Global shares rose on Tuesday, a day ahead of U.S. inflation data that could

warrant a quicker end to Fed rate hikes, while the prospect of China propping up

growth helped to lift oil and other commodities.

The U.S. dollar traded around its lowest in two months, in line with a

retreat in Treasury yields. Gold prices scaled a near three-week high.

Oil settled up about 2%, boosted by a falling U.S. dollar, hopes for higher

demand in the developing world and supply cuts by the world's biggest oil

exporters.

Commodities

All eyes are on U.S. consumer prices data due on Wednesday, which is expected

to show prices cooled on an annual basis in June.

‘In the very long term, silver is expected to trade significantly above the

$26/oz mark and should increasingly decouple from gold,’ TD Securities wrote in

a note.

Brent's settlement was its highest since April 28 and WTI's since May 1.

Brent was in technically overbought territory for the second time in three

days.

The IEA said the oil market should remain tight in the second half of 2023,

citing strong demand from China and developing countries combined with recently

announced supply cuts, including by top exporters saudi arabia and Russia.

The EIA projected global oil output would rise to 101.1 million bpd in 2023

and 102.6 million bpd in 2024, while world demand will rise to 101.2 million bpd

in 2023 and 102.8 million bpd in 2024.

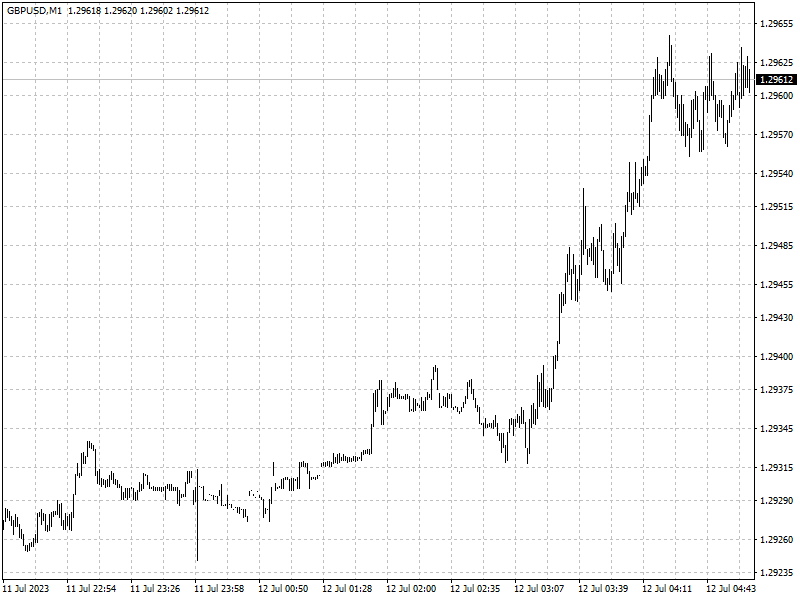

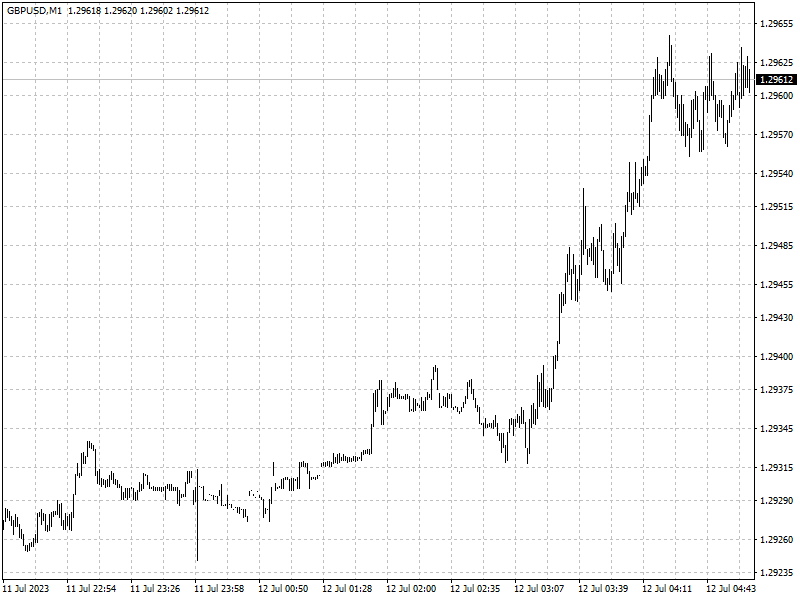

Forex

Against the yen, the dollar fell to a four-week trough of 140.17 and plunged

to its lowest in 2.5 years against the Swiss franc.

Several Fed officials said on Monday the central bank would likely need to

raise interest rates further to bring down inflation but the end to its current

monetary policy tightening cycle was getting close.

Sterling hit a near 15-month high of $1.2934 after British wage growth hit a

joint record high, heaping pressure on the BOE to tighten policy further to

bring inflation under control.