Global markets took on a tentative tone on Monday as investors struggled to

gauge the impact of the weekend’s short-lived armed revolt in Russia and

continued to contemplate a general weakening economic outlook.

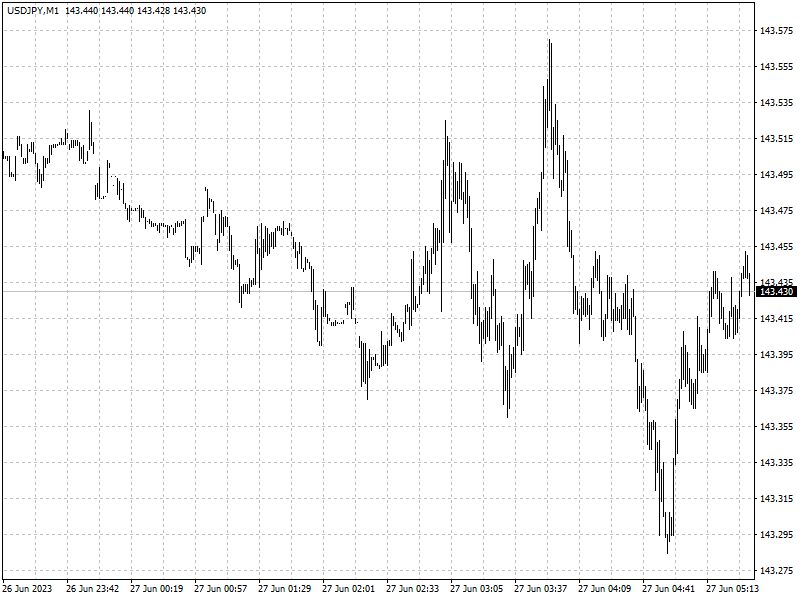

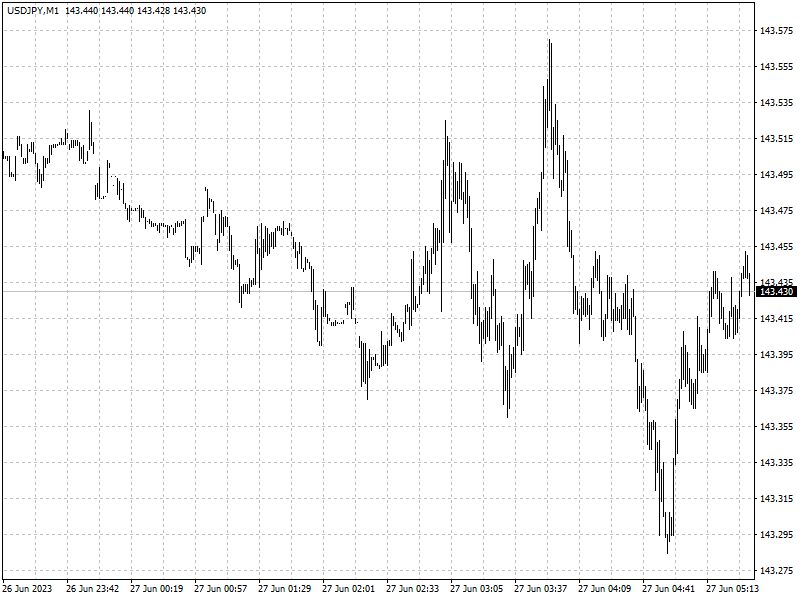

The dollar gained against the Russian rouble but backed down from a 15-year

high, while the yen posted modest gains.

Oil moved higher as political turmoil in Russia stoked concerns over supply

disruption. Gold inched off from the three-month low as geopolitical

reverberations from Russia outweighed Fed hawkishness.

Commodities

Both Brent and WTI prices fell by about 3.6% last week on worries that

further interest rate hikes by the Fed could sap oil demand at a time when

China's economic recovery has also disappointed investors.

‘There's not much geopolitical impact on the market now. It is dominated by

economics, not geopolitics,’ Daniel Yergin, vice chairman of S&P Global,

said on the sidelines of an industry event on Monday.

Forex

German business morale worsened for the second consecutive month in June,

hitting its lowest level since the end of 2022. That means Europe's largest

economy is facing an uphill battle to shake off recession.

The Turkish lira touched a record low against the dollar after the central

bank loosened regulations aimed at keeping customers from holding dollar

deposits.

Japan is not ruling out any options in responding appropriately to excessive

currency moves, its top currency diplomat said, currencies should move in a

stable way.

The yen weakened beyond 143 yen on Friday, a seven-month low versus the

dollar, and fell to a 15-year low beyond 155 yen to the euro.