For anyone serious about mastering forex trading, one of the most effective tools available is a forex trading simulator. These platforms allow you to practise trading in real-time market conditions, using virtual funds. The benefit? You can refine your strategies, understand market movements, and gain confidence, all without risking your actual capital. Whether you're new to forex or looking to improve your trading approach, a simulator provides a controlled, risk-free environment to hone your skills.

But how do forex simulators work, and what should you look for when choosing one?

What Is a Forex Trading Simulator

In simple terms, a forex trading simulator is a software tool that replicates real-world forex market conditions, allowing traders to practise without financial risk. It uses live or near-live market data, so you can make decisions based on the same market movements you'd encounter in actual trading.

These simulators enable traders to experiment with buying and selling currency pairs, manage open positions, and test different strategies—all while trading with virtual funds. For beginners, forex simulators offer a safe space to learn the basics of trading, understand how the market works, and familiarise yourself with your trading platform. More advanced traders can use them to refine strategies, test new approaches, and track their performance without the pressure of real financial stakes.

Key Features to Look for in a Forex Trading Simulator

Choosing the right forex simulator is essential for maximising your learning experience. Here are some of the key features that can enhance your practice:

Real-Time Market Data and Charting Tools

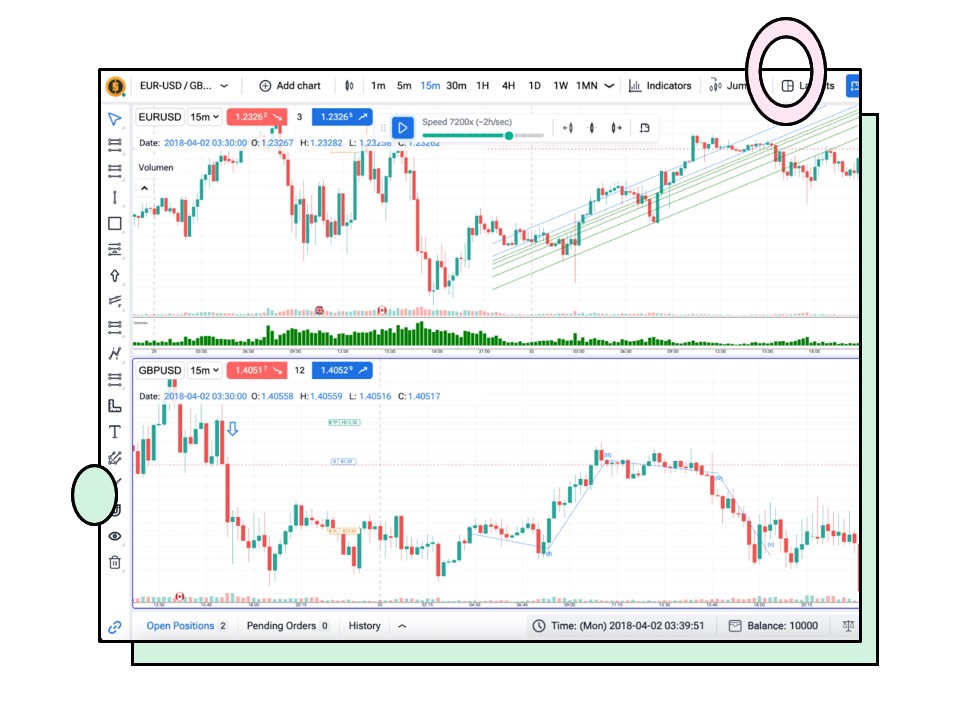

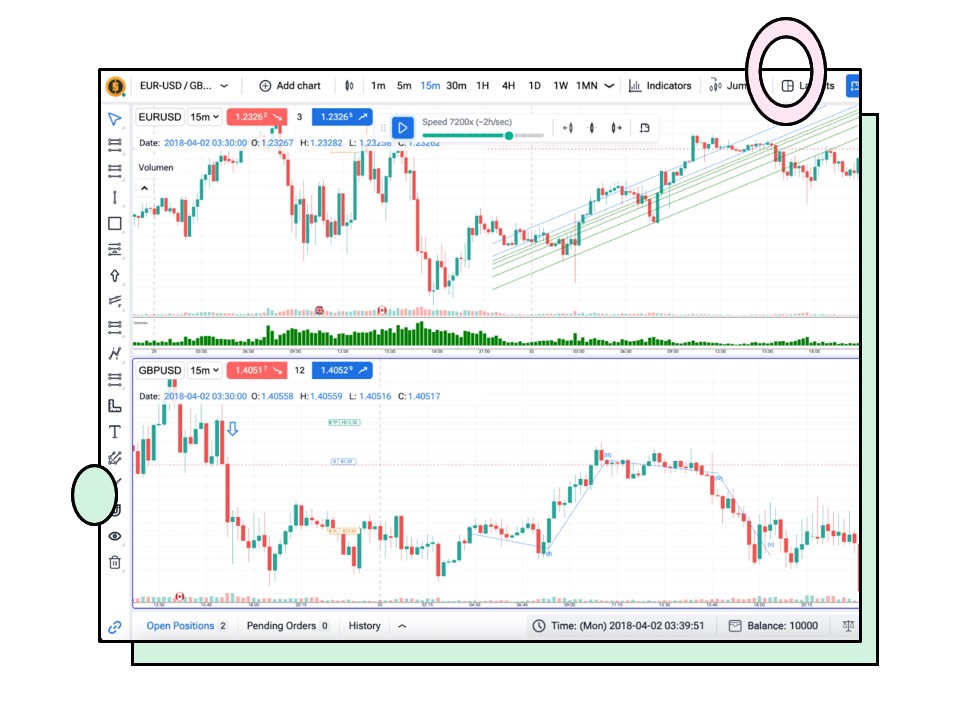

A good forex trading simulator should provide real-time or near-real-time market data. This ensures that your practice experience is as close as possible to actual trading. You’ll want to see live price feeds, real-time fluctuations, and up-to-date market conditions—just like you would in the live forex market.

Additionally, the best forex simulators include advanced charting tools to help you analyse market trends. These might include candlestick charts, moving averages, oscillators like RSI, and other technical indicators that allow you to build a trading strategy. These features are crucial for understanding price movements and testing different technical analysis techniques.

Risk Management Features

Even when trading with virtual money, risk management is a key component of any trading strategy. A quality forex simulator should offer various risk management tools, such as stop-loss orders, take-profit levels, and the ability to adjust your position size.

These features help simulate real-world risk management and allow you to practise minimising losses while maximising gains. Being able to set stop-loss orders in advance, for example, will help you get used to limiting potential losses, which is vital when you start trading with real capital.

User-Friendly Interface

A good forex simulator should also feature a clean, user-friendly interface. The platform should be easy to navigate, with intuitive controls for placing trades, monitoring positions, and reviewing your performance. The more straightforward the interface, the less you'll need to focus on figuring out how to use the software, and the more you'll be able to focus on the actual act of trading.

Performance Tracking and Analytics

The best forex simulators offer tools to track your trading performance over time. This could include a trade journal, performance reports, or other forms of analysis to review your decision-making. Being able to evaluate your successes and mistakes is vital for improvement.

These features allow you to identify patterns in your trading habits, pinpoint areas for improvement, and adapt your strategy. The more you track your results, the clearer your path to becoming a more consistent and confident trader.

Why Should You Use a Forex Trading Simulator?

So, what makes using a forex simulator beneficial? Whether you're just starting or looking to refine your skills, there are several advantages to practising in a risk-free environment.

Practise Without Financial Risk

The primary benefit of a forex trading simulator is that you can practise without risking real money. As a beginner, you'll inevitably make mistakes—and making those mistakes with virtual funds rather than real money allows you to learn from them without financial consequences.

For more experienced traders, forex simulators offer a great way to test new strategies or experiment with different techniques in a low-risk setting. You can simulate trading scenarios, such as high volatility or sudden market changes, to see how your strategy performs without the pressure of actual money on the line.

Build Confidence and Learn at Your Own Pace

Another major advantage is the ability to learn at your own pace. Trading can be stressful, especially for beginners, and trading with real money can amplify that pressure. A forex simulator removes the fear of failure, allowing you to focus purely on developing your skills. As you practise and see your strategies come to life, your confidence will naturally grow.

Whether it's understanding how the market reacts to news or fine-tuning your technical analysis skills, simulators give you the time and space to learn and progress without external pressure. As you become more proficient, you'll be better equipped to take on live markets with confidence.

Track Your Performance and Improve Decision-Making

Forex simulators also provide the opportunity to track your performance over time. With detailed analytics, you can review your trades, evaluate your success rate, and see where improvements can be made. Many simulators allow you to view a trade journal or generate reports on your trading history, which can be invaluable for identifying patterns in your decision-making.

By tracking your results, you can assess what works, what doesn't, and how you can refine your approach. This type of self-reflection is crucial for any trader who wants to improve their results in live markets.

In conclusion, forex trading simulators offer a comprehensive, risk-free way to develop your trading skills. With features like real-time market data, risk management tools, and performance tracking, they provide an ideal environment to test strategies, build confidence, and enhance decision-making. Whether you’re new to forex trading or a more seasoned trader looking to perfect your approach, a good simulator can be a valuable asset in your trading toolkit. By practising in a controlled environment, you'll be better prepared when it's time to take your trading live.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.