Dollar index hits two-week high on rising rate hike expectations

2023-06-30

Summary:

Summary:

The S&P 500 advanced on Thursday and benchmark Treasury yields hit their highest level since early March as robust economic data helped ease recession fears.

The S&P 500 advanced on Thursday and benchmark Treasury yields hit their

highest level since early March as robust economic data helped ease recession

fears.

The dollar touched a two-week high against a basket of world currencies as

upbeat economic data provided cushion to the Fed to continue raising rates.

Gold prices steadied just above the key $1,900 level, its nominal gains

hampered by the strengthening dollar.

Oil prices posted modest gains as the solid economic data suggested strong

demand and a steeper-than-expected drop in U.S. crude inventories.

Commodities

Investors were concerned about rising interest rates and economic growth

after Fed Chair Jerome Powell reiterated that he expects the moderate pace of

interest rate decisions to continue in the coming months.

The number of Americans filing new claims for unemployment benefits fell last

week by the most in 20 months, offering an upbeat picture of the labor market

that could encourage the Fed to keep raising interest rates.

Adding to pressure, annual profits at industrial firms in China, the world's

second-biggest oil consumer, extended a double-digit decline in the first five

months as softening demand squeezed margins.

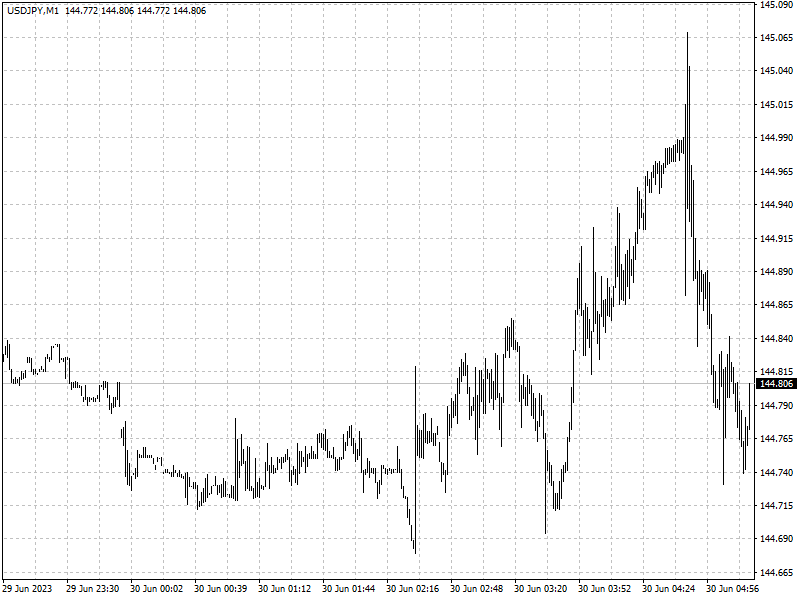

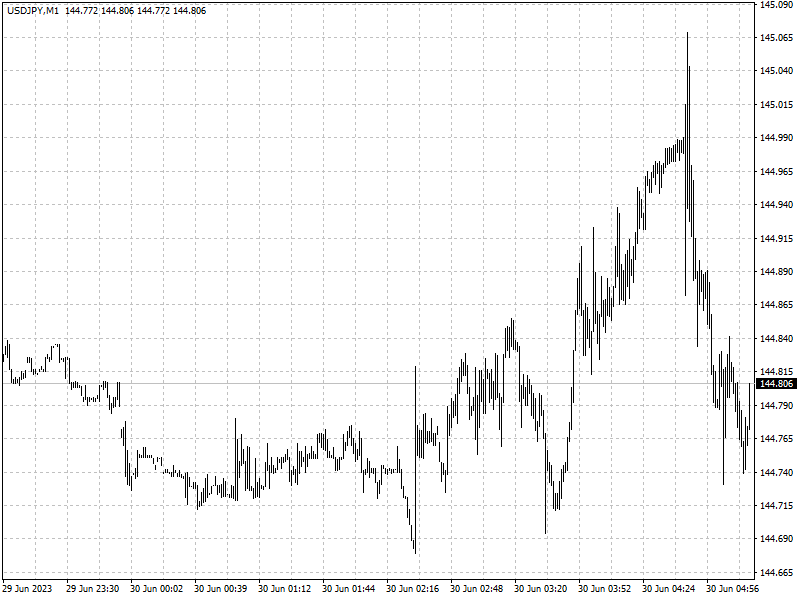

Forex

Atlanta Fed President Raphael Bostic said the Fed will have to increase rates

if price growth moves away from target, or inflation expectations start to move

in ‘a difficult way.’

Market expectations for a 25 basis-point hike by the Fed at its July meeting

rose to 86.8% from 81.8% in the prior session, according to CME's FedWatch Tool,

and completely rule out a rate cut this year.

The dollar strengthened against the Japanese yen for a third straight day,

hitting a fresh 7-1/2 month high of 144.90, as U.S. and Japanese central bank

policy plans are expected to remain at opposite ends of the spectrum.