Wall Street closed sharply higher and the dollar softened on Friday as

investors closed the books on a solid quarter, with data showing progress in the

Fed's efforts to tame inflation.

In the first half of 2023, the S&P 500 advanced 15.9%, while the

tech-heavy Nasdaq Composite rode the artificial intelligence wave, surging

31.8%, its best performance in four decades.

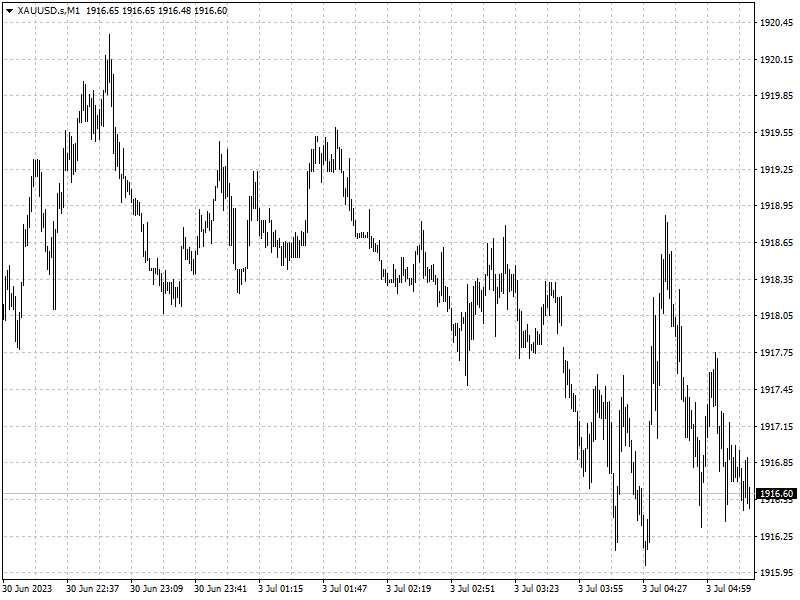

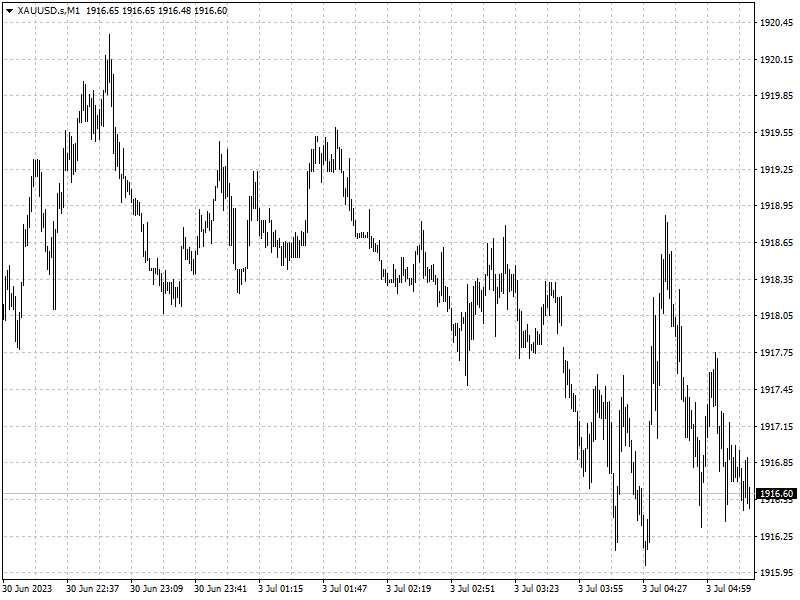

Gold was bound for its first quarterly decline in three. Oil prices settled

higher but posted their fourth straight quarterly loss as investors worried that

sluggish global economic activity could crimp fuel demand.

Commodities

Gold shed 2.5% in the first quarter, dropping from levels just shy of

all-time highs at $2,072 in May, to flirt with $1,900 level.

‘In the short term, the prospect for more US rate hikes combined with rising

US real yields to or near cycle highs may pose a continued challenge to gold,’

Saxo Bank head of commodity strategy Ole Hansen said in a note.

Demand for crude and petroleum products fell slightly to 20.446 million bpd

in April but remained seasonally strong, EIA data showed.

A Reuters survey of 37 economists and analysts showed oil prices will

struggle for traction this year as global economic headwinds linger.

‘Despite the announcements of two fresh rounds of cuts from OPEC+/Saudi

Arabia, crude prices have largely remained below $80 a barrel as the market has

been driven less by fundamentals and more by macroeconomic concerns,’ HSBC

analysts said in a note.

‘We think this will continue to be the case for part of the summer, although

the deep deficit of around 2.3 million barrels forecast for 2H23 should help to

spur some upwards price momentum.’

Forex

The PCE gained 0.1% in May after an 0.4% rise in April while advancing 3.8%

on an annual basis, slowing from a revised 4.3% the prior month.

Expectations for a 25 basis points hike at the Fed's July meeting dipped

slightly, with markets now pricing in an 84.3% chance of a hike, down slightly

from the 89.3% on Thursday, according to CME's FedWatch Tool.

Japan's Finance Minister Shunichi Suzuki warned the country will take the

appropriate stEPS should the yen continue to weaken, and warned against

investors selling the yen too far.