I wonder if investors have ever heard of range-trading, which is a rather

interesting financial strategy that is also nicknamed Grid Trading or fishnet

strategy. Unlike many other stock trading methods, range trading does not

require studying market trends but focuses on the rise and fall of prices within

a specific range. The flexibility of this strategy makes it suitable for a

variety of market situations; whether the market is crazy up, down, or sideways,

there are opportunities to profit from it. Next, we'll delve into the principles

of range-trading, as well as its advantages and challenges, and look at some

practical ways to do it.

The implications of range trading:

Range trading is a financial term, also known as grid trading or fishnet

trading strategy, often used to describe a specific trading strategy that

involves buying or selling an asset, such as a stock, foreign exchange,

commodity, or other financial instrument, with the expectation that the price

will fluctuate within a specific price range. This strategy aims to profit from

the price of an asset moving within a certain range of minutes, hours, days, or

even longer periods of time, depending on the trader's preferences and market

conditions. In range-bound trading, traders try to buy low prices and sell high

prices in order to make small but frequent profits, rather than relying on the

trend direction of prices.

In range-bound trading, traders usually set a ceiling and a floor price,

which constitute the so-called "trading range". They will buy or sell when the

asset price reaches this range. When the asset price reaches the upper limit,

traders may sell, and when the price falls to the lower limit, they may buy.

This process is repeated as the price moves within this particular range in the

expectation of profiting from the price movements.

To better understand range trading, let's take an example. Suppose a stock

trader notices that the price of a certain stock has been fluctuating between

$50 and $60 over the past few weeks. He decided to use this price range for

range-trading. He set a floor price of $50 and a ceiling price of $60. When the

price drops to $50, he buys the stock, and when the price rises to $60, he

sells. If the stock price moves within this range, he will repeat the process

over and over again in the hope of making a profit from the price

fluctuations.

A key advantage of range-bound trading is that it does not depend on the

direction of market trends. This means that whether the market is up, down, or

sideways, traders have the opportunity to profit.

Advantages of range-bound trading:

-

Wide applicability

Range-trading is applicable to a variety of markets, including stocks, forex,

commodities, and cryptocurrencies, which gives traders the flexibility to apply

this strategy across multiple markets.

-

Reduce risk

Range trading usually involves trading within a price range, which helps

reduce risk and allows traders to more easily set stop and profit points,

reducing the risk of loss.

-

More stable returns

Range trading can provide relatively stable returns because it does not

depend on the direction of the market trend but focuses on the oscillation of

the price range.

-

Frequent trading

Range trading allows traders to make frequent trades because it relies on

short-term fluctuations. This can provide traders with more opportunities to

make profits.

-

Easier to implement

Range-bound trading typically involves the use of technical analysis tools to

determine support and resistance levels, which are relatively easy to understand

and apply.

-

Reduce emotional impact

The regular and mechanical nature of range-trading strategies can help reduce

emotion-driven trading decisions and reduce anxiety and decision errors in

trading.

Disadvantages of range-bound trading:

-

Limited profit potential

Range-bound trading usually involves small price movements, so the potential

profits are also relatively small. This may require more capital and more

trading opportunities to achieve decent returns.

-

Fierce competition

Range trading is a relatively popular trading strategy, so there are many

other traders in the market, which can lead to intense competition and affect

profit potential.

-

Technical analysis skills are required

Successful range trading requires skilled technical analysis skills to

determine support and resistance levels and make informed trading decisions.

-

May be disturbed by market noise

When prices move within a range, they can be affected by short-term market

noise, resulting in inaccurate Trading signals. Traders must learn to filter out

the noise to identify effective trading opportunities.

-

Frequent trading may be required

Range trading may require frequent buying and selling operations, which can

increase trading costs, especially in a high-frequency trading environment.

-

Emotional factor

Range trading requires discipline and emotional control, as frequent trading

can lead to anxiety and poor decision-making. Traders need to stay calm and

focused.

In range trading, there are many different strategies that can be employed in

order to make a profit within a specific price range.

Here are some common range trading strategies:

-

Support and resistance strategies

This is one of the most common range-trading strategies. Traders use

technical analysis tools such as trend lines, moving averages, and volatility

indicators to determine support and resistance levels for prices. They will buy

when the price approaches support and sell when it approaches resistance.

-

Moving Average strategy

This strategy involves using moving averages of different maturities, such as

the simple moving average (SMA) or the exponential moving average (EMA). Traders

watch the crossing between two or more averages to determine buy and sell

signals.

-

Bollinger belt strategy

A Bollinger band is a volatility indicator that includes an intermediate band

and two standard deviation channels. Traders use the Bollinger band to identify

high and low price ranges. When the price hits an upward trajectory, they may

sell, and when the price hits a downward trajectory, they may buy.

-

Volatility strategy

This strategy takes advantage of the perception of market volatility. Traders

observe the historical volatility of prices and then trade according to the

periodicity of the volatility. This can include setting stop-loss and profit

levels based on ATR (average true range) indicators.

-

RSI strategy

The relative strength indicator (RSI) is a momentum indicator commonly used

in range-trading. When the RSI is above 70, it indicates that the market is

overbought and may be a sell signal. When the RSI is below 30, it indicates that

the market is oversold and may be a buy signal.

-

Channel strategy

The channel strategy uses the upper and lower limits of the price channel to

execute trades. The trader's buy price hits the channel floor, and the sell

price hits the channel ceiling.

-

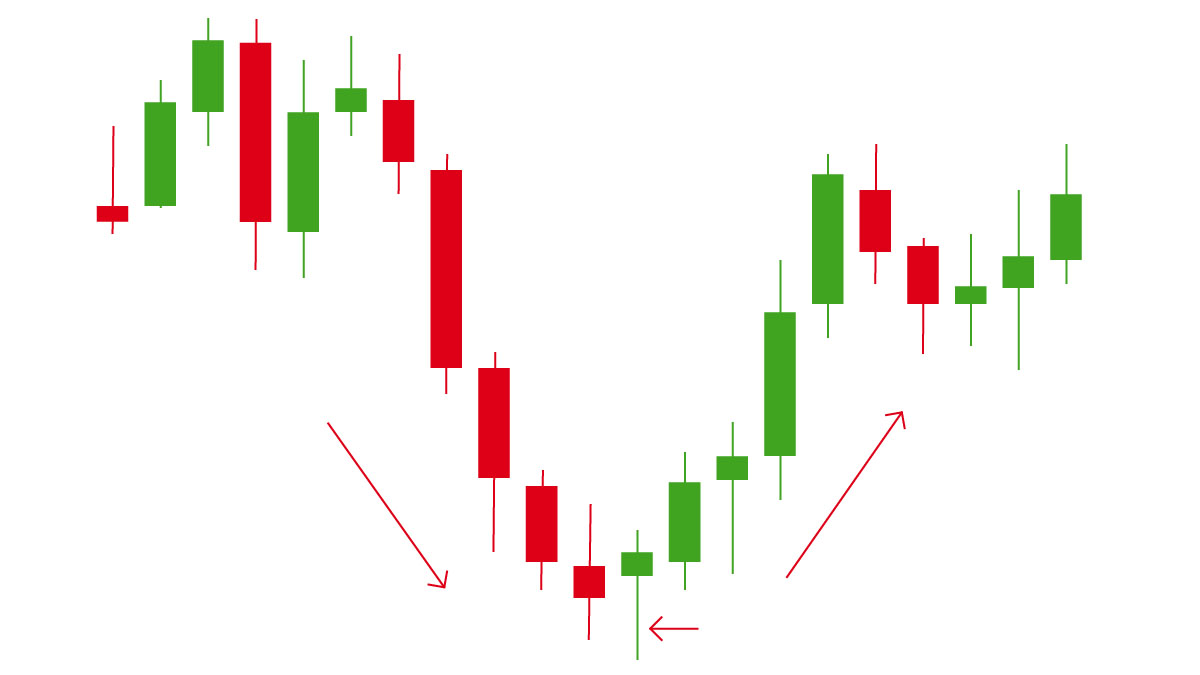

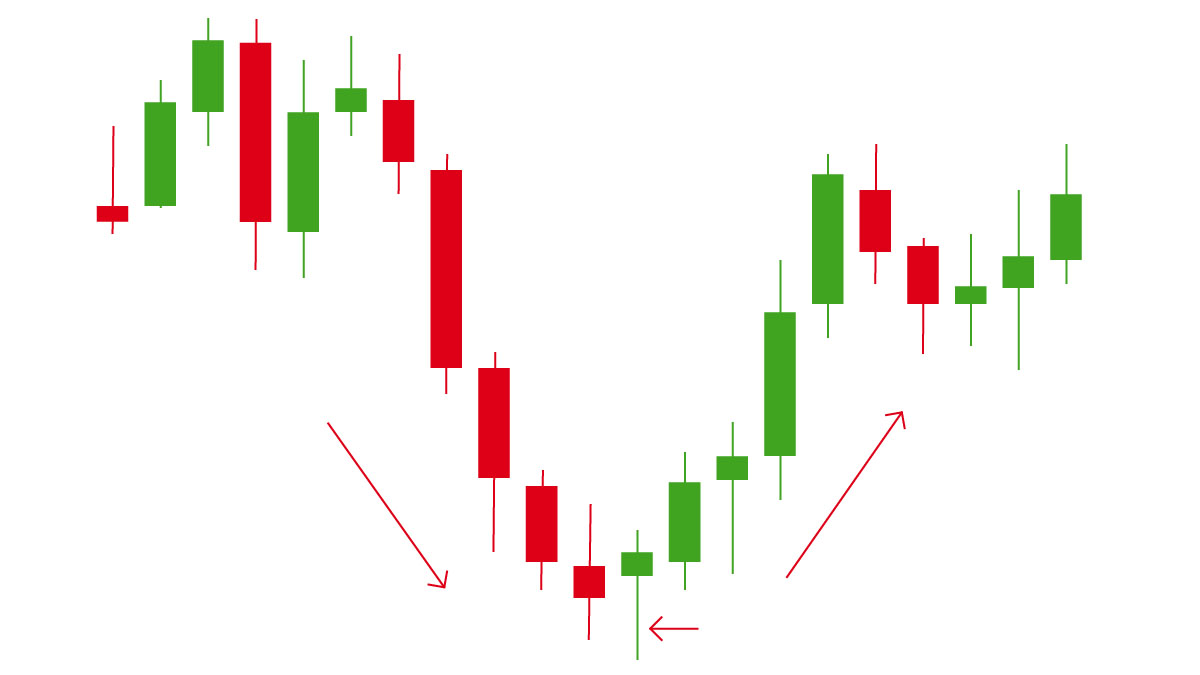

K-line graphics strategy

Traders observe K-line graphics such as head-and-shoulders tops, double tops,

double bottoms, etc., to predict the likelihood of a price reversal. They may

take corresponding trading actions after the graphic appears.

-

Trend Line crossover strategy

This strategy involves using trend lines to

capture reversals in price trends. Traders observe the intersection of trend

lines and execute a buy or sell operation when a cross signal appears.

Range trading is a trading strategy suitable for the pursuit of small but

frequent profits. Although it has some obvious advantages, including risk

management and being suitable for a variety of markets, traders also need to be

aware of its potential disadvantages, such as small profits and market noise.

Choosing a range trading strategy that is appropriate for you and having

sufficient practice and discipline will help improve your chances of success in

this area. Above all, traders should always remain calm and emotionally

controlled in order to make informed decisions.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.