Oil prices ease despite China cuts

2023-06-21

Summary:

Summary:

Global stock indexes fell and the dollar index inched up on Tuesday as investors weighed the U.S. interest rate outlook ahead of FedChair Jerome Powell's congressional testimony.

Global stock indexes fell and the dollar index inched up on Tuesday as

investors weighed the U.S. interest rate outlook ahead of FedChair Jerome

Powell's congressional testimony.

Gold retreated on strong U.S. housing starts data and a firmer dollar. Oil

eased in choppy trading on forecasts for slower oil demand growth.

U.S. Treasury yields fell, in line with declines in Europe. Investors also

were digesting China's move to cut its benchmark loan prime rates (LPR) for the

first time in 10 months.

Commodities

Adding to the bearish market sentiment, traders noted crude supplies from

Iran and Russia have increased in recent weeks.

The price drop, however, was limited by expectations that oil demand will

grow in China and India in the second half of the year.

‘Oil locked in on anything and everything that has to do with China. This

week, energy traders are seeing oil weakness emerge on disappointing stimulus

efforts,’ said Edward Moya, senior market analyst at data and analytics firm

OANDA.

Commerzbank analysts lowered their gold price estimate for the second half of

2023 by $50 to $2,000 per ounce, seeing another rate hike by the Fed in July and

no rate cuts until the second quarter next year.

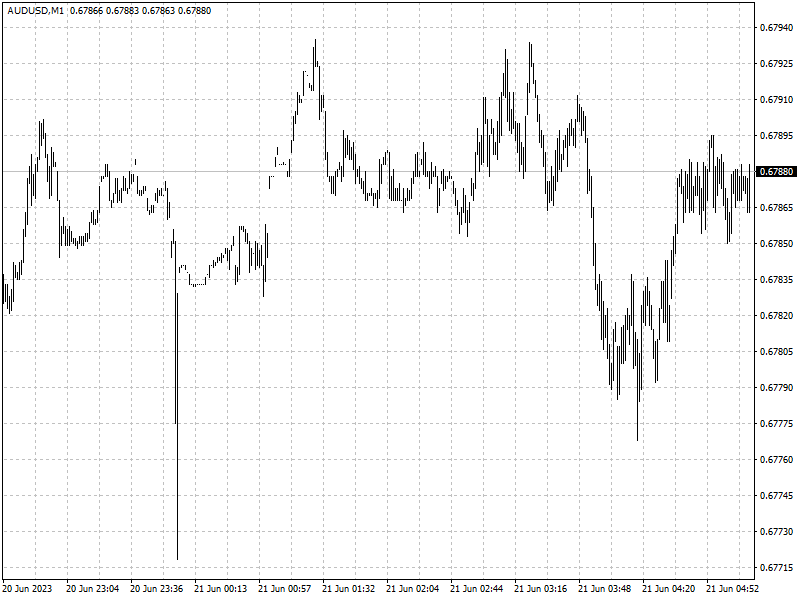

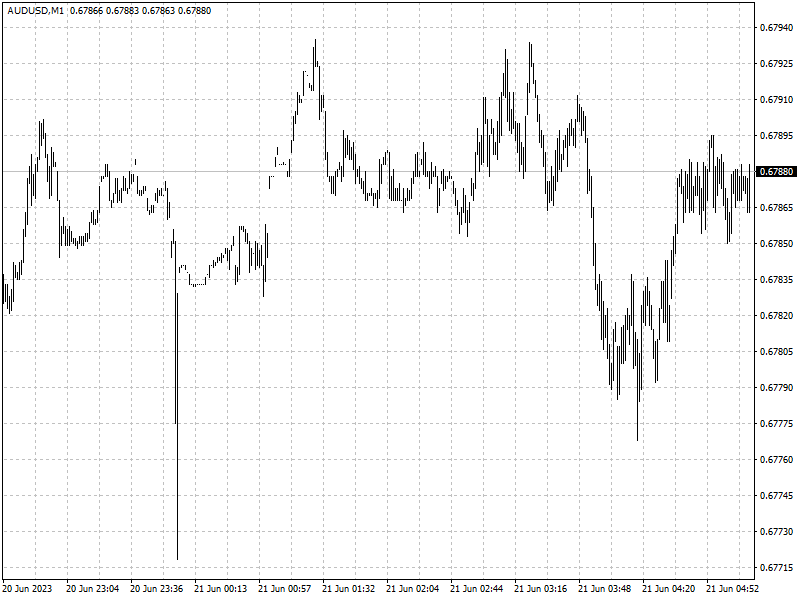

Forex

The Australian dollar fell after minutes from its latest central bank meeting

showed keeping interest rates unchanged had been under consideration, while

Sweden's crown slipped to a record low against the euro.

U.S. single-family homebuilding jumped in May to its highest in more than a

year and permits issued for future construction also climbed, suggesting the

housing market may be turning a corner after getting clobbered by Fed interest

rate hikes.