Global equities retreated and benchmark U.S. Treasury yields eased off

two-month highs on Tuesday as talks over the U.S. debt ceiling continued without

resolution.

Hawkish comments from Federal Reserve officials about the possibility of

further rate hikes sent the U.S. dollar to a two-month high.

Oil prices rose on forecasts for a tighter gasoline market and a warning from

the Saudi energy minister to speculators that raised the prospect of further

OPEC+ output cuts.

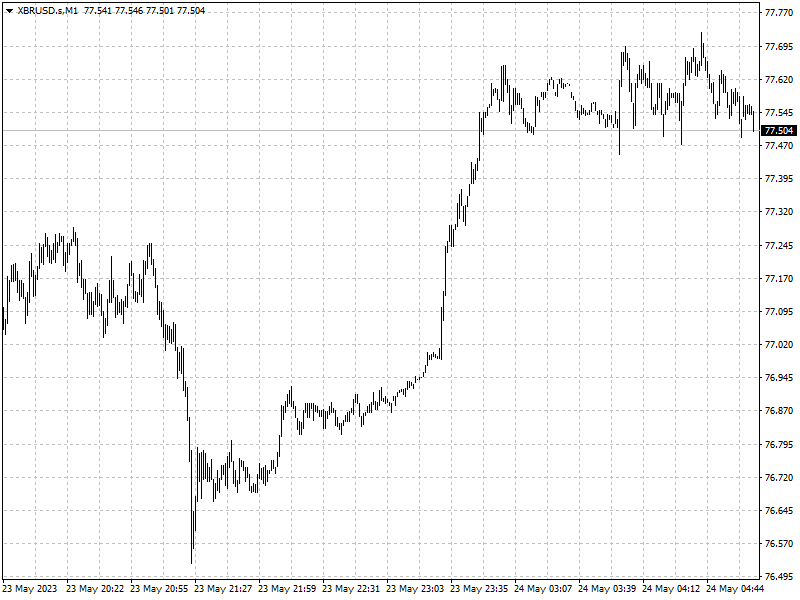

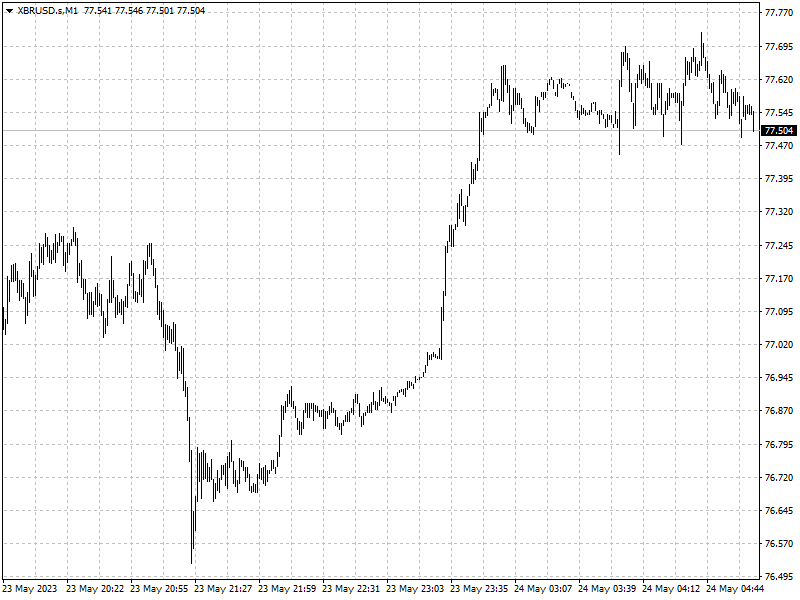

Commodities

Oil prices rose by more than a dollar a barrel and extended gains to about 2%

in post-settlement trade, after figures from the API showed a large draw in

crude and gasoline last week, according to market sources.

Production cuts by some OPEC+ members take effect this month. Fears of a

supply squeeze mounted after Saudi Arabia's energy minister said he would keep

short sellers - those betting that prices will fall - "ouching" and told them to

"watch out".

The comments could mean the Organization of Petroleum Exporting Countries and

allies including Russia will consider further output cuts at a meeting on June

4, said OANDA analyst Craig Erlam.

Brent crude prices need to rise above $77.50 a barrel to signal a sentiment

shift, he added.

Forex

The greenback ose to 138.91 against the Japanese yen, the highest since Nov.

30, before falling back to 138.57.

Traders have ramped up bets that the Fed funds rate will stay elevated, with

markets pricing in almost a 30% chance of a rate hike in June and the Fed funds

rate seen at about 4.75% in December.

Data on Tuesday showed that sales of new U.S. single-family homes jumped to a

13-month high in April.

S&P Global's flash U.S. Composite PMI Output Index, which tracks the

manufacturing and services sectors, also climbed to a reading of 54.5 this

month, the highest level since April 2022.