The inverse Head and Shoulders Pattern is one of the most well-known and widely used reversal patterns. Traders and investors use this formation to identify potential shifts from a downtrend to an uptrend, known as bullish reversals in financial markets, including stocks and forex.

However, understanding how to trade the inverse head and shoulders pattern effectively requires knowledge of its formation, key characteristics, and ideal entry and exit points, which is where this guide comes in handy.

Understanding and Identifying the Inverse Head and Shoulders and Its Variations

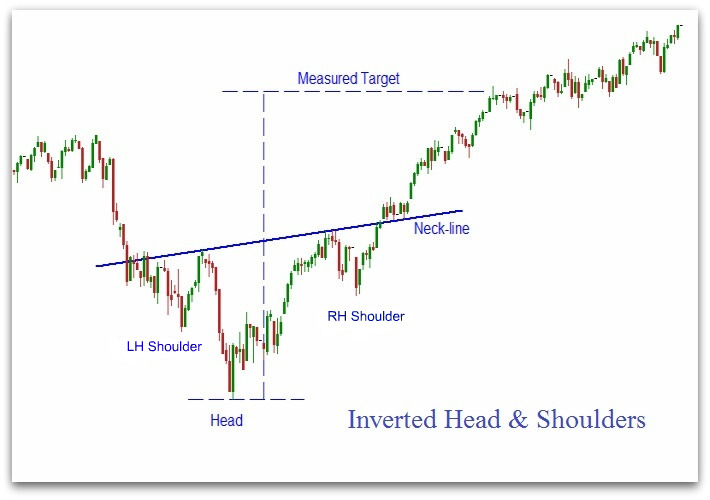

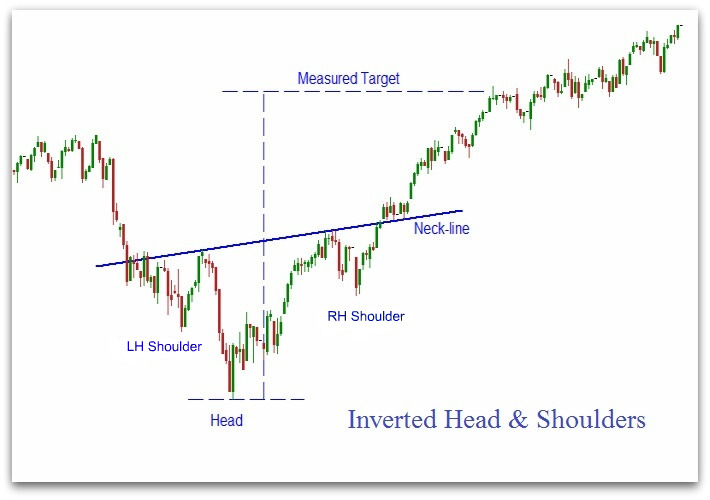

The inverse head and shoulders pattern is a bullish reversal formation that appears at the end of a downtrend. It indicates that selling pressure is weakening, and buyers are gaining control. The pattern consists of three troughs:

Left Shoulder: The market declines, finds temporary support, and bounces upward before falling again

Head: The price forms a lower low, creating the head of the pattern before recovering.

Right Shoulder: The price drops again but forms a higher low than the head, indicating weakening bearish momentum.

A key feature of this pattern is the neckline, which serves as a resistance level connecting the highs between the shoulders. Once the price breaks above this neckline, traders interpret it as a confirmation of the bullish reversal.

While the traditional inverse head and shoulders pattern is the most common, variations exist that traders should be aware of. One variation is the slanted neckline, where the resistance level is not perfectly horizontal but slopes upward or downward. A downward-sloping neckline may suggest a weaker reversal, while an upward-sloping neckline can indicate a stronger bullish move.

Another variation is the complex inverse head and shoulders pattern, which contains multiple shoulders or heads. This pattern can be more challenging, but the underlying principle remains the same — a breakout above the neckline signals a trend reversal. Traders should exercise patience and confirm the breakout before making trading decisions.

Trading Strategies for the Inverse Head and Shoulders Pattern

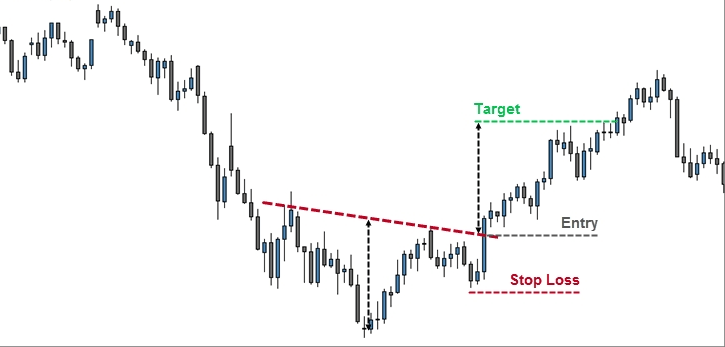

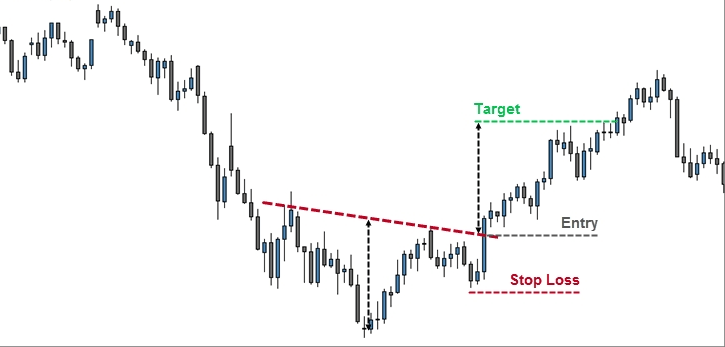

Trading the pattern involves identifying it correctly and waiting for confirmation before entering a position. Traders typically look for a breakout above the neckline, which signals a long trade opportunity.

One common approach is to wait for a daily or hourly close above the neckline to confirm the breakout. Some traders also wait for a retest of the neckline as support before entering a trade, reducing the risk of false breakouts.

The price target for the pattern is typically calculated by measuring the distance from the head to the neckline and adding that distance to the breakout point. It provides an estimate of the potential upward movement.

The Importance of Volume and Using Other Indicators

Volume plays a crucial role in validating the inverse head and shoulders pattern. During the pattern's formation, trading volume often decreases as the downtrend weakens. When the price breaks above the neckline, a surge in volume confirms the breakout, indicating strong buying interest. If the breakout occurs on low volume, there is a higher risk of a false breakout, and traders should be cautious before entering a trade.

Analysing volume can help traders distinguish between genuine and weak breakouts. A breakout with a high volume suggests a strong bullish sentiment, while a breakout with a low volume may indicate hesitation among buyers. Monitoring volume trends alongside price action can improve trade accuracy and help traders avoid false signals.

Moreover, combining the inverse head and shoulders pattern with other technical indicators enhances trading accuracy. The 50-day and 200-day moving averages help confirm the trend reversal when the price moves above these levels after the breakout.

In addition, Bollinger Bands can indicate whether the price is overextended, helping traders determine if they should wait for a pullback before entering. The Fibonacci retracement tool can also help identify potential support levels in case of a retest of the neckline.

Common Mistakes to Avoid

One of the most common mistakes traders make is entering a trade before confirmation. The inverse head and shoulders pattern requires a breakout above the neckline to be valid. Entering too early can lead to losses if the pattern fails to complete.

Another mistake is ignoring volume analysis. As mentioned above, a weak breakout with low trading volume may indicate a false breakout. Waiting for strong volume confirmation reduces the risk of being trapped in a fake move.

Traders should also avoid setting unrealistic price targets. While the measured move from the head to the neckline provides a price target, markets can be unpredictable. Using trailing stops instead of fixed price targets allows traders to maximise gains.

Historical Examples

The inverse head and shoulders pattern appears across various markets, including forex and stocks. In forex trading, it often occurs after prolonged downtrends in major currency pairs such as EUR/USD or GBP/USD.

As for the stock market, the pattern can be observed in individual stocks and indices when a bearish trend exhausts and buyers regain control. Traders looking for trend reversals often spot this pattern in major indices like the S&P 500 after periods of heavy selling.

Conclusion

In conclusion, the inverse head and shoulders pattern is a powerful tool for traders looking to identify trend reversals and capitalise on bullish market movements.

While this pattern is highly reliable, patience and discipline are key to avoiding premature entries, watching for volume confirmation, and setting appropriate stop-loss levels can help traders navigate market conditions effectively.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.