Wall Street stocks advanced on Wednesday and the dollar and Treasury yields

fell after new U.S. inflation data showed a slowdown in the seemingly relentless

rise of consumer prices.

Second-quarter U.S. earnings start to roll in this week, with several Wall

Street banks expected to report higher profits as rising interest payments

offset a downturn in deal making.

Gold prices jumped more than 1%on hopes that the Fed could hit the brakes on

its interest rate hike cycle sooner than expected. Oil benchmark Brent futures

breached $80 a barrel for the first time since May.

Commodities

The Labour Department said, CPI advanced 3.0% in the 12 months through June,

down from 4.0% in May and the smallest year-on-year increase since March 2021

due to a decrease in prices of used motor vehicles.

Benchmark 10-year U.S. note yields dropped to 3.8770%. Spot silver climbed

4.4% to $24.11 per ounce, its highest since June 19.

Crude inventories rose by 5.9 million barrels in the week to July 7 to 458.1

million barrels, compared with analysts' expectations in a Reuters poll for a

500,000-barrel rise, the EIA said.

Forex

The greenback hit its lowest against the Swiss franc since early 2015 after

the inflation report. The euro surged to its highest since March last year of

1.1134.

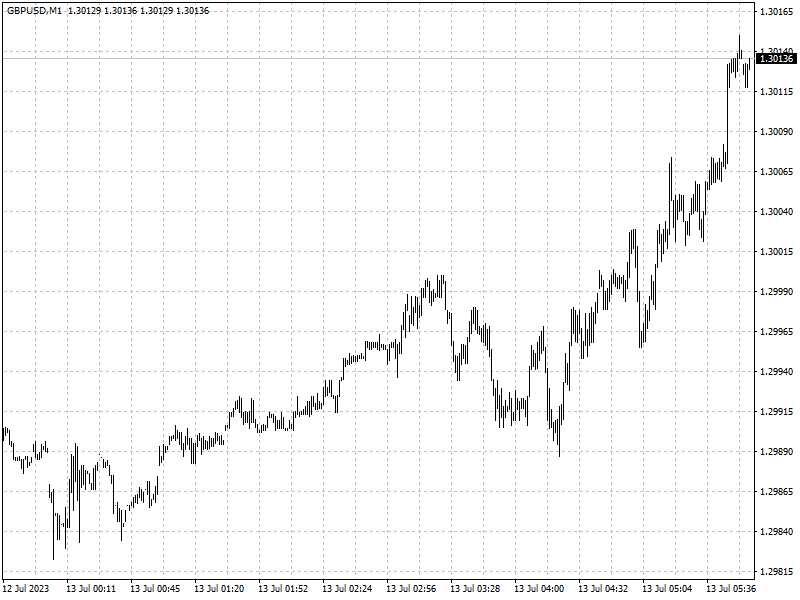

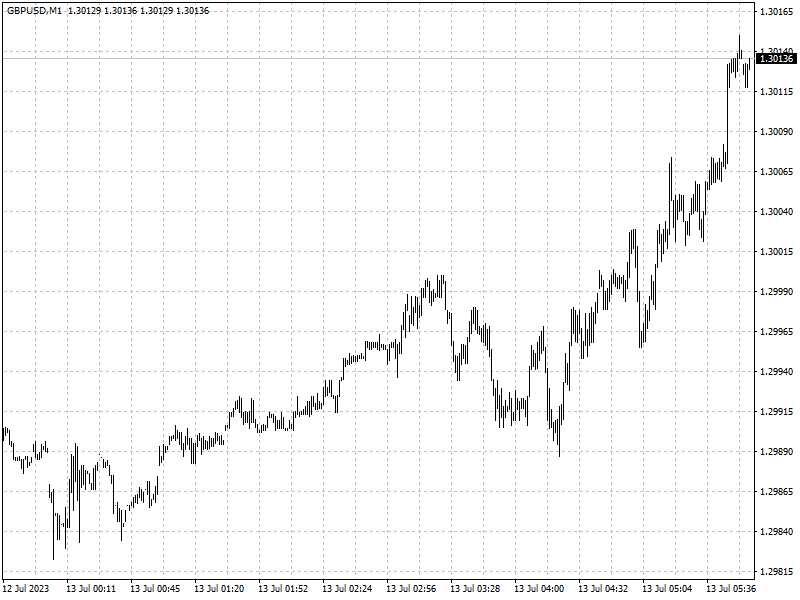

Sterling struck a fresh 15-month high of $1.30, driven by expectations for

the BOE to deliver more rate rises to tame U.K. inflation, which is the highest

of any major economy.

Jordan Rochester, senior G10 FX strategist at Nomura in London, in a research

note said he is raising his conviction on his long euro/dollar trade, targeting

1.14 by the end of September.