Yen continues to bleed after intervention threat

2023-07-04

Summary:

Summary:

Wall Street stock indexes ended Monday's shorter session up slightly along with U.S. Treasury yields, as investors weighed up a mixed bag of economic data ahead of second-quarter earnings and uncertainty over the direction of central bank policy.

Wall Street stock indexes ended Monday's shorter session up slightly along

with U.S. Treasury yields, as investors weighed up a mixed bag of economic data

ahead of second-quarter earnings and uncertainty over the direction of central

bank policy.

The dollar and gold prices were virtually unchanged as weaker economic

readings cast doubts over whether the Federal Reserve would stick to its hawkish

policy outlook.

Oil prices settled down 1% after rallying earlier in the day as continuous

concern over fuel demand outweighed new supply cuts announced by Saudi Arabia

and Russia.

Commodities

The spread between the 2-year and 10-year U.S. Treasury note yields hit the

widest since 1981, reflecting concerns that tightening will tip the U.S. into

recession.

‘Gold has probably found a home around 1900,’ said Edward Moya, senior market

analyst at OANDA.

‘There’s some positioning happening here ... the market last week seemed to

be slowly pricing in more Fed rate hikes, but data going forward might suggest

that might not be happening, we could get really get one more rate hike.’

Saudi Arabia said it would extend its voluntary cut of one million barrels

per day (bpd) for another month to include August, the state news agency

said.

But prices moved lower after business surveys showed global factory activity

slumped in June as sluggish demand in China and in Europe clouded the outlook

for exporters.

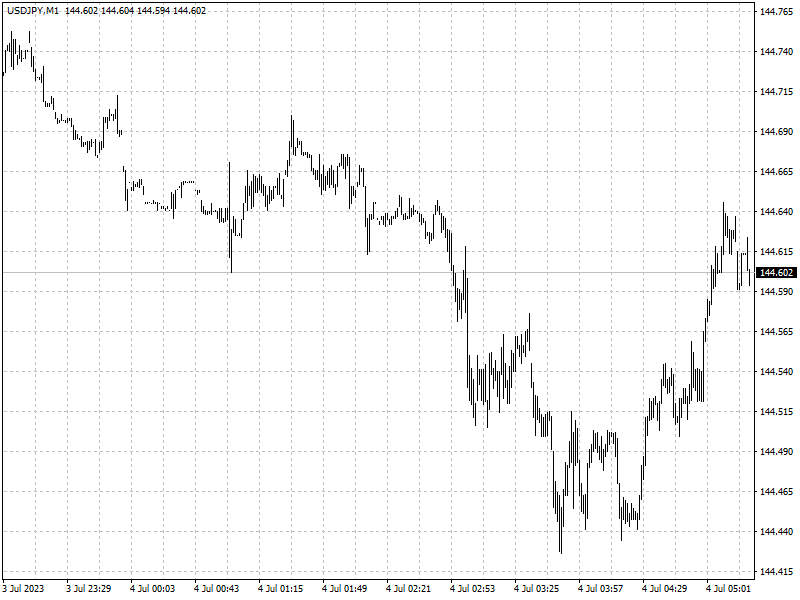

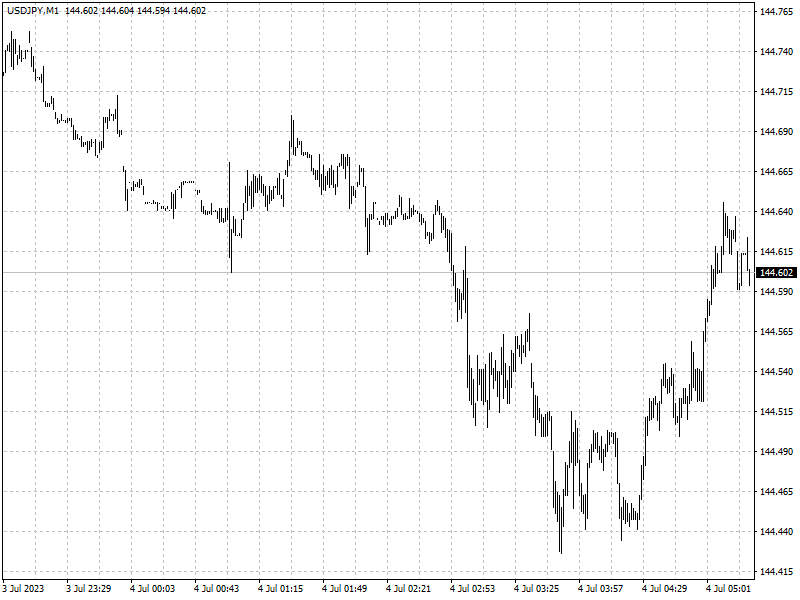

Forex

The yen fell to near eight-month lows against the dollar as intervention came

into sight after Finance Minister Shunichi Suzuki warned on Friday against

investors selling the yen too far as it weakened past the threshold of 145 to

the dollar.

The euro rebounded after earlier weakening on data showing a slowdown in

factory activity in the euro zone renewed concerns about economic growth.

HCOB's final manufacturing Purchasing Managers' Index (PMI) fell to 43.4 from

May's 44.8, its lowest since the COVID pandemic was cementing its grip on the

world, below a preliminary reading of 43.6 and further from the 50 mark

separating growth from contraction.