Trading in financial markets involves risk, and many new traders struggle with making informed decisions without losing money. However, what if we told you there was a way to practice trading strategies without using actual money? The answer is paper trading.

Thus, what is paper trading? To sum it up, paper trading allows beginner and experienced traders a risk-free way, using virtual funds to learn the mechanics of trading, develop strategies, and gain confidence before committing to real capital.

Understanding What Is Paper Trading

As mentioned, paper trading refers to simulated trading, where individuals practice buying and selling financial assets without using real money. It derives its name from the traditional practice of recording trades on paper before executing them in the market. Today, online platforms provide sophisticated paper trading accounts that mimic real market conditions, allowing users to experience live price movements, order executions, and portfolio management without financial risk.

This form of trading is widely used by beginners looking to understand how markets operate and experienced traders who want to test new strategies. Since no real money is involved, it eliminates the emotional stress associated with losses while allowing traders to focus on strategy development.

The accuracy of paper trading platforms ensures that traders experience realistic conditions, including bid-ask spreads, slippage, and market volatility, helping them prepare for real-world trading scenarios.

How Paper Trading Works and Choosing the Right Platform

To begin paper trading, traders need access to trading platforms offering demo accounts. Many brokers provide these accounts free of charge, allowing users to trade many financial instruments, including stocks, forex, and commodities.

For example, some of the best paper trading platforms include MetaTrader 4 and 5 (MT4/MT5) and TradingView. These platforms provide comprehensive tools for analysing price movements, testing strategies, and simulating trades in various asset classes. Once a trader opens a demo account, they are assigned a balance of virtual funds that they can use to execute trades. These accounts operate in real-time market conditions, meaning traders experience actual price movements and order execution similar to live trading.

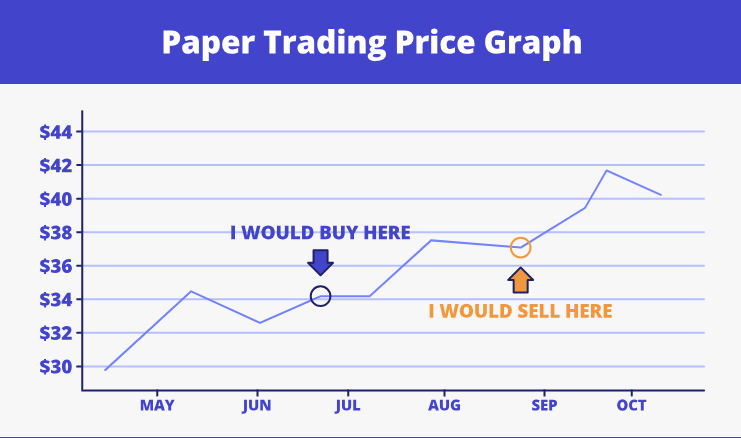

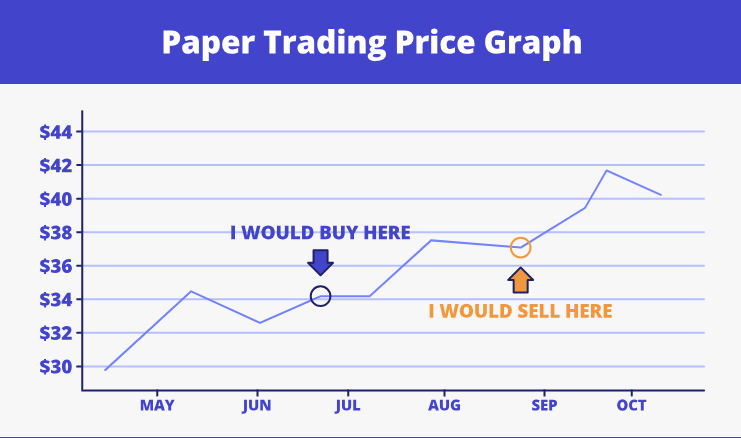

As mentioned, placing trades in a paper trading environment mirrors real trading. Traders analyse price charts, identify trade setups, place orders, and monitor their positions. They can execute various orders, including market orders, limit orders, and stop-loss orders, just as they would in a real trading scenario. The primary difference is that no real-life money is at risk, making it an ideal environment for experimentation and learning.

How to Use Paper Trading Effectively

To make the most of paper trading, traders should treat it as seriously as live trading. This involves following a structured approach, maintaining accurate trade records, and evaluating performance objectively. Setting clear goals, such as mastering technical analysis, testing a specific strategy, or improving risk management, can help traders stay focused and gain meaningful insights.

Setting realistic goals is also crucial for effective paper trading. Traders should define their objectives, whether mastering technical analysis, refining a specific strategy, or improving risk management skills. Establishing a structured approach ensures that paper trading is a productive learning experience rather than an aimless practice.

Analysing trade performance is another important aspect of paper trading. Traders should review their trades regularly, identify patterns, and assess profitability, risk-reward ratios, and execution efficiency. Keeping a trading journal that records entry and exit points, reasons for trade decisions, and emotional responses can provide valuable insights for improvement.

Simulating real trading scenarios, including market volatility and news events, can enhance the learning experience. Traders should test their strategies in different market conditions to understand their performance under various circumstances. Practising during high-impact economic events, such as interest rate decisions and earnings reports, can help traders prepare for the unpredictability of live trading.

Benefits vs Limitations of Paper Trading

To prevent you from reading another subsection of texts, listed below is a table summarising the advantages and drawbacks of paper trading, helping traders understand its usefulness and limitations before transitioning to real-market trading.

Advantages of Paper Trading

|

Drawbacks of Paper Trading |

|

Risk-Free Learning: Allows traders to practice without risking real money. |

No Real Financial Consequences: Traders may take excessive risks they wouldn’t take in live trading. |

|

Strategy Testing: Helps evaluate different trading strategies before applying them in real markets. |

Execution Differences: Paper trading may not account for real-world factors like slippage and liquidity. |

|

Familiarity with Trading Platforms: Enables users to learn order execution, charting tools, and market operations. |

Lack of Emotional Impact: Since no real money is at stake, traders don’t experience the psychological pressure of real trading. |

|

Developing Risk Management Skills: Traders can practice setting stop-loss and take-profit levels to manage risk effectively. |

Market Conditions May Differ: Certain market dynamics, such as spreads and order fills, may behave differently in real trading. |

|

Performance Tracking: Helps traders analyse their trades, refine strategies, and improve decision-making. |

Overconfidence Risk: Success in a demo account does not always translate to success in a live market. |

|

Testing Market Conditions: Allows traders to practice in trending, ranging, and volatile market environments. |

No Slippage or Real-World Market Impact: Paper trading orders are executed perfectly, which may not be the case in real markets. |

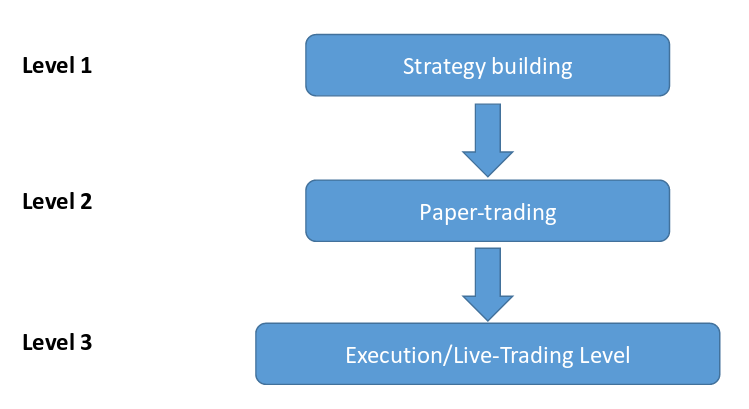

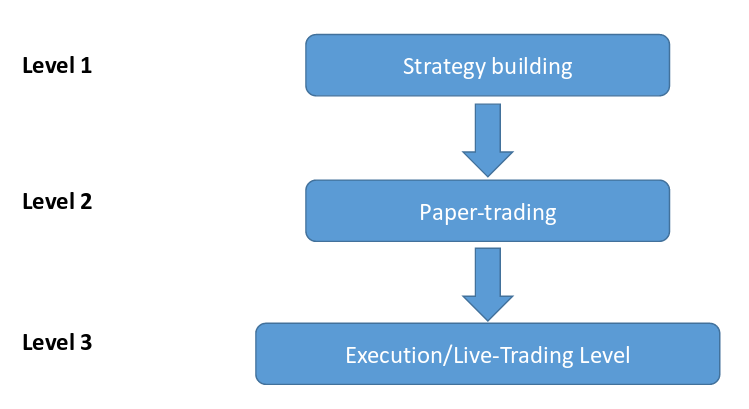

Transitioning from Paper Trading to Live Trading

Speaking of live trading, shifting from paper trading to live trading requires careful planning and preparation. Traders should only transition once they have demonstrated consistent profitability in a demo environment and have developed a solid understanding of their trading strategy. Jumping into live trading without adequate preparation can lead to significant losses and frustration.

Starting with a small live account is a practical approach. Trading with minimal real capital allows traders to experience the emotional aspect of live trading while minimising financial risk. This step helps to bridge the gap between simulated and live trading, enabling traders to adjust to the psychological challenges associated with live market conditions.

Implementing strict risk management rules is crucial during the transition. Setting stop-loss levels, managing position sizes, and avoiding impulsive trades can help traders navigate the uncertainties of live trading. Maintaining the same discipline used in paper trading ensures a smooth transition and reduces the risk of emotional decision-making.

Gradually increasing trading size as confidence and experience grow can lead to long-term success. Traders should focus on refining their strategies, adapting to market conditions, and continuously learning from successes and failures. Remaining disciplined and patient is also key to sustaining profitability in live trading.

Conclusion

In conclusion, the answer to what is paper trading is that it is an invaluable tool for beginner and experienced traders. By offering a risk-free environment to learn, practice, and refine trading strategies, paper trading allows traders to understand market mechanics, develop technical skills, and improve decision-making without financial consequences.

While it has limitations, such as the absence of emotional pressure and market conditions, paper trading remains essential in building confidence and preparing for live trading. Treating it as a serious learning tool, maintaining discipline, and using realistic trading conditions can maximise your move from simulation to real-world profitability.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.