Oil prices rise 2% in thin trading

2023-07-05

Summary:

Summary:

European shares were steady in thin trading on Tuesday, with a lack of fresh economic data from the region and uncertainty around the direction of global interest rates keeping investors cautious.

European shares were steady in thin trading on Tuesday, with a lack of fresh

economic data from the region and uncertainty around the direction of global

interest rates keeping investors cautious.

Top central bankers have maintained their focus on bringing inflation back to

their target levels, even in the face of slowing growth in the U.S. and the euro

zone, adding to uncertainty about future global monetary policy stEPS.

Gold prices edged higher as some traders bet that recent weak U.S. economic

data may prompt the Fed to rethink its rate-hike trajectory.

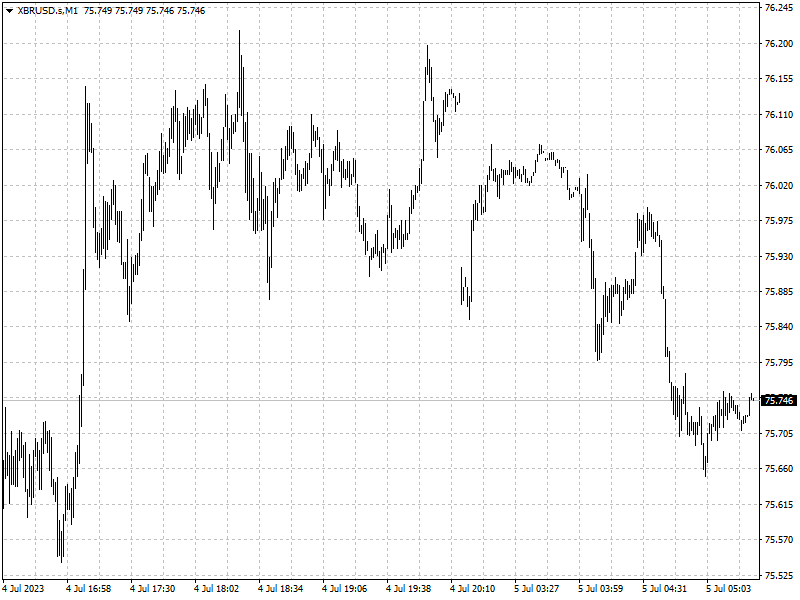

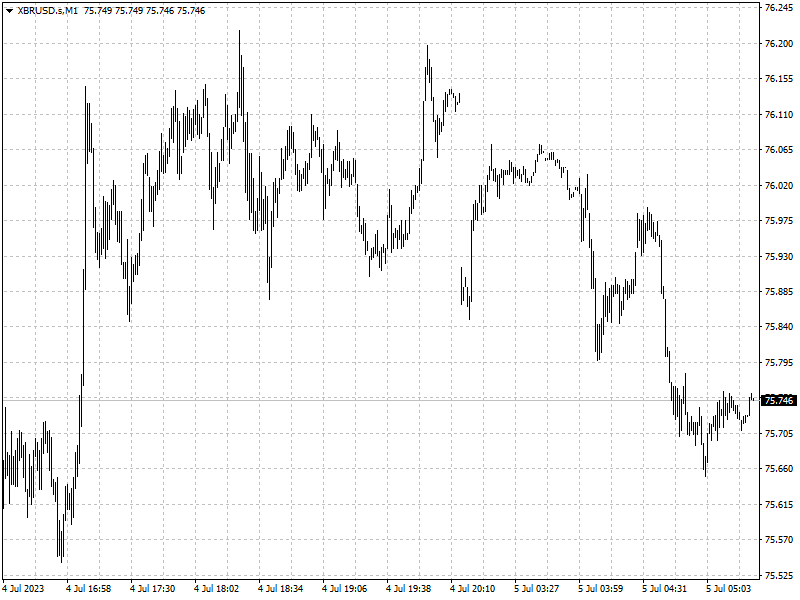

Oil prices climbed 2% as markets weighed August supply cuts by top exporters

Saudi Arabia and Russia against a weak global economic outlook.

Commodities

Even before the latest cut announcements, IEA data suggested the oil market

was set to show a supply deficit of roughly 2 million bpd in the third and

fourth quarters.

Little has changed in oil dynamics despite Monday's announcements, said OANDA

analyst Craig Erlam. ‘Only a significant break above $77 will suggest something

has changed, otherwise range-bound trade could well continue.’

Forex

The Australian dollar fell 0.3% after the RBA held interest rates steady,

ducking expectations from a slim majority of analysts that the bank would hike

rates for a third straight month.

But losses in the Australian currency were limited, as the RBA still raised

the possibility of more rate hikes in the near future.

The Japanese yen moved little, hovering just around seven-month lows as

markets continued to watch for any potential intervention by the government in

currency markets.