An iceberg order is a trading strategy employed by institutional investors to buy or sell large quantities of securities without revealing the full order size.

This technique helps minimise market impact and price slippage, making it a valuable tool for smarter trading.

Definition and Purpose of an Iceberg Order

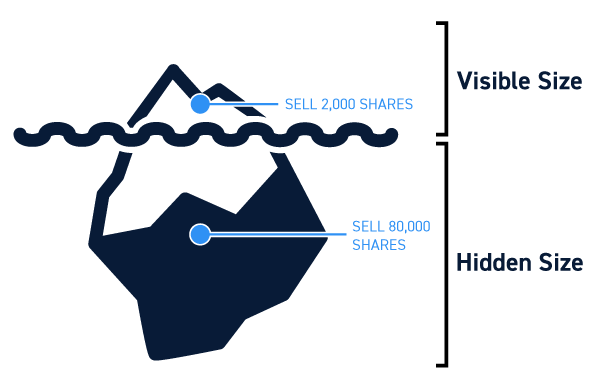

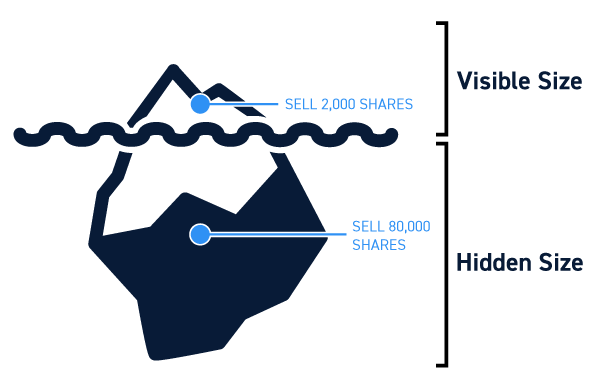

An iceberg order allows traders to execute large transactions in smaller, more manageable parts. Only a small portion of the total order is visible to the market at any given time, with the rest remaining hidden until the visible part is filled. This approach helps maintain market stability and avoid sudden price movements.

Primary Purpose:

Mechanics of Iceberg Order Execution

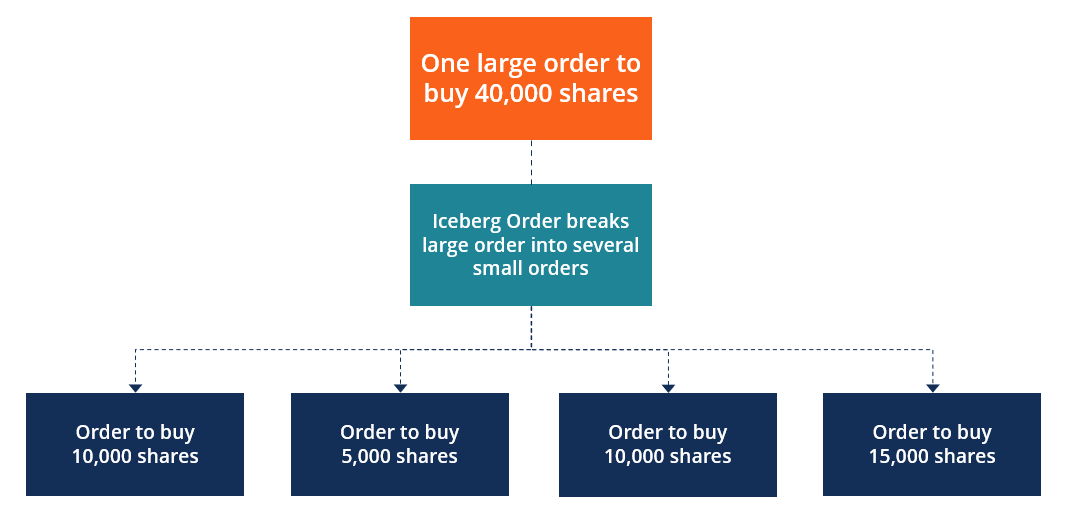

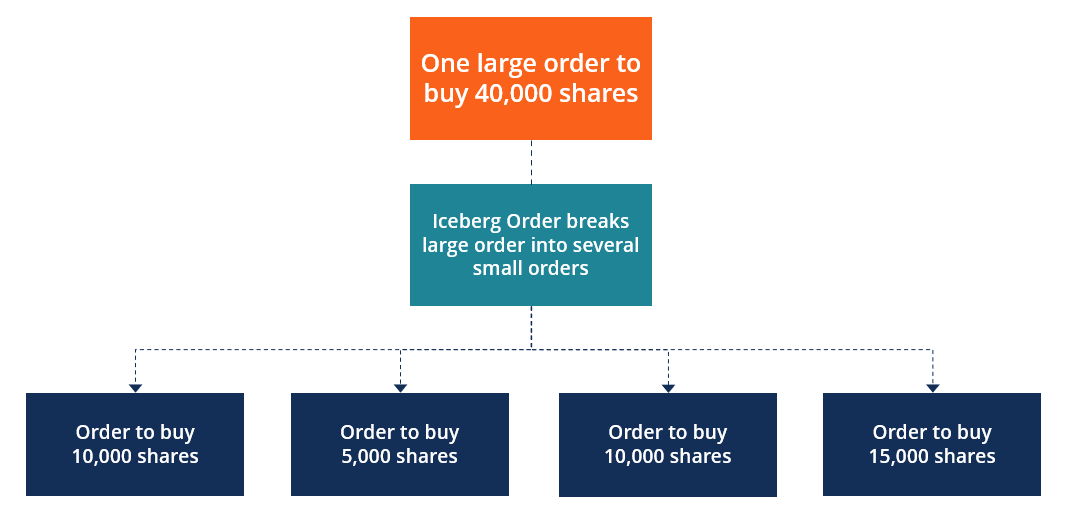

The execution of an iceberg order involves breaking down a large order into smaller visible portions. As each visible part is executed, a new portion becomes visible until the entire order is filled. This method ensures that the full order size remains hidden from the market, reducing the likelihood of adverse price movements.

How It Works:

Large order is divided into smaller chunks

Only a portion is visible to the market

New portions become visible as previous ones are filled

Benefits and Advantages of Iceberg Orders

Iceberg orders offer several benefits for institutional investors, including:

Market Stability: Prevents large orders from disrupting market prices.

Reduced Price Volatility: Minimises the risk of sudden price changes.

Better Average Prices: Achieves more favourable transaction prices over time.

Anonymity: Hides the true size of the order, preventing predatory trading practices.

Impact on Market Liquidity

Iceberg orders can have a dual effect on market liquidity. While they obscure the true liquidity levels by hiding the full order size, they also facilitate large transactions without disrupting market prices. This balance helps maintain overall market efficiency.

Key Points:

Obscures true liquidity levels

Facilitates large transactions

Maintains market efficiency

Identifying and Detecting Iceberg Order

Identifying iceberg orders in the market can be challenging due to their hidden nature. However, certain signs may indicate their presence, such as a series of similar-sized orders from the same market maker or unusual trading patterns.

Detection Tips:

Look for similar-sized orders

Monitor unusual trading patterns

Observe market maker behaviour

Strategic Use of Iceberg Orders

Iceberg orders can be strategically used to avoid predatory trading practices and manage risk in volatile markets. By concealing the full order size, traders can execute large transactions without attracting undue attention or triggering adverse price movements.

Strategies:

Avoiding Predatory Trading: Prevents other traders from exploiting large orders.

Risk Management: Reduces exposure to sudden market fluctuations.

Optimising Execution: Achieves better execution prices over time.

Case Study 1: An institutional investor wants to purchase 1 million shares of a company without causing a price spike. By using an iceberg order, they break down the purchase into chunks of 10,000 shares. As each chunk is filled, another becomes visible, allowing the investor to accumulate shares at favourable prices without alerting other market participants.

Case Study 2: A hedge fund aims to sell a large position in a volatile stock. They use an iceberg order to sell 500,000 shares in increments of 5,000. This approach prevents a sudden drop in the stock price and ensures the fund can exit its position without significant market impact.

Conclusion

Iceberg orders are a powerful tool for institutional investors looking to minimise market impact and optimise trading. By breaking down large orders into smaller, more manageable parts, traders can achieve better average prices and maintain market stability. Understanding the mechanics, benefits, and strategic uses of iceberg orders can help you make more informed investment decisions.

Mastering the use of iceberg orders can significantly enhance your trading strategy. By leveraging this approach, you can execute large transactions with minimal market disruption, achieve favourable prices, and manage risk effectively. Stay vigilant for signs of iceberg orders in the market and consider incorporating them into your trading toolkit for smarter, more strategic investing.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.