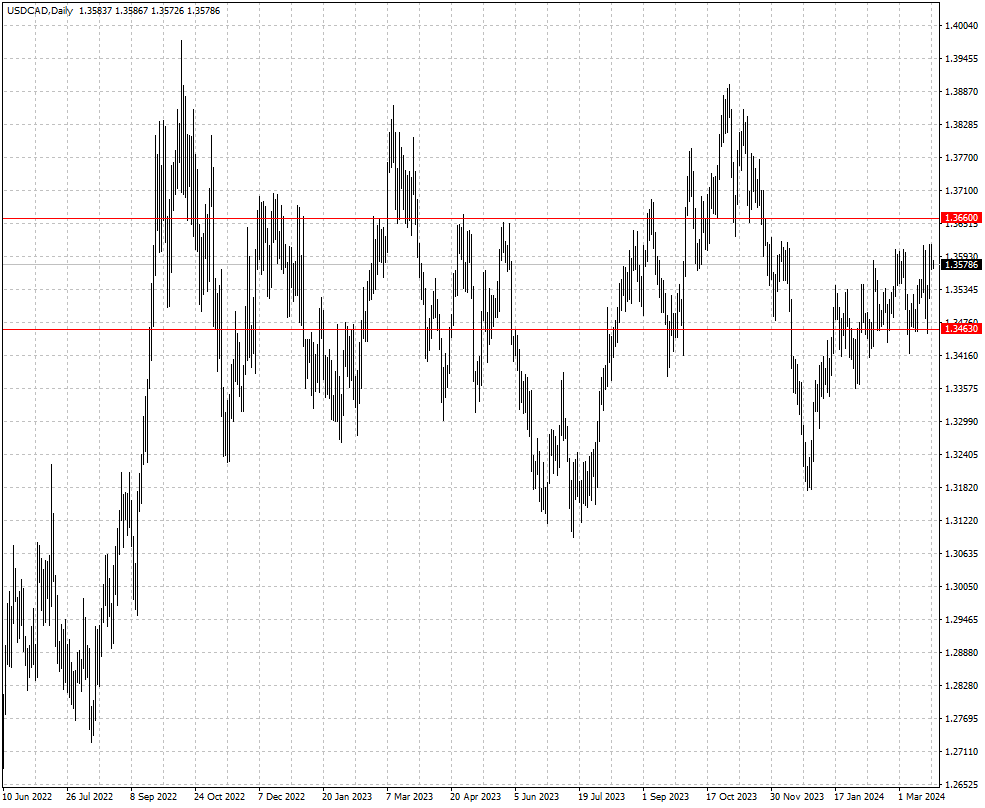

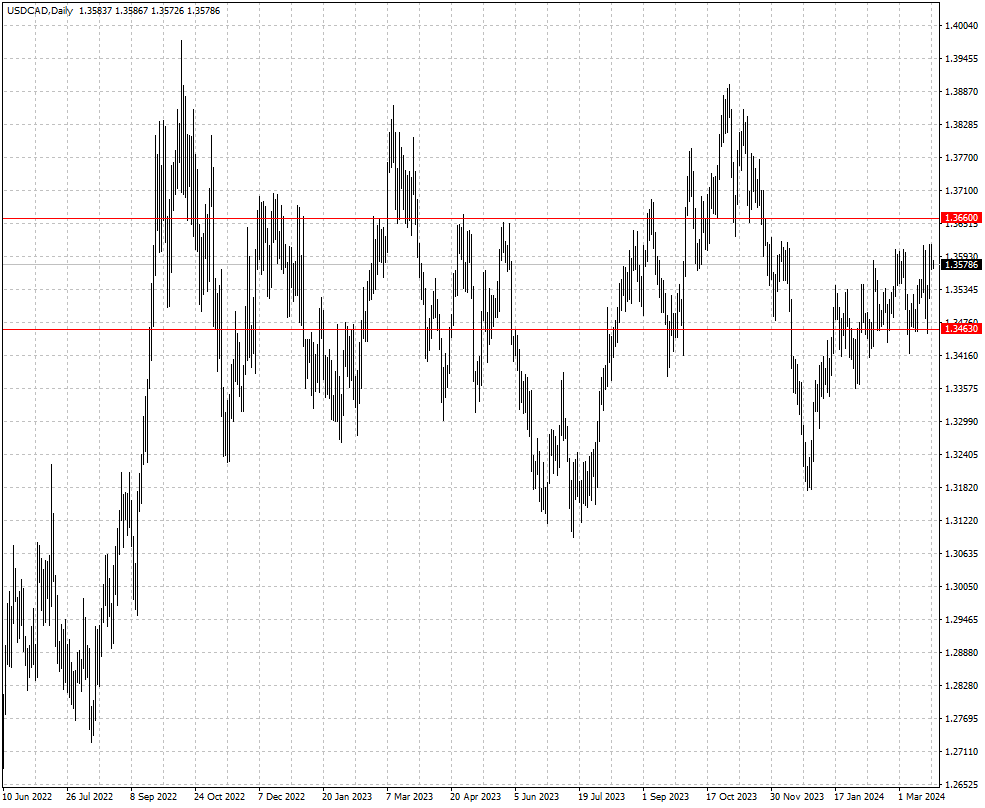

The Canadian dollar remains at 3-month lows

2024-03-26

Summary:

Summary:

Tuesday saw the dollar decline due to profit-taking and pressure from a firmer yen, fueled by ongoing Japanese government efforts to support it.

EBC Forex Snapshot, 26 Mar 2024

The dollar dropped on Tuesday, owing to profit-taking and pressured in part

by a slightly stronger yen as Japanese government officials continued with their

jawboning to defend the currency.

With a relatively light economic data calendar for the week, FX volatility

has been muted. The Canadian dollar hovered around its weakest level in more

than three months against the dollar despite of oil rally.

Canadian retail sales fell 0.3% in January from December, weighed down by

lower goods prices and sales of motor vehicle and parts. The country’s factory

sales rose 0.7% in February on a monthly basis.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 18 Mar) |

HSBC (as of 26 Mar) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0695 |

1.1017 |

1.0764 |

1.0944 |

| GBP/USD |

1.2503 |

1.2896 |

1.2506 |

1.2827 |

| USD/CHF |

0.8741 |

0.9000 |

0.8807 |

0.9099 |

| AUD/USD |

0.6443 |

0.6691 |

0.6464 |

0.6641 |

| USD/CAD |

1.3359 |

1.3607 |

1.3463 |

1.3660 |

| USD/JPY |

146.26 |

149.21 |

147.97 |

153.36 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.