Wall Street shares were mixed and European stocks finished little-changed as

talks in Washington resumed to avert a U.S. default, while gold prices retreated

under pressure from hawkish remarks by Fed officials.

House Republican Speaker Kevin McCarthy said Monday morning's debt talks were

‘on the right path’. A failure to lift the debt ceiling would trigger a default,

likely sparking chaos in financial markets and a spike in interest rates.

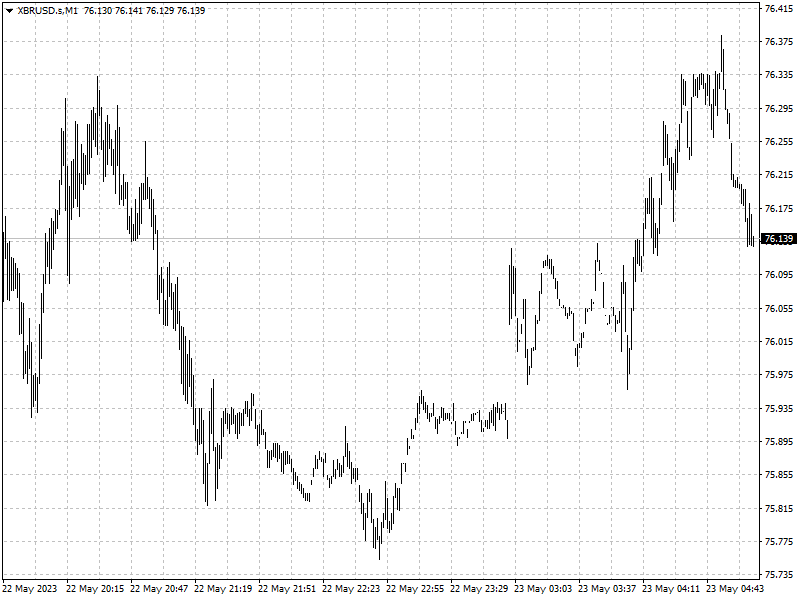

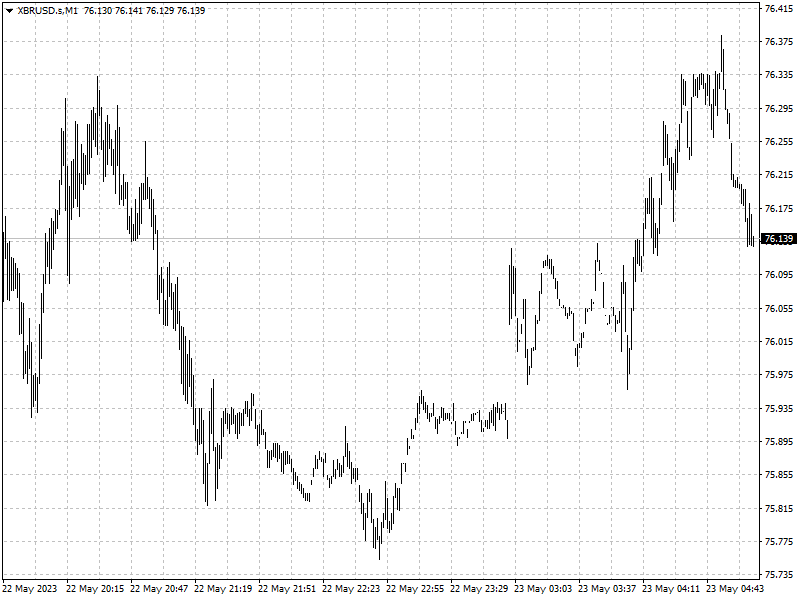

Oil prices edged up 1% with a rise in U.S. gasoline futures and forecasts for

oil demand to rise in the second half of the year, while supplies from Canada

and OPEC+ declined in recent weeks.

Commodities

The IEA warned of a looming oil shortage in the second half of the year when

demand is expected to eclipse supply by almost 2 million bpd.

A senior executive at Vitol said Asia will lead oil demand growth of around 2

million bpd in the second half of the year, an increase that could potentially

lead to a shortage of supply.

Adding to oil gains, wild fires shut in large amount of crude supply in

Canada and voluntary production cuts by the OPEC+ which began this month.

Total exports of crude and oil products from OPEC+ plunged by 1.7 million bpd

by May 16, JP Morgan said, adding that Russian oil exports will likely fall by

late May.

Forex

The dollar rose against the Japanese yen, holding just below a six-month

high. The greenback has gained for the past two weeks on stronger than expected

economic reports and hawkish Fed officials.

The dollar got a mild boost after St. Louis Fed President James Bullard said

that the Fed may still need to raise its benchmark interest rate by another

half-point this year.

‘Friday there was a bit of a setback but there's a bit more optimism after

the weekend,’ said Francesco Pesole, FX strategist at ING. ‘Markets are seeing a

deal on the debt limit and at the same time the Fed pushing back on rate cuts

which is ultimately proving positive for the dollar.’