The dollar was broadly steady on Monday

2024-04-01

Summary:

Summary:

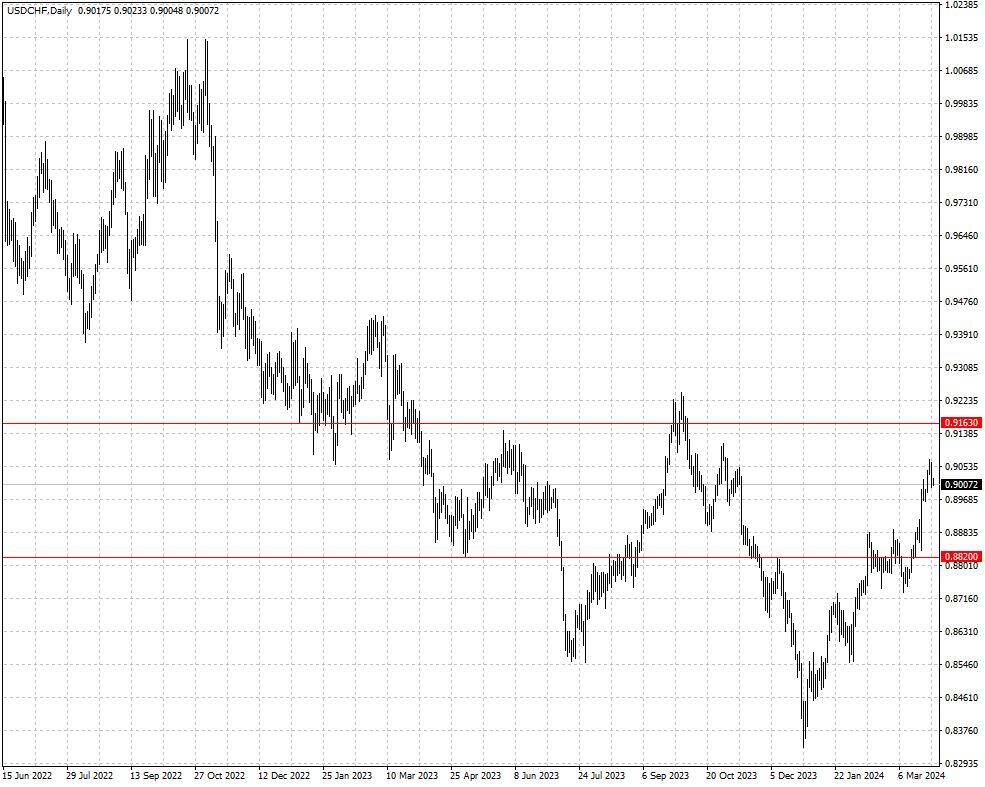

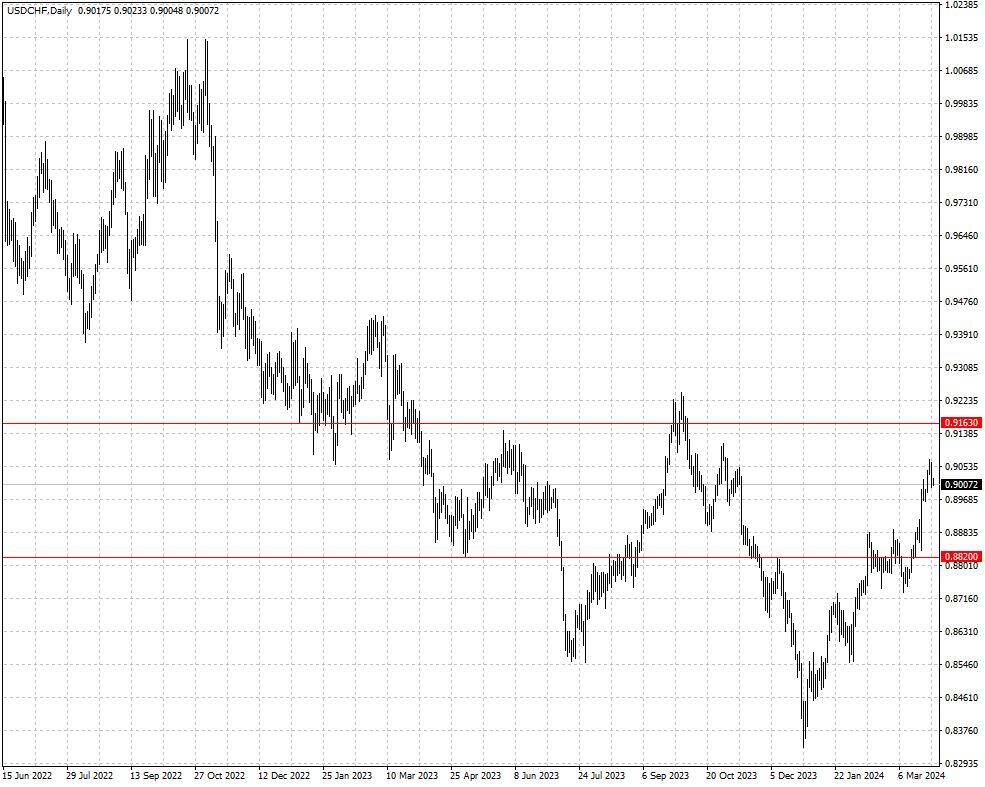

USD weak on Monday due to US inflation cooling, raising June rate cut expectations; CHF near 4-mo low on the Swiss rate cut may align with EUR.

EBC Forex Snapshot,1 Apr 2024

The dollar was broadly steady on Monday as data showing easing US prices bolstered bets that the Fed could cut interest rates in June. Markets are now pricing in 68.5% chance according to the CME FedWatch.

PCE price index increased 2.8% from a year ago in February due to rising energy costs, in line with expectations. That countered the trend over the past year when the service sector held sway over inflation.

The Swiss franc traded around its lowest in over four months. BofA strategists are predicting parity for the currency against the euro this year after surprise interest rate cuts last month.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 25 Mar) |

HSBC (as of 28 Mar) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0695 |

1.1017 |

1.0757 |

1.0937 |

| GBP/USD |

1.2503 |

1.2896 |

1.2509 |

1.2830 |

| USD/CHF |

0.8741 |

0.9112 |

0.8820 |

0.9163 |

| AUD/USD |

0.6443 |

0.6691 |

0.6468 |

0.6633 |

| USD/CAD |

1.3359 |

1.3607 |

1.3451 |

1.3648 |

| USD/JPY |

146.66 |

151.91 |

147.87 |

153.37 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.