The dollar hovered near its peak in four months

2024-04-02

Summary:

Summary:

The dollar nears a 4.5-month high as traders ease bets on a Fed rate cut. CME's FedWatch tool sees a 61.3% chance of a June pivot.

EBC Forex Snapshot, 2 Apr 2024

The dollar hovered near its peak in four months and a half on Tuesday as

traders dialled back bets for the Fed's first rate cut this year. Market now

factors in 61.3% odds of pivot in June, according to the CME's FedWatch

tool.

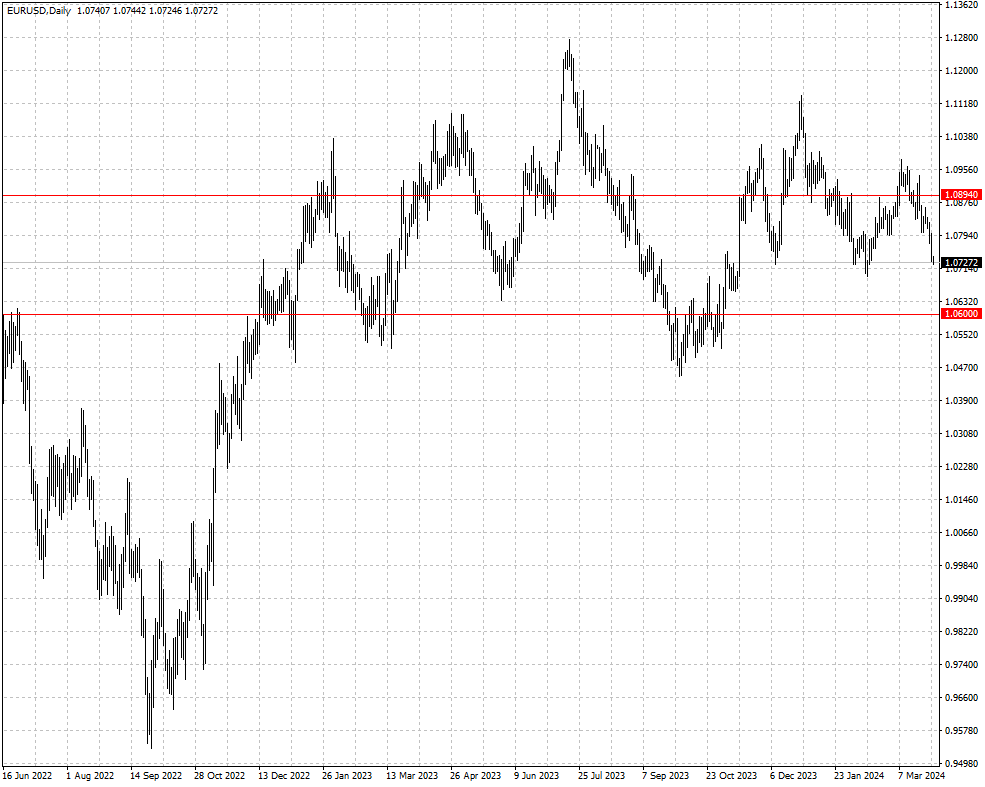

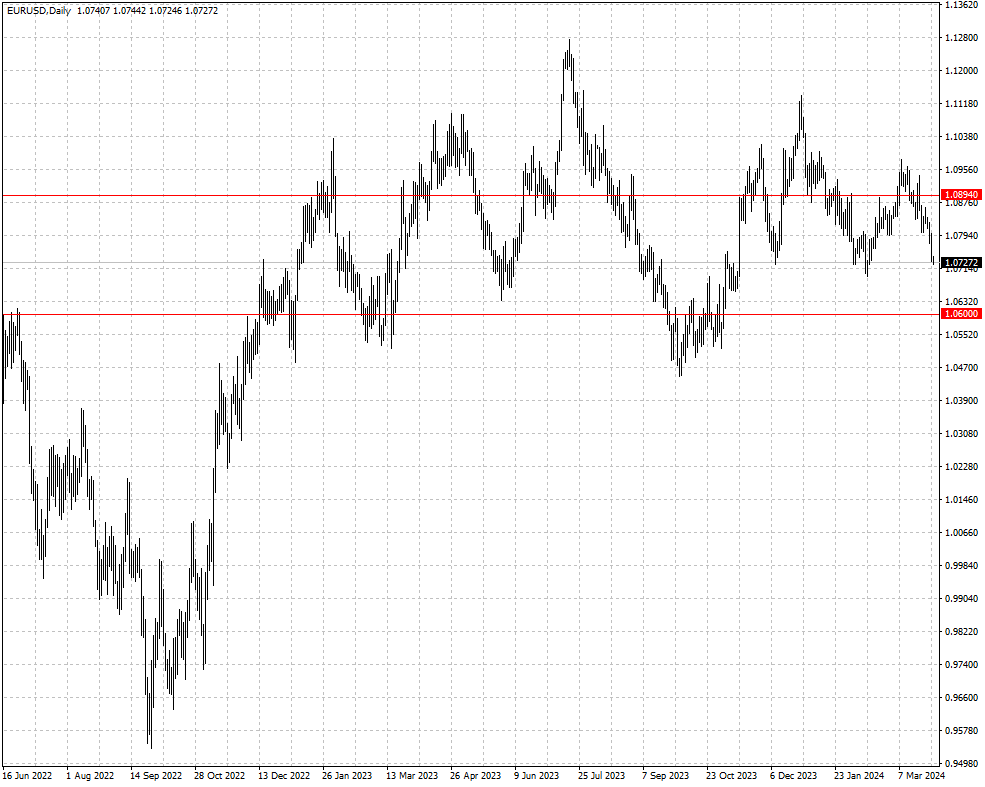

The euro dipped to a six-week low after data showed the first expansion in US

manufacturing since Sep 2022. The ISM index rose to 50.3 in March from 47.8,

well above the market expectation of 48.4.

French inflation fell to its lowest level since Jul 2021 in March, while

price growth also undershot expectations in Italy. That has boosted hopes that

the ECB will cut interest rates sooner.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 25 Mar) |

HSBC (as of 2 Apr) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0695 |

1.1017 |

1.0600 |

1.0894 |

| GBP/USD |

1.2503 |

1.2896 |

1.2450 |

1.2736 |

| USD/CHF |

0.8741 |

0.9112 |

0.8846 |

0.9153 |

| AUD/USD |

0.6443 |

0.6691 |

0.6433 |

0.6589 |

| USD/CAD |

1.3359 |

1.3607 |

1.3477 |

1.3638 |

| USD/JPY |

146.66 |

151.91 |

148.58 |

153.33 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.