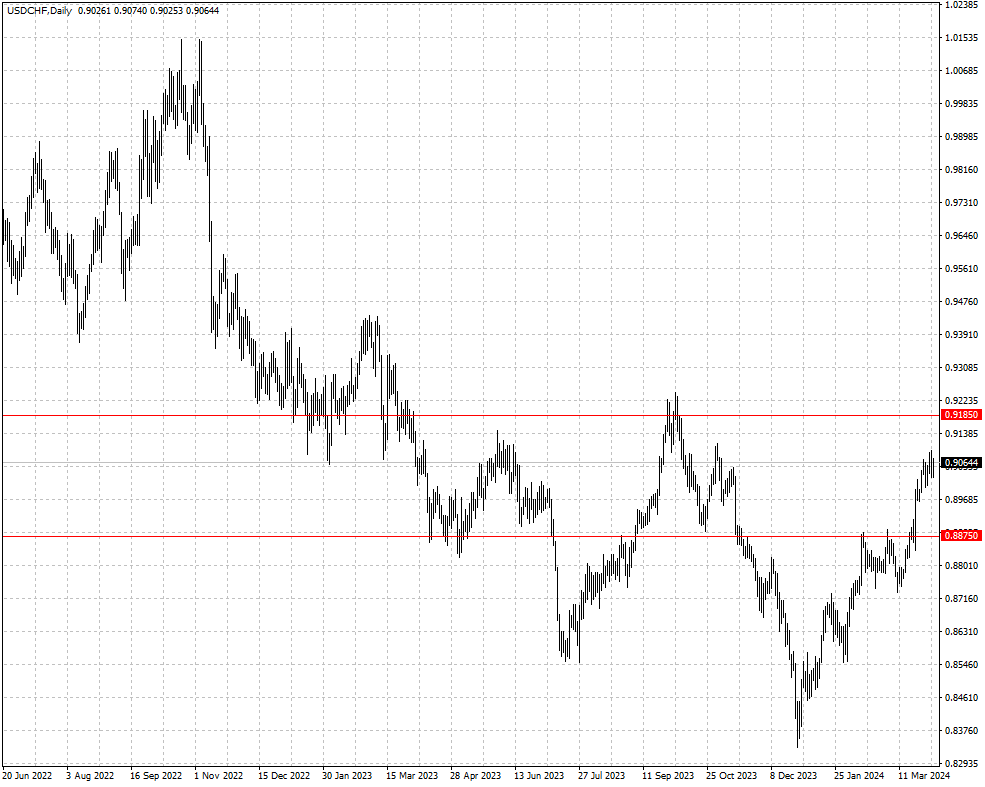

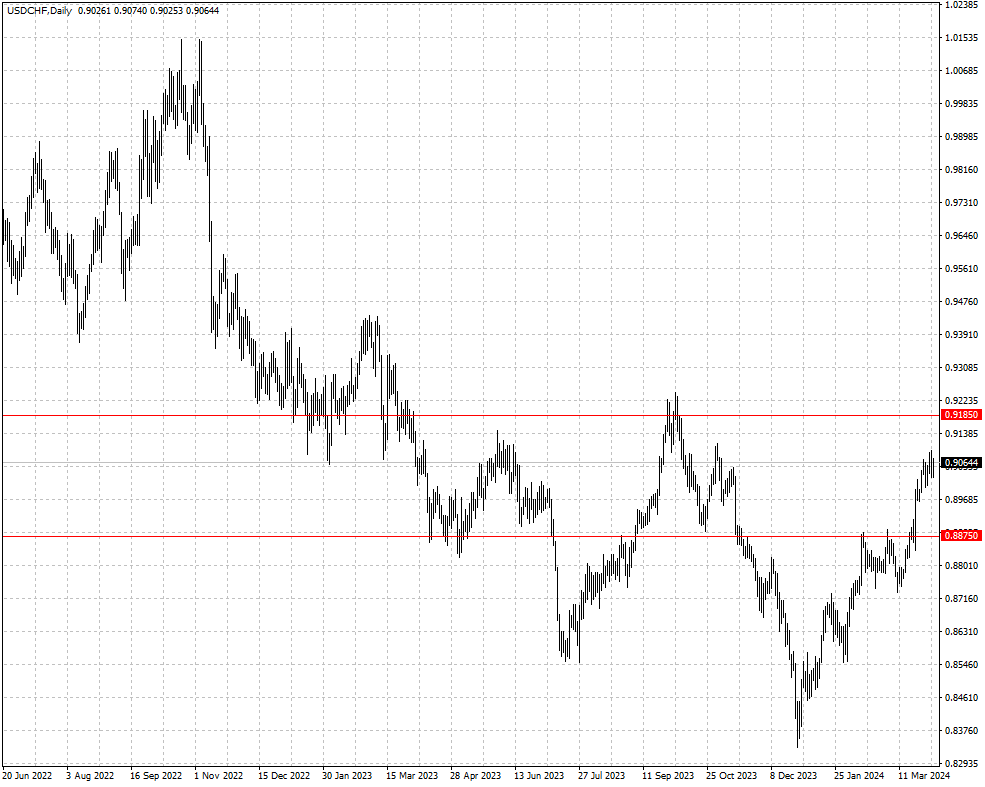

The dollar traded below recent peaks on Thursday as investors waited on this

week's US jobs report to guide the interest rate outlook. The Swiss franc

dropped as nflation eased further.

ISM said that its non-manufacturing PMI fell to 51.4 last month from 52.6 in

February, the second straight monthly decline, weighing on the greenback which

was the best performing G10 currency in Q1.

CPI rose by 1% in Switzerland last month from a year ago, the slowest pace

since Sep 2021 This came after the SNB unexpectedly cut interest rates in its

last policy meeting.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 25 Mar) |

HSBC (as of 3 Apr) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0695 |

1.1017 |

1.0676 |

1.0907 |

| GBP/USD |

1.2503 |

1.2896 |

1.2468 |

1.2754 |

| USD/CHF |

0.8741 |

0.9112 |

0.8875 |

0.9185 |

| AUD/USD |

0.6443 |

0.6691 |

0.6453 |

0.6608 |

| USD/CAD |

1.3359 |

1.3607 |

1.3473 |

1.3634 |

| USD/JPY |

146.66 |

151.91 |

148.66 |

153.21 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.