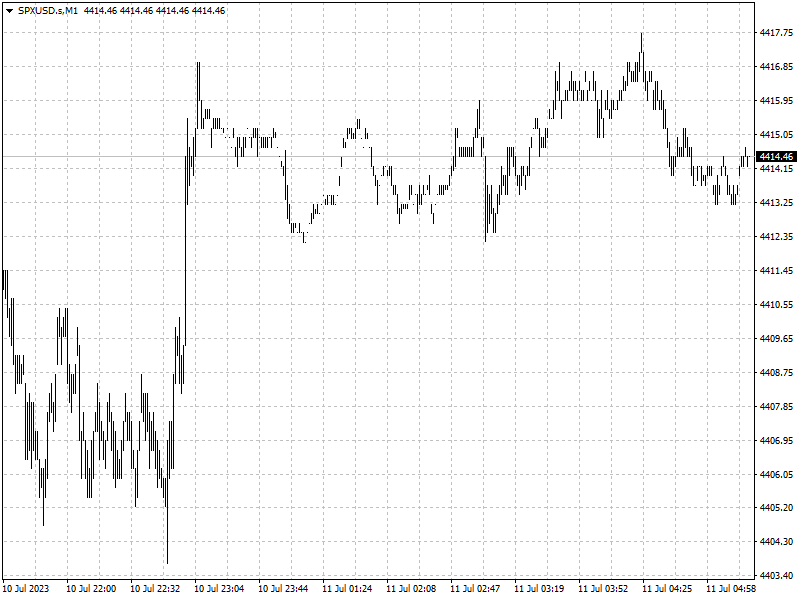

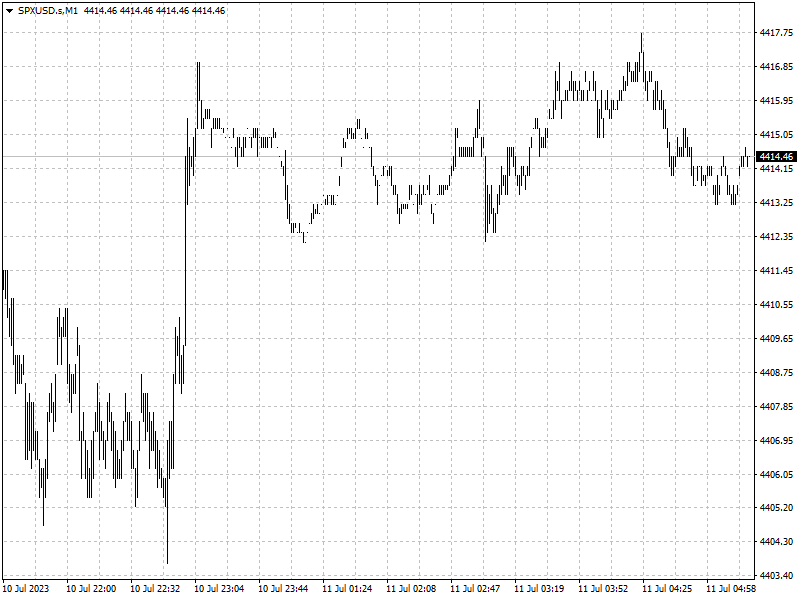

Wall Street stocks rose slightly on Monday, while the dollar dipped, as

investors digested Chinese economic data and looked ahead to a key U.S.

inflation report and corporate earnings.

Citigroup downgraded U.S. stocks in anticipation of a pullback in growth

equities and a recession in the fourth quarter of the year, while betting on

beaten-down counterparts in Europe with an upgrade.

Gold was little changed after making a slight gain last week. Oil declined 1%

after weak economic data from top consumers, although expected crude supply cuts

from saudi arabia and Russia limited losses.

Commodities

Gold prices have dropped more than 7% since reaching near-record levels in

early May as investors scaled back expectations of an end to the Fed's

rate-hiking cycle.

Both benchmarks rose more than 4.5% last week after Saudi Arabia and Russia

announced fresh output cuts bringing total reductions by the OPEC+ group to

around 5 million bpd, or about 5% of global oil demand.

Oil demand from China and developing countries, combined with OPEC+ supply

cuts, is likely to keep the market tight in the second half of the year despite

a sluggish global economy, the head of the IEA said.

Forex

The dollar sank to a three-week low after comments by Fed officials

reinforced market expectations that the U.S. central bank is near the end of its

tightening cycle.

Several Fed officials led by San Francisco Fed President Mary Daly said the

central bank likely will need to raise interest rates further to bring down

inflation that remains persistently high, but the end to its current monetary

policy tightening cycle is getting close.

‘The weaker pressure on the dollar has ... been hard to square from a

relative rates and growth standpoint,’ said Erik Nelson, macro strategist at

Wells Fargo in London.

‘U.S. growth has outperformed expectations, while Europe and China have

underperformed. I think the U.S. economy is stronger than we give it credit

for,’ Nelson added.