The dollar rose on Tuesday

2024-01-16

Summary:

Summary:

Tuesday saw the dollar climb, with reduced expectations for Fed rate cuts after the ECB's hawkish remarks. The euro lost momentum.

EBC Forex Snapshot

16 Jan 2024

The dollar rose on Tuesday as investors pared back bets on near-term

rate-cuts by the Fed following hawkish comments from ECB. The euro lost its

upward momentum.

Markets are now pricing in a 66% chance of a 25 bps cut in March by the Fed,

the CME FedWatch Tool showed. Meanwhile the ECB and the BOE are expected to cut

interest rates later, mostly likely in April and May respectively.

The pound fell after data showed that growth in British wages slowed in the

three months through Nov - a sign the labour market was normalising.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 8 Jan) |

HSBC (as of 16 Jan) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0833 |

1.1150 |

1.0836 |

1.1100 |

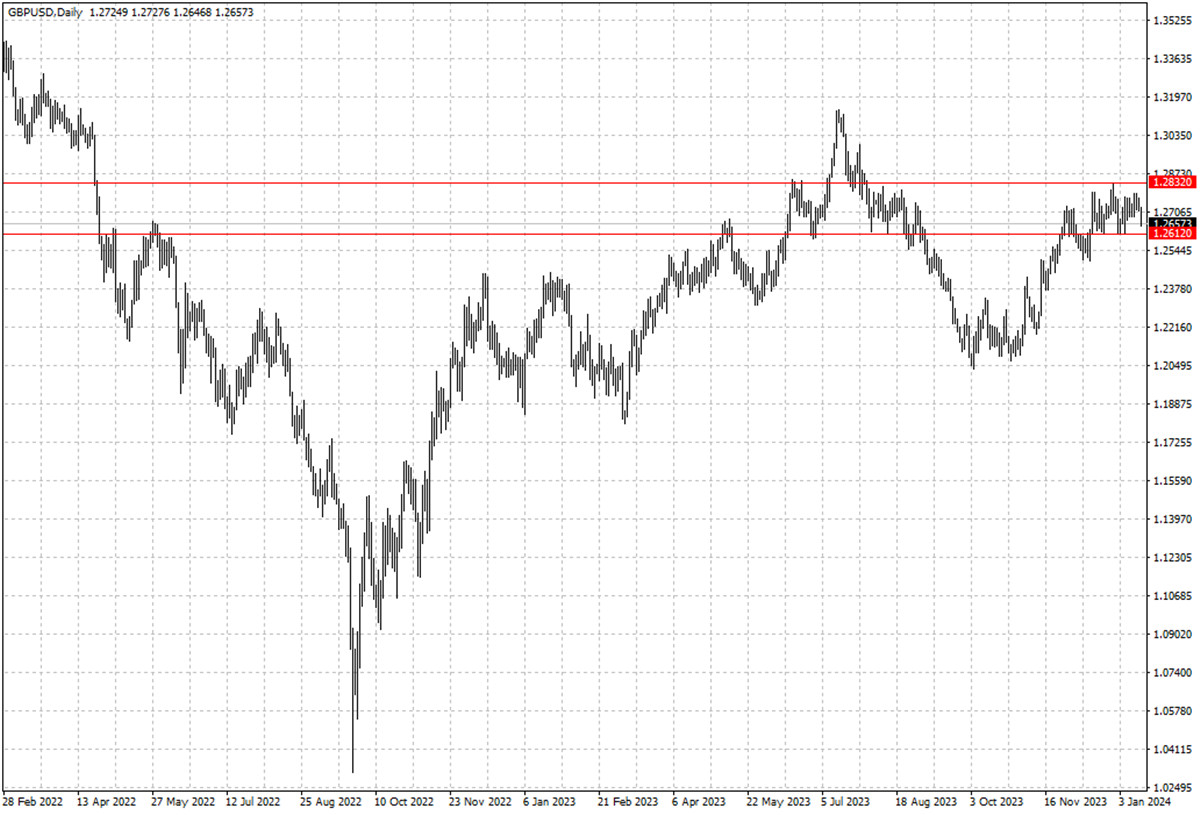

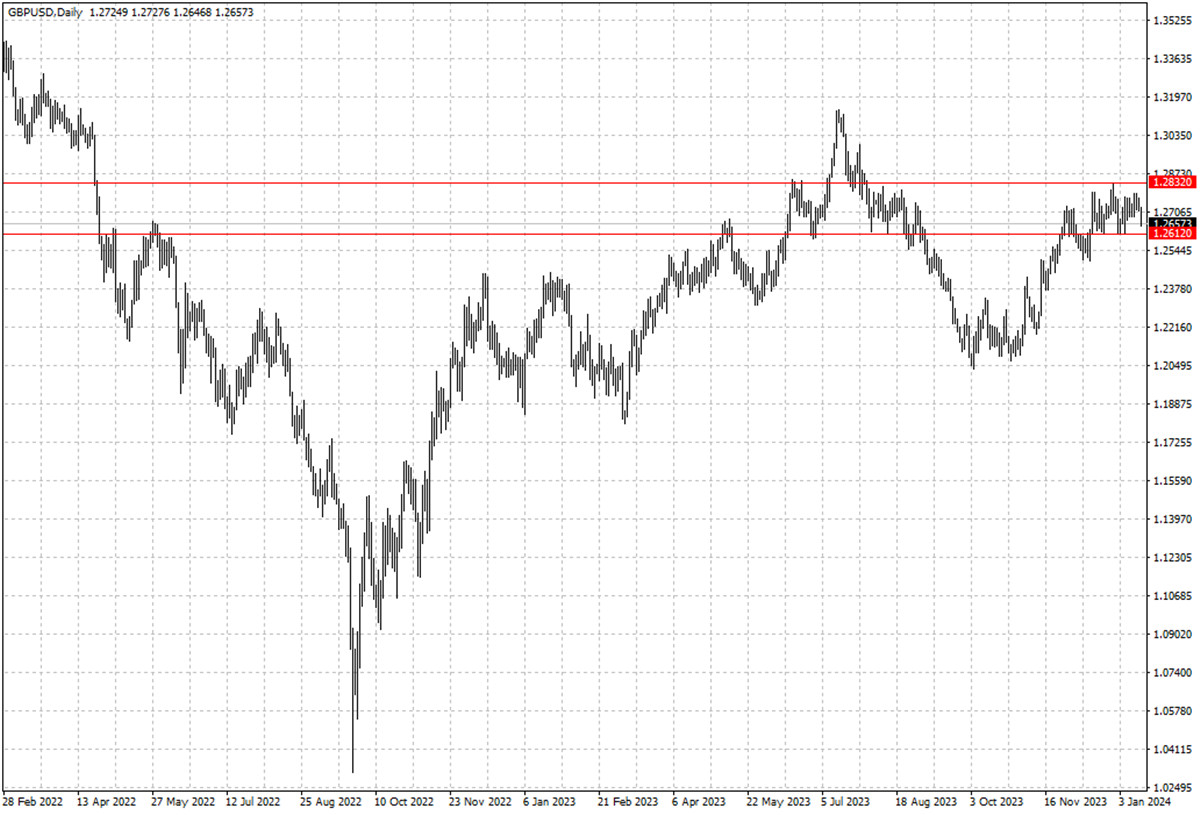

| GBP/USD |

1.2536 |

1.2848 |

1.2612 |

1.2832 |

| USD/CHF |

0.8333 |

0.8667 |

0.8398 |

0.8644 |

| AUD/USD |

0.6641 |

0.6900 |

0.6561 |

0.6815 |

| USD/CAD |

1.3177 |

1.3483 |

1.3246 |

1.3529 |

| USD/JPY |

139.48 |

144.96 |

141.84 |

148.01 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.