The Australian dollar slipped on Wednesday

2024-03-27

Summary:

Summary:

Strong US data raised doubts on rate cuts, lifting the dollar and pushing the yen to a 30-year low. The Aussie slipped on weak inflation.

EBC Forex Snapshot, 27 Mar 2024

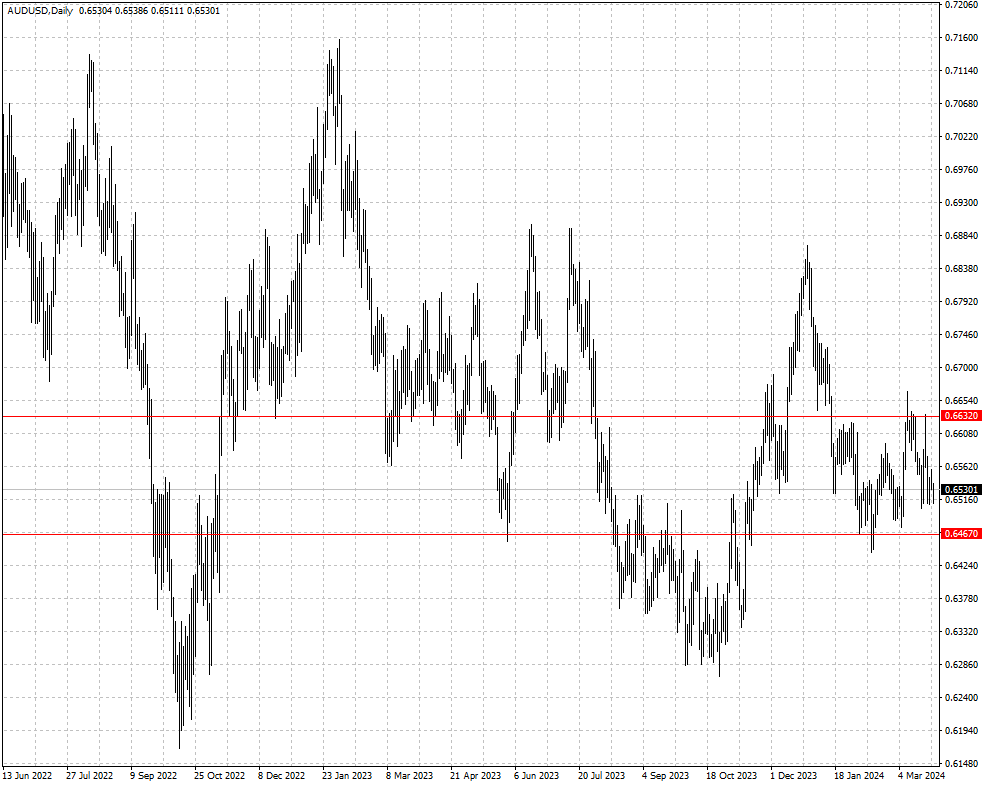

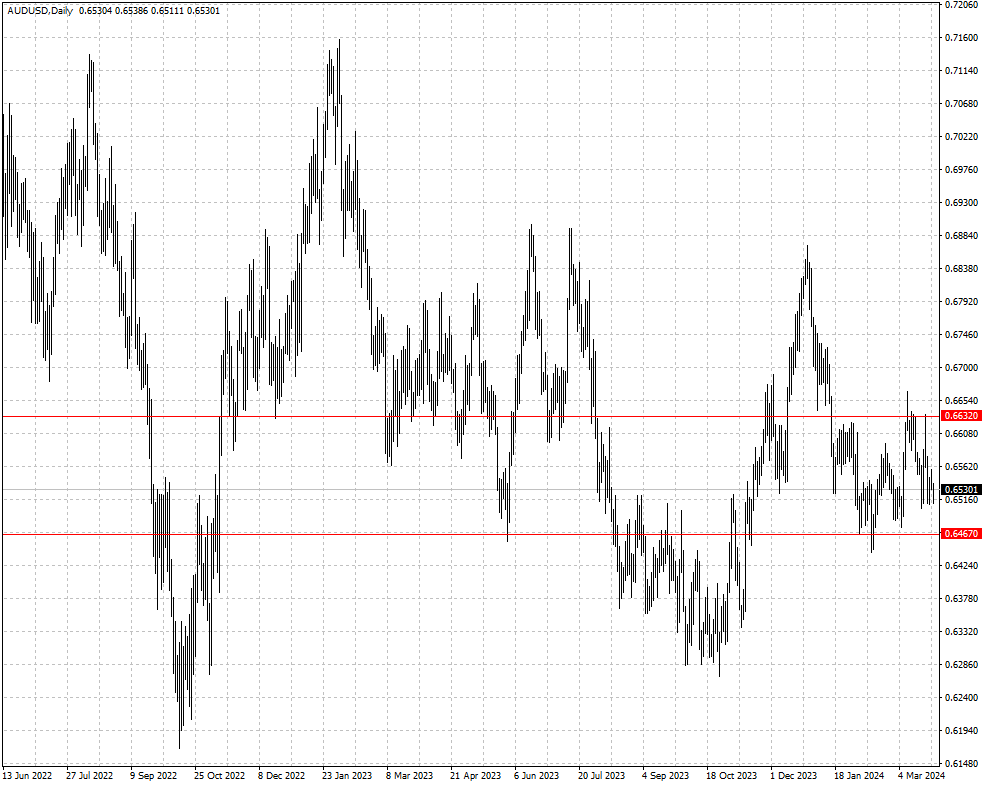

The dollar rose on Wednesday as more strong US economic data raise doubt over

the likelihood of interest rate cuts, sending the yen to a three-decade low. The

Aussie slipped as inflation fell short of expectations.

CPI rose only 3.4% last month, close to the pace of the increases in January.

The figure offers an indication of how much interest rates are squeezing demand

in the economy.

An aggregate gauge of investor positioning in the Aussie — net non-commercial

futures and options positions — showed the most bearish bias since at least

1995, according to CFTC data for the week to 19 March.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 18 Mar) |

HSBC (as of 27 Mar) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0695 |

1.1017 |

1.0760 |

1.0940 |

| GBP/USD |

1.2503 |

1.2896 |

1.2500 |

1.2821 |

| USD/CHF |

0.8741 |

0.9000 |

0.8830 |

0.9145 |

| AUD/USD |

0.6443 |

0.6691 |

0.6467 |

0.6632 |

| USD/CAD |

1.3359 |

1.3607 |

1.3461 |

1.3658 |

| USD/JPY |

146.26 |

149.21 |

148.06 |

153.45 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.