Forex swing trading is one of the most exciting ways to trade in the market – you're not tied to watching prices move in real-time like a day trader, but you're still actively looking to catch those sweet price swings within a trend. The key to being successful at it? Spotting the right signals. These are the signs that tell you when the market is about to make a move, whether it's up or down. It's like having an insider's look into the market's next big move. But how do you identify the best signals when you're just getting started? Let's break it down.

What Are Forex Swing Trading signals?

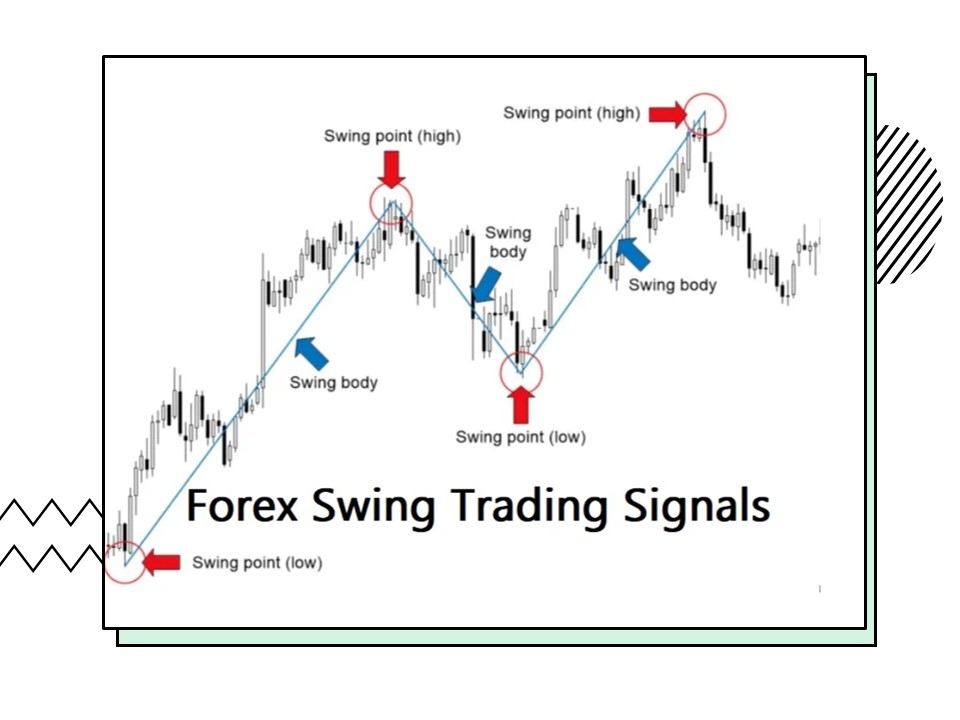

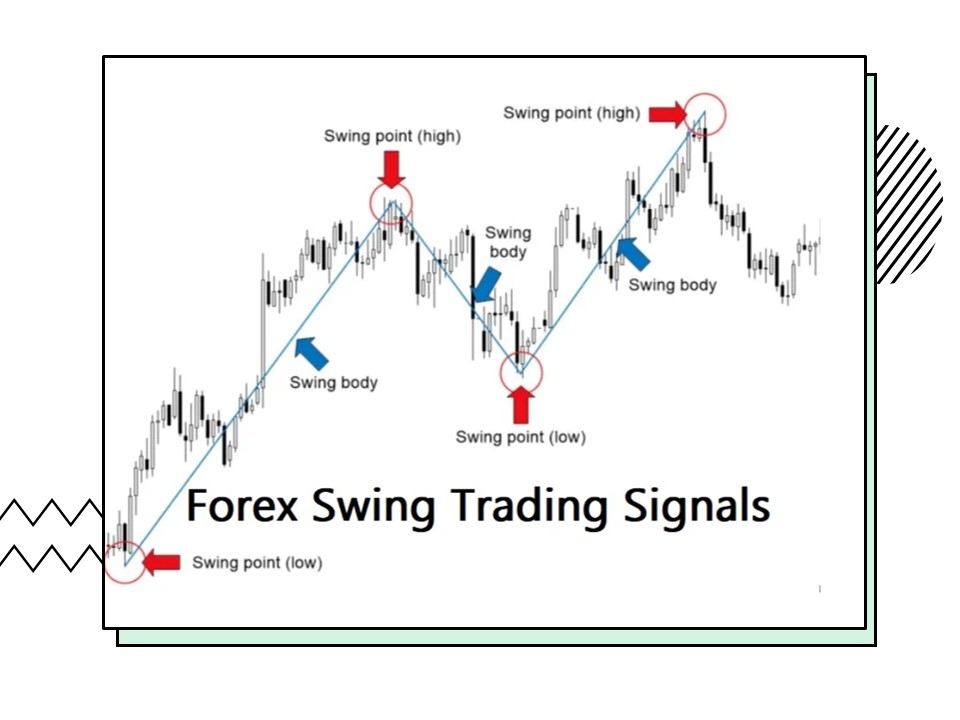

So, first things first: what exactly are swing trading signals? Well, they're essentially clues that tell you when a price is likely to make a significant move. These forex swing signals don't predict the future, but they do highlight moments when the odds are in your favour. Swing traders are interested in catching moves that happen over a few days or weeks – not hours. They're looking for those moments when the price might swing from one level to another, and they want to hop on that ride.

At the heart of it, forex swing trading is about recognising patterns and trends. You’re constantly looking for forex signals that indicate a change in direction, whether that's a breakout from a support level, a shift in momentum, or a trend reversal. And there's no shortage of tools to help you with that.

The Tools You Need to Spot Reliable Swing Trading Signals

If you're just starting out, the range of forex swing trading indicators and tools can feel a bit overwhelming. But once you know what you're looking for, these tools can help you make sense of the market. Here are three of the most important indicators to watch for when you're looking for solid swing trading signals:

Moving Averages: Essential for Trend Analysis

Moving averages are like the compass for your trade. They help you figure out the general direction the market is heading. They're simple, but powerful – and once you get a feel for how they work, you’ll use them all the time.

There are two main types: the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). Both give you the average price over a set period of time, but the EMA gives more weight to recent prices, so it reacts more quickly to changes in the market. The basic idea is that when a shorter-term moving average crosses above a longer-term one, it suggests the market is going up – and vice versa for a potential downtrend.

This crossover can be a pretty solid entry signal. But remember, it’s not foolproof – the trend may not always follow through. That’s why you want to combine it with other forex trading indicators.

RSI and MACD: Spotting Momentum

Next up are the RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence). These two indicators are great for spotting whether the market is overbought or oversold, and whether a change in momentum is on the cards.

The RSI measures the speed and change of price movements and tells you whether the market is in overbought or oversold territory. If the RSI is above 70. the market might be overbought (so a reversal could be coming). If it's below 30. the market could be oversold, and a bounce might be on the horizon.

Meanwhile, the MACD helps you measure the strength and direction of a trend. If the MACD line crosses above the signal line, it's often a bullish sign. If it crosses below, it's typically bearish. Traders love this for confirming whether the market has enough momentum to keep going in the direction it's moving.

These two indicators give you a strong sense of whether the market is about to reverse or keep running in the same direction – a key piece of the puzzle for swing traders looking for high-probability forex swing trades.

Support and Resistance: Mapping Out the Market's Boundaries

Think of support and resistance levels as the market's invisible barriers. Support is the price level where an asset tends to find buyers, and resistance is where it faces selling pressure. These levels are crucial because they can act as entry and exit points for your trades.

If the price reaches support, it might bounce back up – a good time to buy. If it hits resistance, it might turn around – a good time to sell. But here's the thing: when the price breaks through support or resistance, it can signal that a new trend is beginning, and that could be your cue to jump in. A breakthrough resistance means the market might be headed higher, and a breakthrough support suggests it could fall further.

Recognising these levels is a bit of an art, and it takes time. But once you get the hang of it, they can be incredibly powerful tools for spotting the right time to enter a trade.

How to Spot High-Probability Swing Trades

Now that you have the tools to spot reliable forex swing trading signals, it's time to put them together and start looking for actual opportunities in the market. It's all about reading the signs and understanding when the odds are in your favour.

1. Identify the Market Trend

Before jumping into a trade, you've got to know which way the market is heading. Is it going up, down, or moving sideways? This is essential because forex swing traders generally prefer to trade in the direction of the trend. So, if the market is in an uptrend, you'll want to look for buying opportunities near support. If the market is in a downtrend, look for selling opportunities near resistance.

Use moving averages to identify the trend. If the price is above the moving average, the trend is up. If it's below, the trend is down. And don't forget to keep an eye on support and resistance levels – they'll help you pinpoint potential entry points.

2. Time Your Entry and Exit

Once you've identified the trend and found key levels, it's all about timing your trade. You don't want to jump in too early or too late. Look for confirmation from your forex swing trading indicators. For example, if the price is approaching support and the RSI is showing it's oversold, it could be a good time to buy. Similarly, if the price is at resistance and the RSI is overbought, it might be time to sell.

For exits, use your target levels and risk management techniques. Set a price target where you'll take profits and consider using a stop loss to limit your potential losses if the market moves against you. The goal is to keep your risk-to-reward ratio in check – ideally aiming for a ratio of 1:2. where your potential reward is twice as much as your risk.

3. Essential Strategies for Protecting Your Capital

Even with the best forex trading signals, the market can be unpredictable. That's why risk management is crucial. Always know how much you're willing to lose on a trade before you enter it, and make sure to set a stop-loss order to limit potential losses. A solid Risk Management Plan ensures that even if a trade doesn't work out, you don't blow your entire account in one go.

The key to forex swing trading is patience and practice. By combining the right forex indicators with solid risk management, you'll be able to spot high-probability opportunities that fit your trading style. Over time, you'll get better at recognising those forex signals, and eventually, you'll find your rhythm in the market. Stay focused, keep learning, and let those swing trades come to you.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.