The U.S. dollar and Treasury yields climbed on Thursday as Fed Chair Jerome

Powell’s second day of testimony did not surprise.

The tech-heavy Nasdaq's robust gain got a boost from momentum stocks led by

Amazon, Apple and Microsoft, while the S&P 500's advance was more

modest.

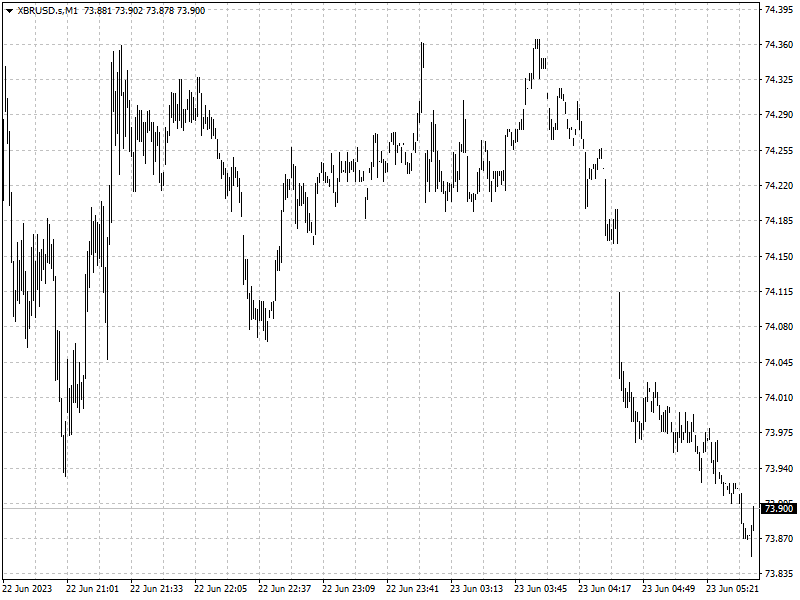

Gold dropped nearly 1% to a three-month low with the possibility of more rate

hikes overriding any support from signs of a softer labour market.

Oil futures fell about 4% as a bigger-than-expected BOE rate hike prompted

worries about the economy and fuel demand that outweighed support from a

surprise draw in U.S. oil supplies.

Commodities

U.S. jobless claims held steady at a 20-month high last week, potentially

signalling a softening labour market.

U.S. crude inventories fell by 3.8 million barrels in the last week to 463.3

million barrels, compared with analysts' expectations in a Reuters poll for a

300,000-barrel rise.

An executive at U.S. shale producer EOG Resources said oil prices could rise

as muted increases in U.S. oil production and cuts by OPEC+ producers will limit

supply in the months ahead.

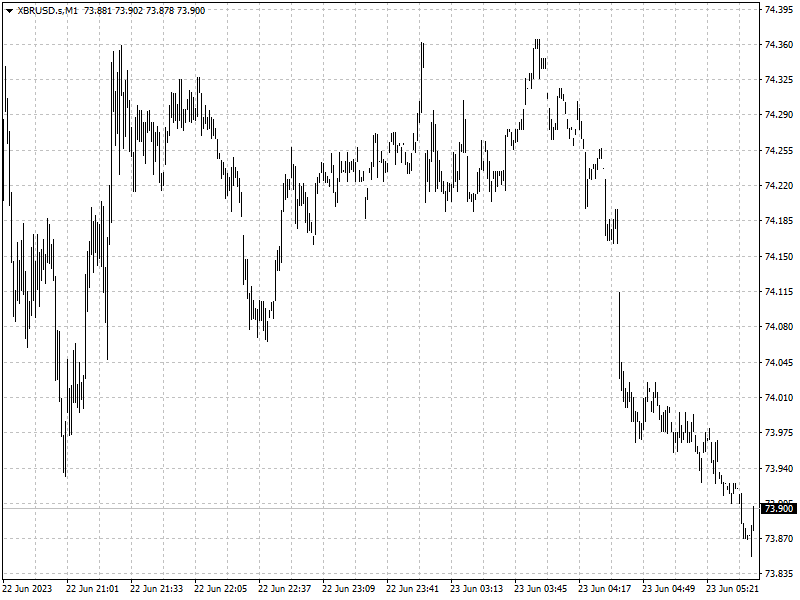

Forex

The slew of rate hikes come a day after Powell told lawmakers on Capitol Hill

further rate increases were "a pretty good guess" of where the central bank was

heading if the economy continued in its current direction.

During the second day of testimony Powell said the central bank would move

interest rates at a ‘careful pace’ from here. Asked about rate cuts, he said it

would not happen any time soon.

Sterling ended lower in a choppy session after the BoE raised its main

interest rate to 5% from 4.5%. The UK inflation held at 8.7% in May, the highest

of any major economy.