Global stock indexes fell and the U.S. dollar rose on Friday as investors

digested comments from Fed officials that signalled further interest rate hikes

ahead.

Nasdaq snapped an eight-week winning streak and the S&P 500 ended a

five-week streak of gains.

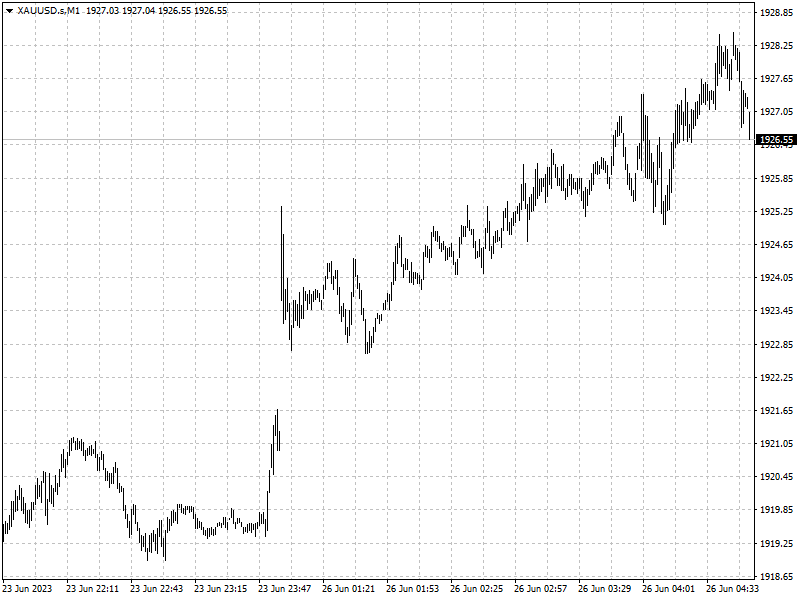

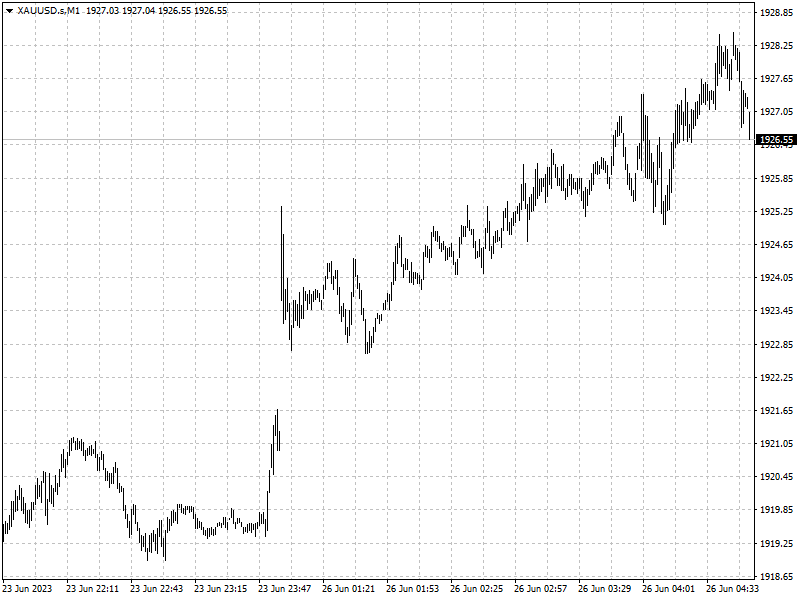

Gold prices were heading for their biggest weekly percentage fall in over

four months, weighed by a stronger dollar.

Oil prices settled lower, posting a weekly decline as traders worried

interest rate hikes could sap demand despite signs of tighter supplies.

Commodities

More U.S. interest rate hikes also seemed likelier. San Francisco Federal

Reserve Bank President Mary Daly said two more rate hikes this year was a "very

reasonable" projection.

‘The sharp drop in exposure since the last (Fed) meeting does not necessarily

suggest imminent short-covering activity, but it does underscore a shift in

sentiment as we head into a seasonally slower period for demand,’ Standard

Chartered analyst Suki Cooper said in a note.

Last week's U.S. inventory report showed crude stocks posted a surprise

decline of 3.8 million barrels.

Money managers raised their net long U.S. crude futures and options positions

in New York and London by 4,790 contracts to 78,064 in the week to June 20, the

U.S. CFTC said on Friday.

Forex

U.S. business activity fell to a three-month low in June as services growth

eased for the first time this year and the contraction in the manufacturing

sector deepened, closely watched survey data showed.

Adding to the dim picture, euro zone business growth virtually stalled in

June. A downturn in manufacturing deepened, while activity in the bloc's

dominant services sector barely expanded, as overall demand fell for the first

time since January.

‘I do think that the concern with the future outlook is weighing on risk

appetite right now and the dollar is catching somewhat bid off of that,’ said

Bipan Rai, North America head of FX strategy at CIBC Capital Markets.

The British currency has come under pressure from rising expectations the UK

economy could slip into recession after the BOE delivered an outsized rate hike

in response to persistent inflation.